Gold prices ended Wednesday’s session down $7.78 an ounce, pressured by a stronger U.S. dollar. The FOCM statement showed no change in U.S. monetary policy. The Federal Reserve kept interest rates unchanged and offered an upbeat assessment of the economy’s performance. Strong economic growth, low unemployment and stable inflation should keep the Fed on track to gradually raise interest rates.

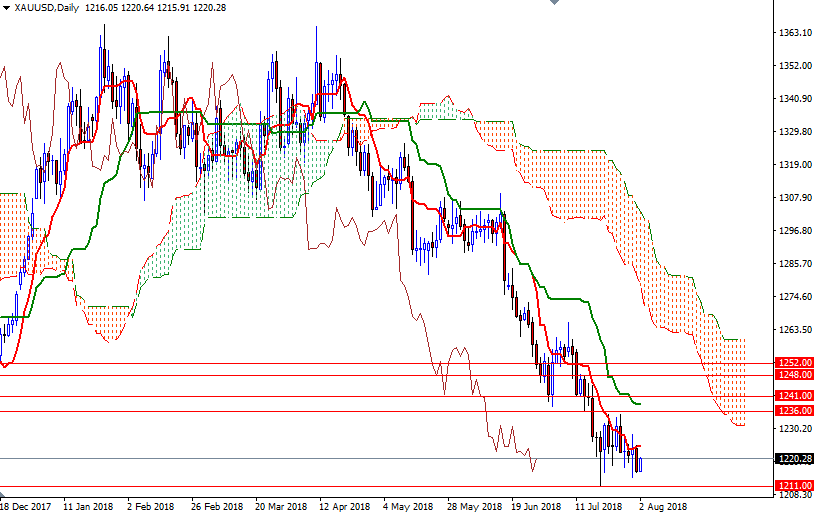

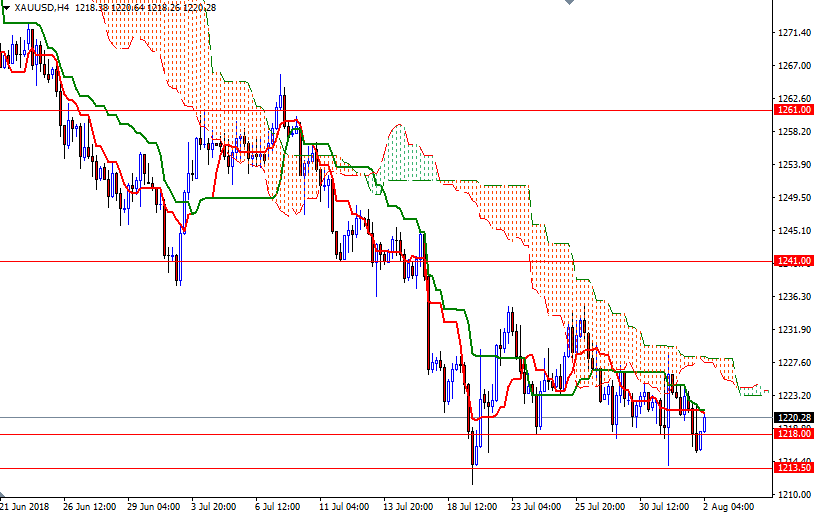

XAU/USD climbed back above the 1218 level after finding some support just above the 1215.50-1214.70 area in early Asia trading, but downside risks remain as the market continues to trade below the daily and the 4-hourly Ichimoku clouds. The 4-hourly Kijun-sen (twenty six-period moving average, green line) sits in the 1222/1 area, and the bulls will need to penetrate this barrier to march towards 1230/28. If prices breaks through this strategic technical resistance, it is likely that the market will proceed to the 1242/1 zone.

However, if XAU/USD is unable to stay above 1218, keep an eye on 1215.50-1214.70. If this support is broken, the market will be targeting 1213 and 1211/09. A break below 1209 paves the way for a test of 1206/2.