Yesterday’s signals were not triggered, as none of the key levels were ever reached.

Today’s BTC/USD Signals

Risk 0.75% per trade.

Trades may only be entered before 5pm Tokyo time, during the next 24-hour period only.

Long Trades

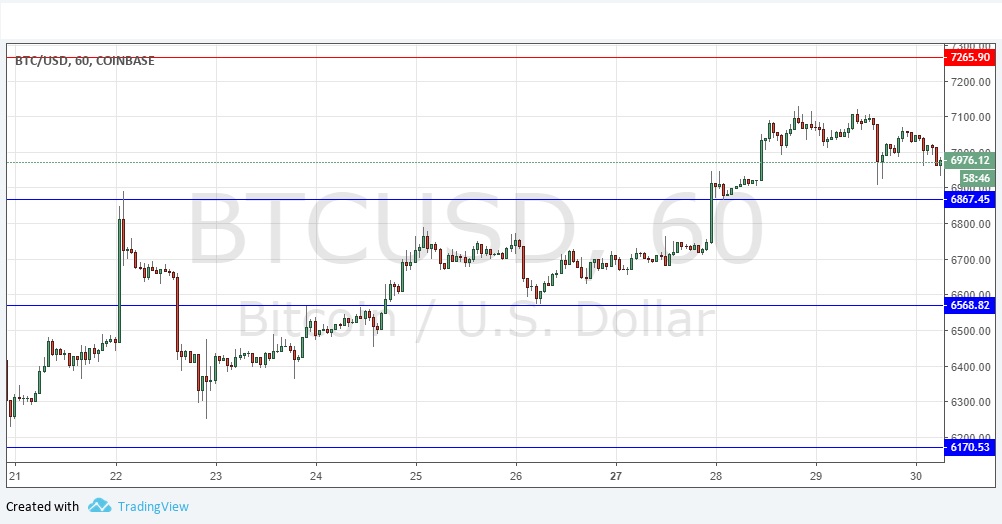

Long entry after a bullish price action reversal on the H1 time frame following the next touch of $6,867 or $6,570.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is $200 in profit by price.

Remove 50% of the position as profit when the trade is $200 in profit by price and leave the remainder of the position to run.

Short Trade

Short entry after a bearish price action reversal on the H1 time frame following the next touch of $7,266.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is $200 in profit by price.

Remove 50% of the position as profit when the trade is $200 in profit by price and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

BTC/USD Analysis

I wrote yesterday that the short-term action at $7,100 suggests that the price may be making a minor top and getting ready for a deeper retracement. I would therefore want to see the price break the high before being bullish today, or alternatively a pull back and strong bullish bounce at the support level of $6,867. This was a good call as after initially rising, the price failed at $7,100 before falling back, but has still not quite reached the support level at $6,867. Therefore, my call yesterday remains identical today. The picture remains generally bullish.

There is nothing important due today concerning the USD.