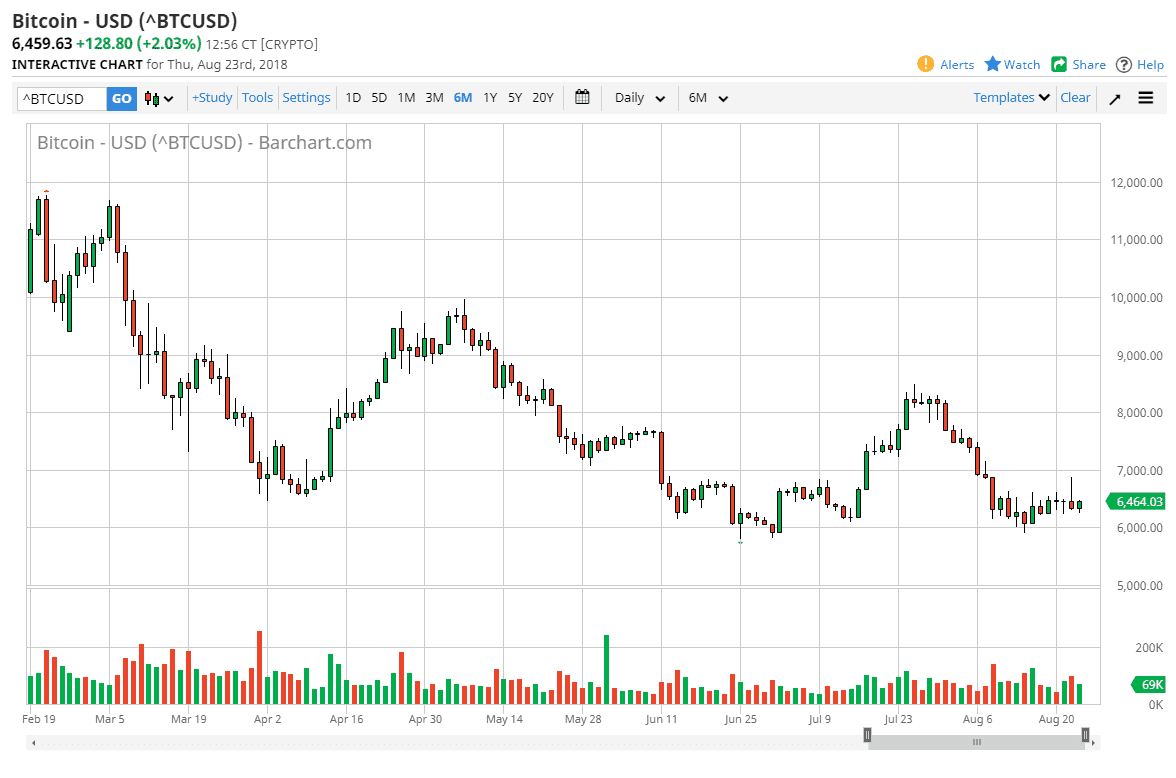

BTC/USD

Bitcoin markets continue to do very little on Thursday, as we are stuck in a short-term range. At this point, it looks as if the $7000 level above is going to cause a significant amount of resistance, while the $6000 level below is going to cause a significant amount of support. In other words, I think that we are simply stuck in these levels. I know that’s not much to trade off of, but you do have a $1000 range if you choose to be a short-term scalper. Other than that, there is in a lot to do until we break out of the overall trading malaise that we have seen for some time. Currently, there is no catalyst to move the bitcoin markets, so unless you are a longer-term investor or a scalper, this market provides little in the way of opportunity.

However, if we were to break down below the $6000 level, that could change things rather rapidly and send things much lower. At that point, I think the market will probably reach towards the $5000 handle, which should be even more stringent support. We’ve recently seen rallies get sold off, and I think that will probably continue to be the case. All things being equal, I favor the downside but really at this point it’s not until we clear the $6000 level that you can put any faith into a move lower. Sometimes markets put people to sleep, this is one of those times. However, typically one a market since like this a huge move is coming. If we can break above $8000, that huge move will be to the upside. If we break down below $6000, that huge move will be to the downside.