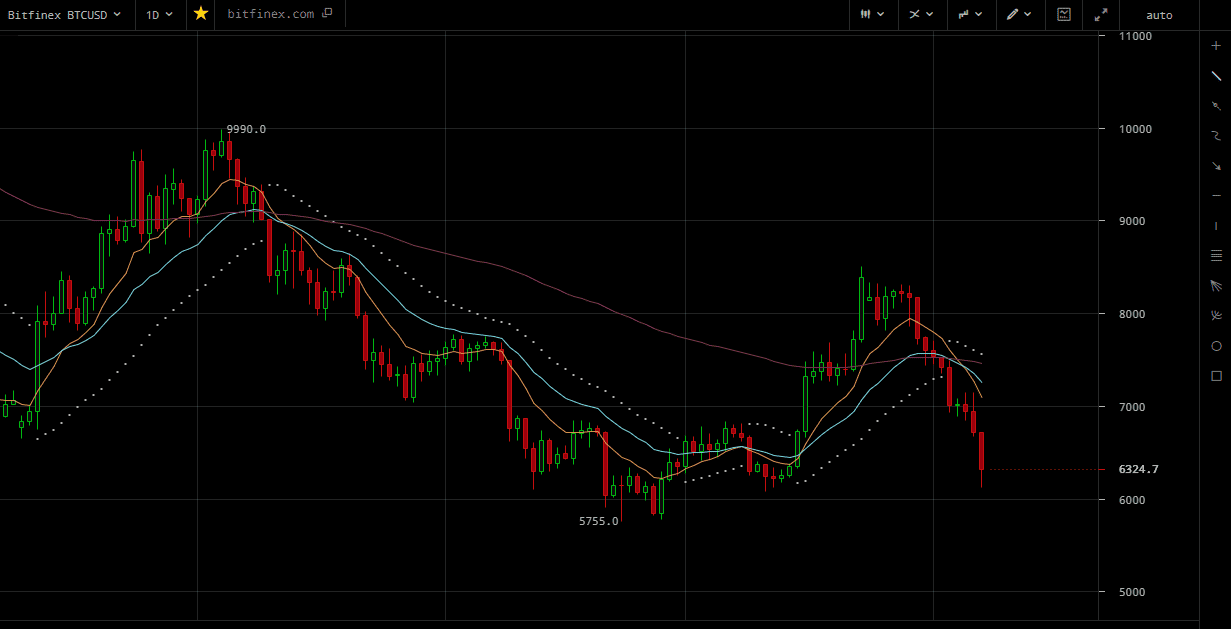

BTC/USD

Bitcoin markets got hammered again during trading on Wednesday, in somewhat of a broken record. I think that this point in time it’s obvious that any time this market rallies, you need to be selling. The 6000 level offers a significant amount of support, but I think the one thing that you cannot get away from is that every time we have rallied from that area, a bounce has been smaller. I believe bitcoin is probably going to break down, although it may take a while for that to happen.

It seems as if a bitcoin based ETF is farther away than many people thought, but quite frankly I don’t understand the excitement of a bitcoin-based ETF, because it goes against the very core principle of bitcoin in the first place. I’m old enough to remember when bitcoin was supposed to be anonymous, or at the very least away from the hands of Wall Street. Well guess what? It’s firmly in the hands Wall Street as soon as the ETF is launched.

I believe that bitcoin is going through major growing pains and should continue to do so for quite some time. It seems to me that every time the markets bounce, it’s the beginning of the next major leg higher. However, big money doesn’t seem to agree with this and therefore is dumping it off to the retail trader. I still think bitcoin is far too expensive, and I would anticipate that we will eventually break down to a fresh, new low.

Further exacerbating this damages the fact that the US dollar has been strengthening, which is the one half of the equation that most people ignore, as crypto currency traders typically aren’t thinking in terms of pairs. That being said, I’d be a seller of rallies.