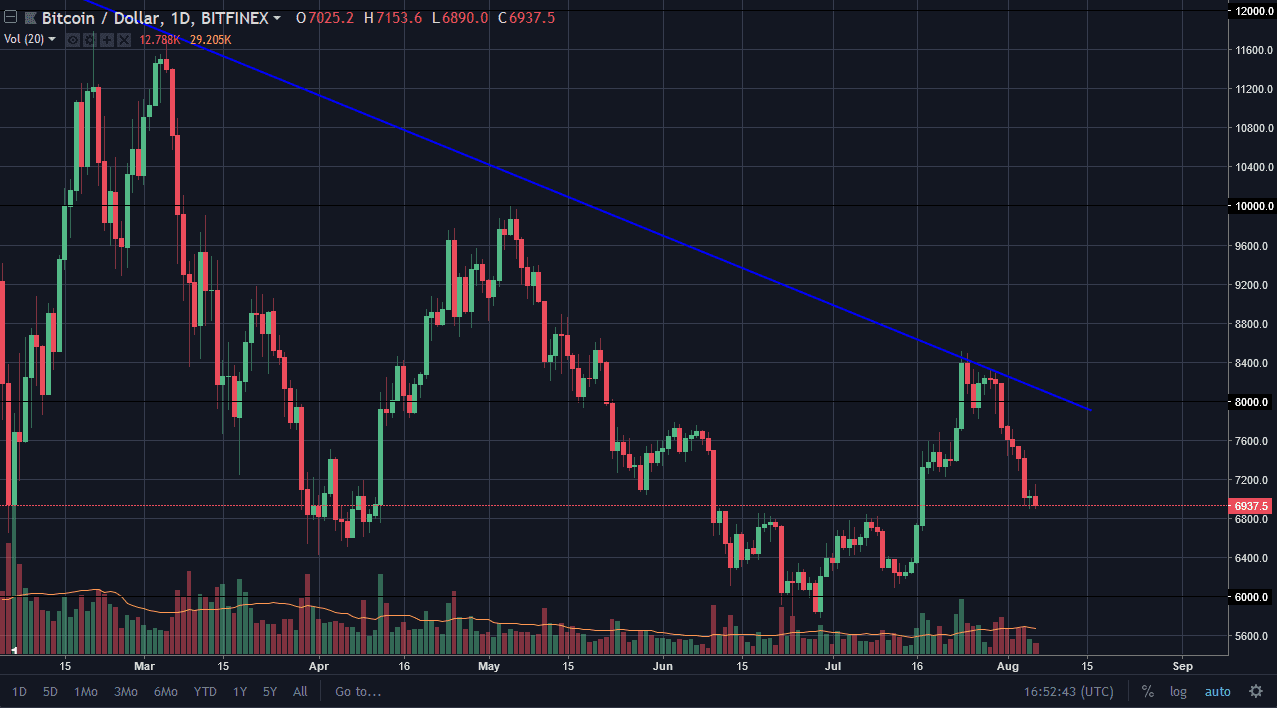

BTC/USD

Bitcoin fell again during trading on Monday, as we continue to see sellers jump into this market. We are now approaching the $6800 level, which is the beginning of the next support region that could open the door towards the $6000 level. I think at this point it’s obvious the bitcoin can’t sustain rallies, and that those rallies again are going to end up being selling opportunities. As I once said and another video, this pig won’t fly”, and there’s nothing on this chart that tells me anything different at this point. At this point, there seems to be a new headline coming out every day that’s going to save bitcoin, but nothing has. If we break down below the $6000 level, we will unwind to $5000 over the next several weeks.

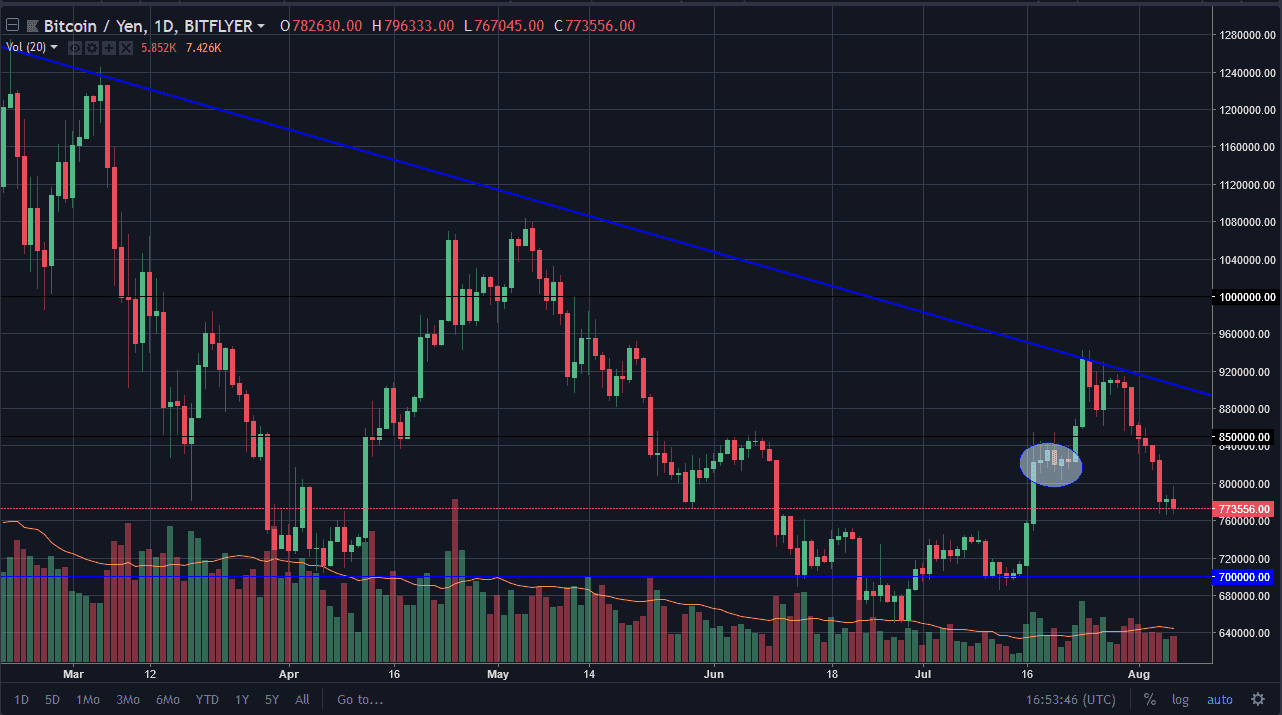

BTC/JPY

Bitcoin fell against the Japanese yen during the weekend and Monday as well, as we are reaching towards the ¥760,000 level. We are getting close to a significant amount of support at the ¥700,000 level, so I think that the move lower will probably slow down a bit from here. Rallies are still selling opportunities though, and you can see that the ellipse I had drawn on the chart from previous support has been broken to the downside, so it’s likely that it should offer resistance. Overall, I believe that the market should continue to be noisy, but negative. We haven’t been able to break out to the upside with any type of significance, and by far the easiest way to trade bitcoin has been to short it. Yes, occasionally we get the strong rallies, but they end up being nice selling opportunities. Think of them as value in the Japanese yen. I find this especially telling considering that the Japanese yen has been soft for some time against other currencies.