Gold prices fell $8.43 an ounce on Thursday, extending losses to a second session, as a strengthening dollar pressured the market and fueled downside momentum. Better risk appetite in the marketplace was another negative for the precious metal. U.S. stocks recovered from earlier losses. U.S. economic data due for release Friday includes the non-farm payrolls report and the ISM non-manufacturing report on business.

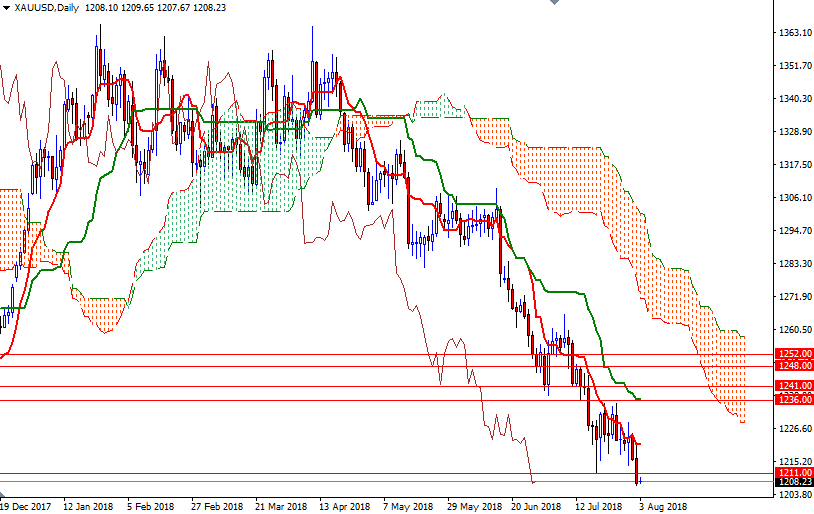

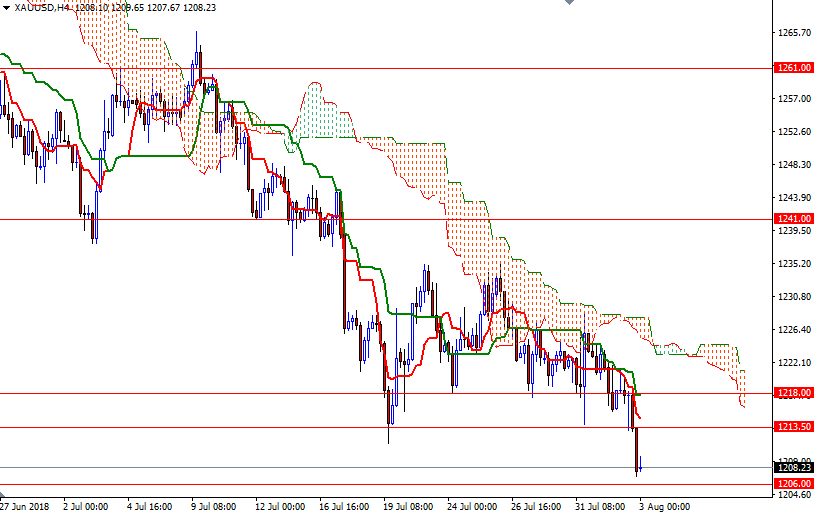

XAU/USD saw a bearish downside breakout from a sideways trading range, which invited chart-based sellers yesterday. The market initially headed higher in early Asia trading, but it appears that the 1211/09 area has flipped from support to resistance. With that in mind, I think prices will continue to grind lower towards 1206/2, which is likely to act as effective support, at least before the release of the jobs report.

A decline below 1202 an ounce could trigger further weakness and lead to a test of the 1198/4 zone. The bears have to produce a daily close below 1194 to make an assault on 1186. If this support is broken, the market will be targeting 1180/79. The bulls, on the other hand, have to lift prices above 1213.50 to revisit 1215.50 and 1218. A break above 1218 implies that the bulls are about to challenge 1222/1. Beyond there, the 1230/28 area stands out as a key technical resistance.