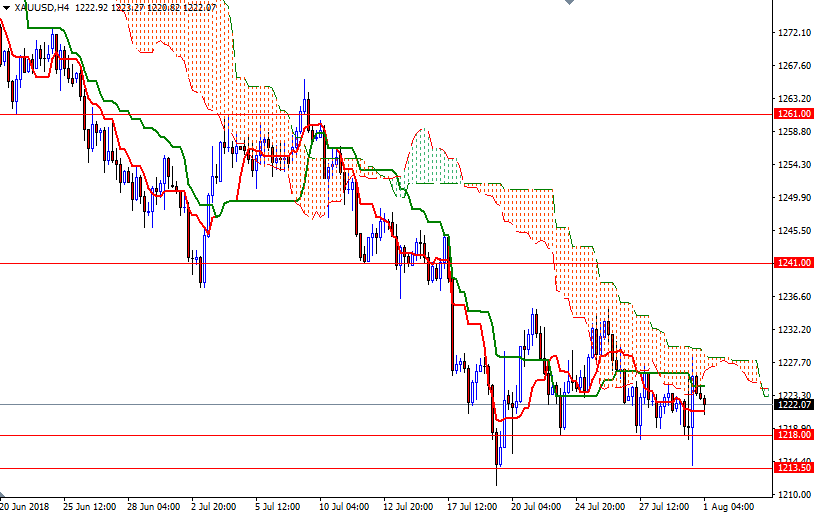

Gold prices swung between gains and losses on Tuesday as investors remained cautious ahead of the Fed's policy statement, which could give clues about the outlook for U.S. interest rates. Some short covering was also featured on the last trading day of the month. XAU/USD pulled back towards the retreated to the $1213.50 level after prices fell below $1218 but found enough support there to reverse its course and test the $1230-$1228 area. On the data front, the Chicago purchasing managers index came out stronger than expected with a print of 65.5, and the Conference Board said its index of consumer confidence rose to 127.4 from 127.1 the prior month.

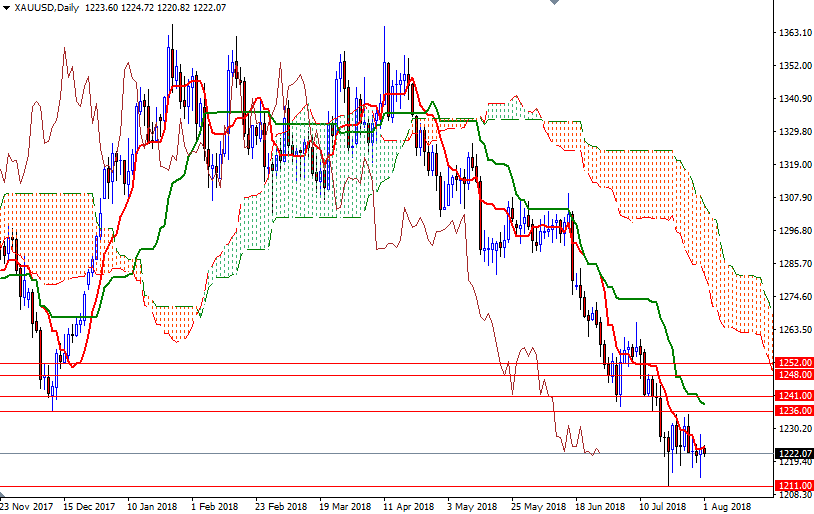

From a chart perspective, the bears still have the overall technical advantage. XAU/USD is trading below the daily and the 4-hourly Ichimoku clouds; plus, the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) are negatively aligned. Despite this bearish technical posture, the downside potential will be limited if the support in the 1211/09 zone remains intact. The bears have to capture this strategic camp to challenge 1206/2. A break below 1202 could lead to a test of 1198/4.

To the upside, the bulls have to lift prices above the 1230/28 area occupied by the 4-hourly cloud to make a run for 1236/4. Beyond there, the 1242/1 area stands out as a solid technical resistance. If this resistance is broken, look for further upside with 1248/7 and 1252 as targets.