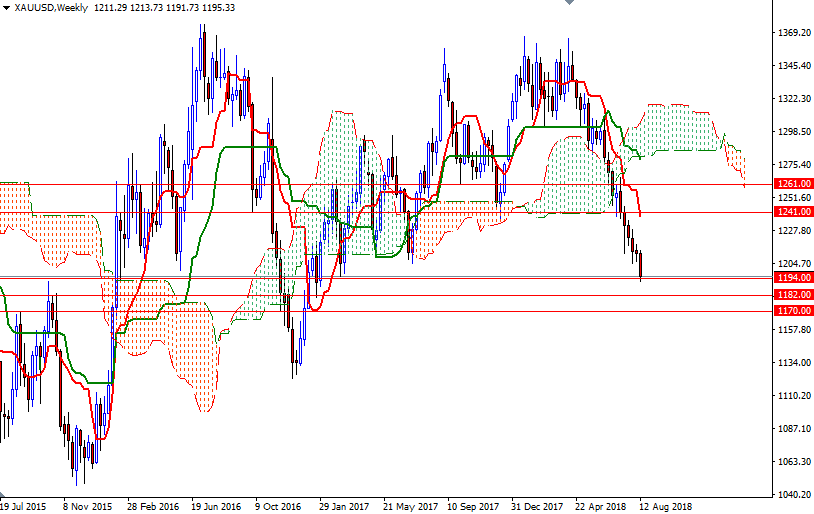

Gold prices dropped $17.89 an ounce on Monday as the U.S. dollar continued to appreciate. Some chart-based selling was also behind gold’s 1.47% decline yesterday. XAU/USD extended its losses and tested the support at $1194 as expected after the market dived below the $1206 level. Another negative for gold today is softer-than-expected Chinese economic data that has rekindled worries over the health of the world’s second-largest economy.

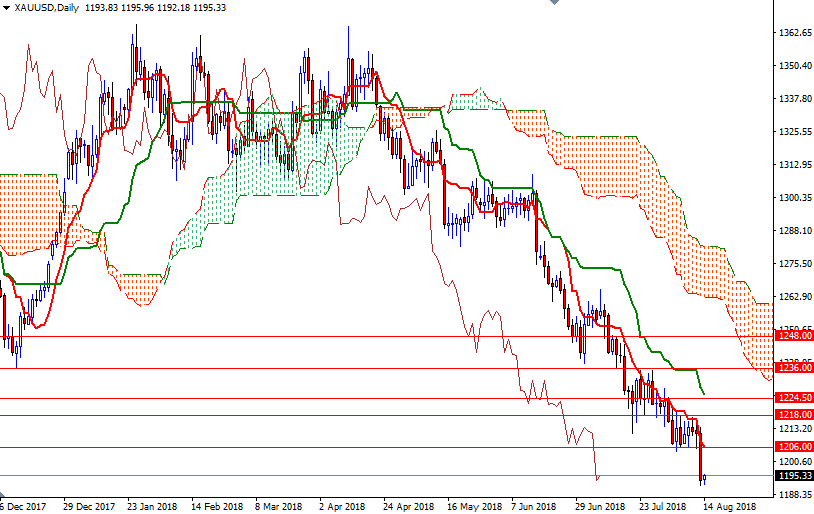

The market is trading below the daily and the 4-hourly Ichimoku clouds; plus the Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) are negatively aligned. The Chikou-span (closing price plotted 26 periods behind, brown line) confirms that the bears have technical momentum on their side.

XAU/USD found some support around 1194 but this area produced only a small bounce so far. If the bulls can defend this strategic area, expect a move towards the hourly Kijun-Sen sitting in the 1200-1198 area. The market has to get back above 1200 to test 1202 and 1206. The bears will need to drag prices below 1194 and take out yesterday's low to challenge the 1188-1187 zone. If this support is broken, the market will be targeting 1182-1180.50.