Gold prices edged down on Thursday, trading down 0.34% at $1191.21 an ounce, as the dollar strengthened after minutes from the latest Federal Reserve Open Market Committee meeting signaled Federal Reserve officials were likely to raise interest rates next month. “Many participants suggested that if incoming data continued to support their current economic outlook, it would likely soon be appropriate to take another step in removing policy accommodation,” according to the minutes of the Fed’s July 31-August 1 meeting. The minutes also indicated that a prolonged trade dispute could disrupt economic growth and employment.

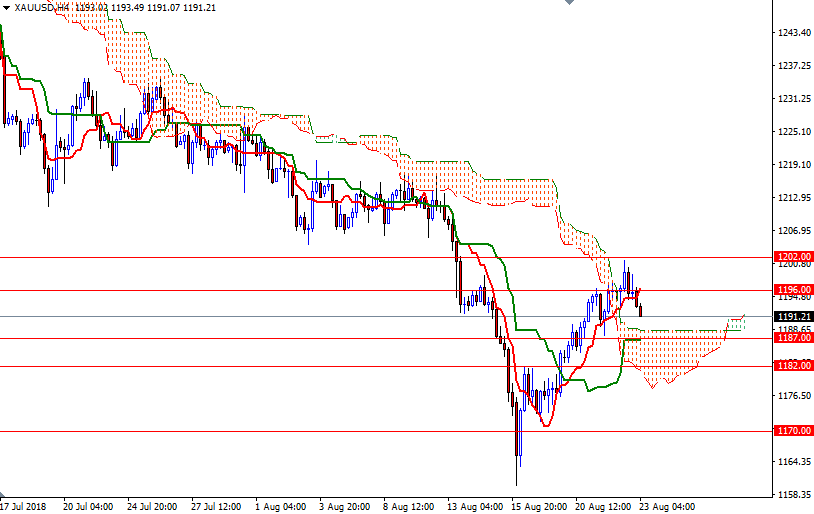

XAU/USD initially edged higher yesterday but the anticipated resistance in the $1202-$1300 area kicked in and pushed prices below $1196. Prices are still above the Ichimoku clouds on the 4-hourly chart, and the Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) are positively aligned. The hourly cloud, which occupies the area between 1191 and 1187, is currently acting as support so the bears need to drag prices below there to tackle the intra-day support at 1184. If this support fails to hold, then the next stop will be 1182-1180.50.

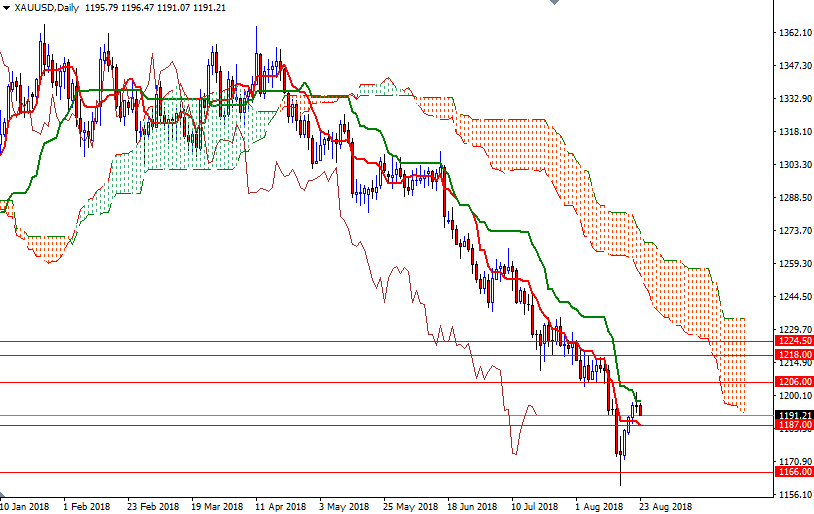

The bulls, on the other hand, have to lift prices above the 1197.58-1196 zone to retest the aforementioned resistance in 1202-1200. A sustained break above 1202 could trigger a push up to 1208/6. Closing above this strategic resistance on a daily basis would open the door to 1218/6.