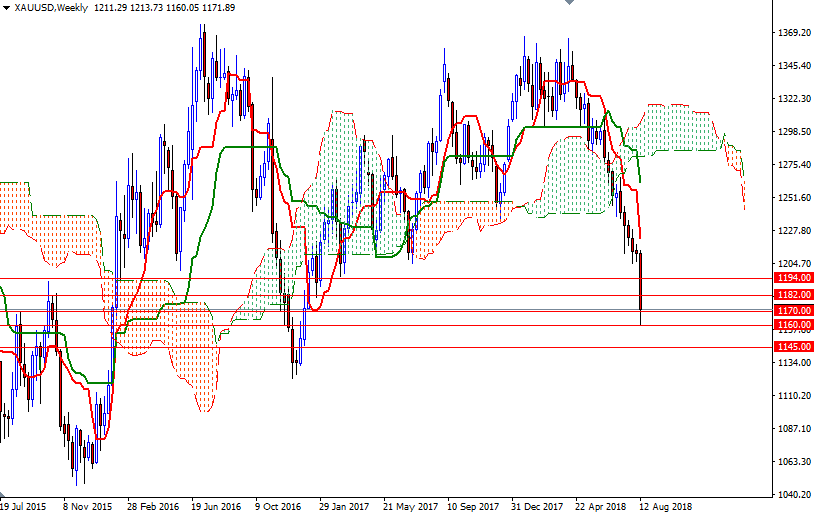

Gold prices dropped for a fourth session yesterday as the dollar strengthened on the back of better-than-expected U.S. economic figures. The Commerce Department reported retail sales increased 0.5% in July. The New York Fed’s manufacturing index came in at 25.6, up from the previous month’s 22.6. Some short covering and some bargain hunting are featured today after XAU/USD notched a 19-month low.

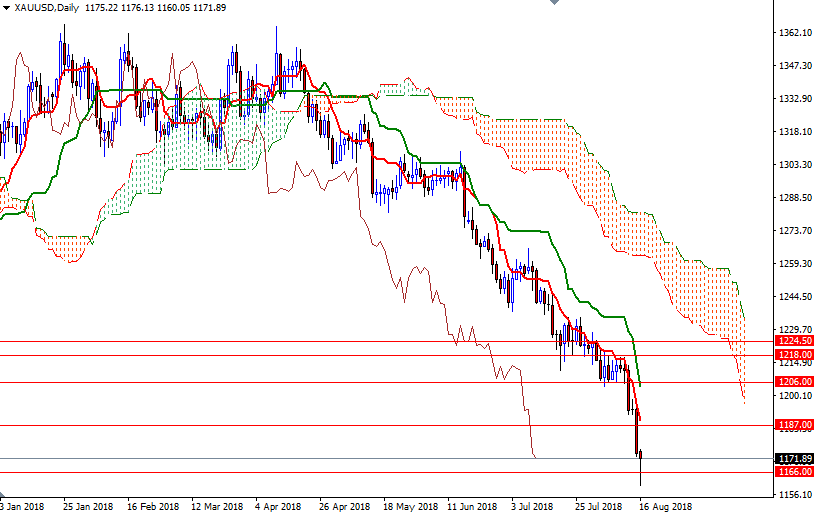

It is way too early to talk about a reversal as the technical outlook for gold remains fully bearish, but a break up above 1177 could see a pull-back targeting 1182-1180.50 or 1188/7. The bulls have to produce a daily close above the 1188 level, which happens to be the daily Tenkan-Sen (nine-period moving average, red line), to gain momentum for a test of 1194.

To the downside, keep an eye on the support in the 1270/69 zone. The bears will need to drag prices below there to revisit 1166/4. Below there, the 1160 level stands out as a strategic support. If XAU/USD dives below 1160, then the next stop will be 1156.