Gold prices rose $4.32 an ounce on Monday as a weaker U.S. dollar index provided support to the precious metal. The dollar came under pressure in the wake of a trade deal between the United States and Mexico. U.S. stock indexes were higher and set new record highs yesterday. Gold’s drivers will remain the same going forward, including the strength of the dollar and China’s economic growth.

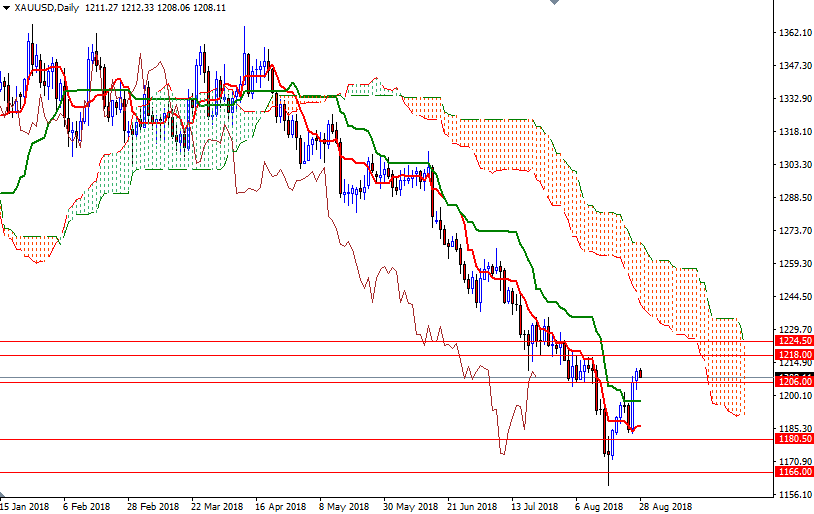

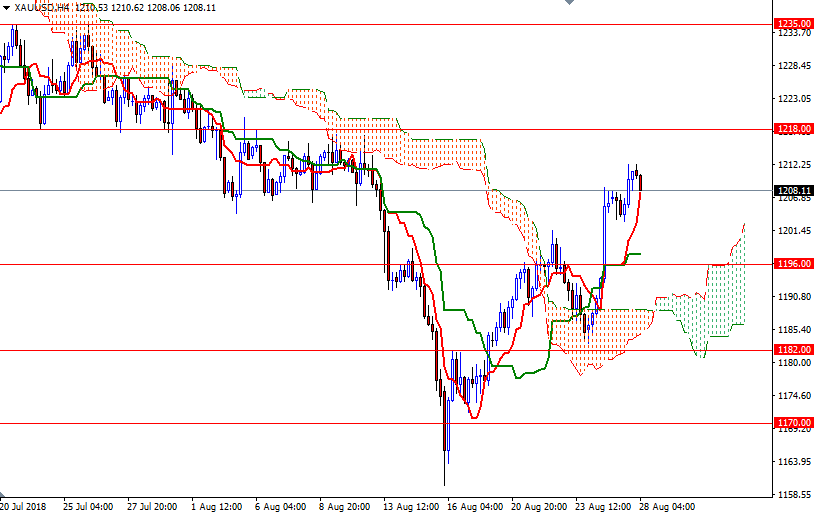

XAU/USD is currently trading above the Ichimoku clouds on the 4-hourly and the hourly charts; plus the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) are positively aligned. The Chikou-span (closing price plotted 26 periods behind, brown line) is above the 4-hourly cloud. Despite this positive short-term outlook, the upside potential will be limited as prices remain below the daily cloud. Technically, Ichimoku clouds not only identify the trend but also define support and resistance zones. The thickness of the cloud is relevant, as it is more difficult for prices to break through a thick cloud than a thin cloud.

To the upside, the first important barrier comes in at 1218, the 38.2% retracement of the bearish run from 1365.10 to 1160.05. The bulls have to penetrate this barrier to challenge the bears on the 1226-1224.50 battlefield. However, if the market fails to stay above 1206, then keep an eye on the 1202/0 zone. A break below 1200 could see a drop towards the 4-hourly cloud. In that case, the 1196/5 area will probably be the next stop.