Gold prices are lower in early Asian trading Wednesday, suffering from a stronger U.S. dollar index. XAU/USD tested the resistance in the $1200-$1198 area yesterday, but it was unable to break through. U.S. economic data due for release today includes retail sales, the Empire State manufacturing survey, industrial production and the NAHB housing market index.

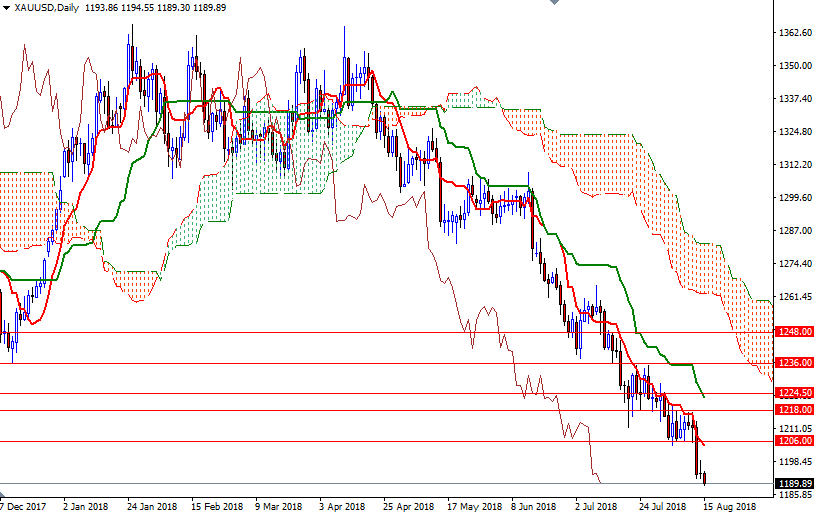

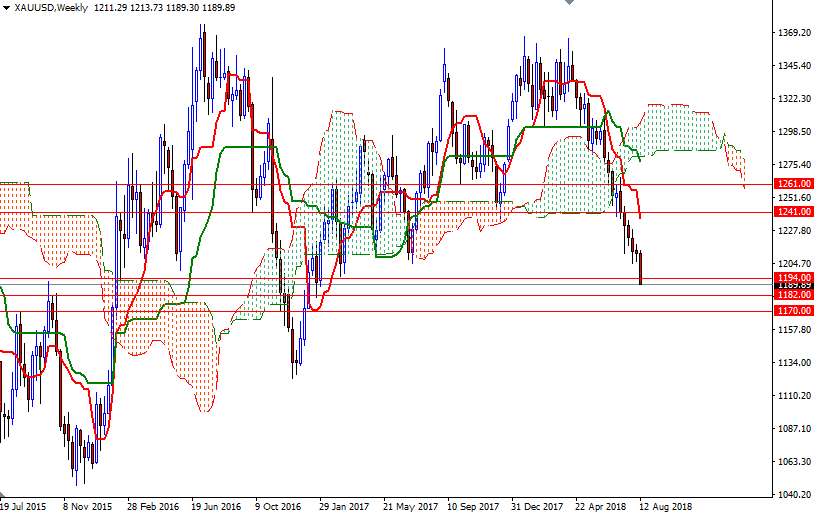

From a chart perspective, the bears have the overall near-term technical advantage amid a four-month-old downtrend on the daily chart. Prices are below the weekly and the daily Ichimoku clouds. The Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) are negatively aligned on both charts.

Breaking below 1194 suggests that XAU/USD is about to test 1188/7. If this support fails to hold, the market will be targeting 1182-1180.50. The bears have to push prices below 1180.50 to make an assault on 1177. To the upside, the 1194 level has now probably flipped from support to resistance so the bulls have to lift prices above there to revisit the 1200-1198 zone. If this resistance is broken, look for further upside with 1202 and 1206 as targets.