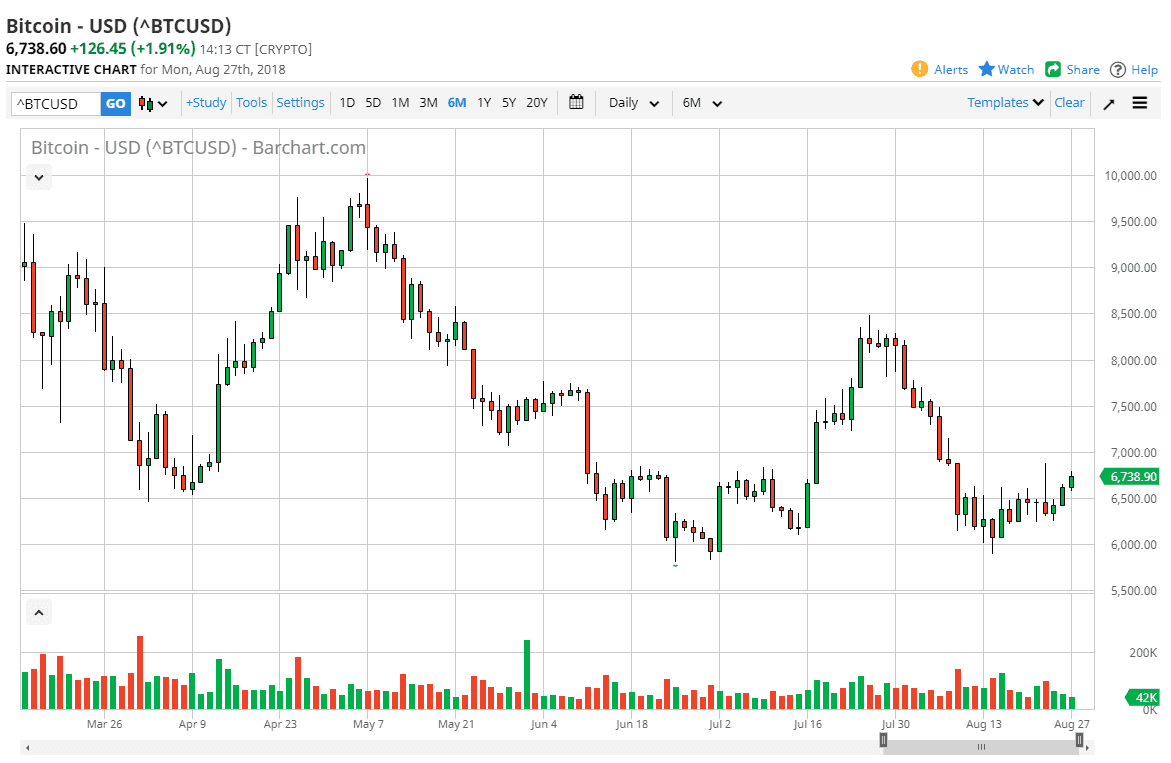

BTC/USD

Bitcoin rallied during the day on Monday as traders came back from the weekend. It did find the $6800 level a bit too much so, and it did not break the shooting star that formed late last week. Because of this, I believe that the $7000 level will offer a somewhat significant amount of resistance. However, if we can get above there then the momentum can carry this market towards the $7500 level. I still believe that rallies will eventually show signs of resistance that we can start selling, as the market continues the bank against the $6000 level.

You will notice that the last three daily candles have had minimal volume, and while you can write off some of that as weekend trading, Monday wasn’t exactly full of volume either. Because of this, it shows a lack of conviction and I think it’s only a matter of time before we roll over. Beyond that, nobody has found a true use for Bitcoin yet, despite what many of the true believers will say. The reality is that Bitcoin faces a major uphill battle beyond whether or not there is an ETF to trade it, as it will need to be more widely adopted for people to flock to it again.

The longer-term outlook for bitcoin is not good in my estimation, simply because cryptocurrencies will probably be the future, but there is nothing to keep central banks from issuing them. The general public likes convenience and isn’t concerned about some of the nuances that Bitcoin aficionados care about. Think of it this way: the old lady down the street is going to trust a crypto currency that’s issued by the Federal Reserve much quicker than she will some random network that she doesn’t understand. I think that’s the biggest problem Bitcoin is going to face into the future, most of the advantages of it are essentially solutions looking for a problem.