Gold prices rose $5.58 an ounce on Tuesday, extending gains to a third session, as a weaker dollar provided support for the metal. There was no major U.S. economic data released yesterday but the greenback was under pressure after President Trump criticized the Federal Reserve for raising interest rates. Market players will be eyeing the minutes of the Fed's latest policy meeting for potential indications on the pace of future rate hikes.

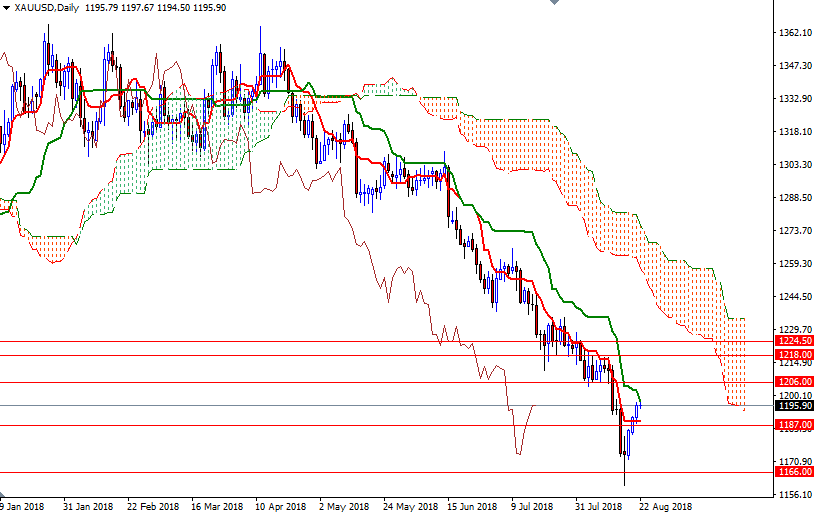

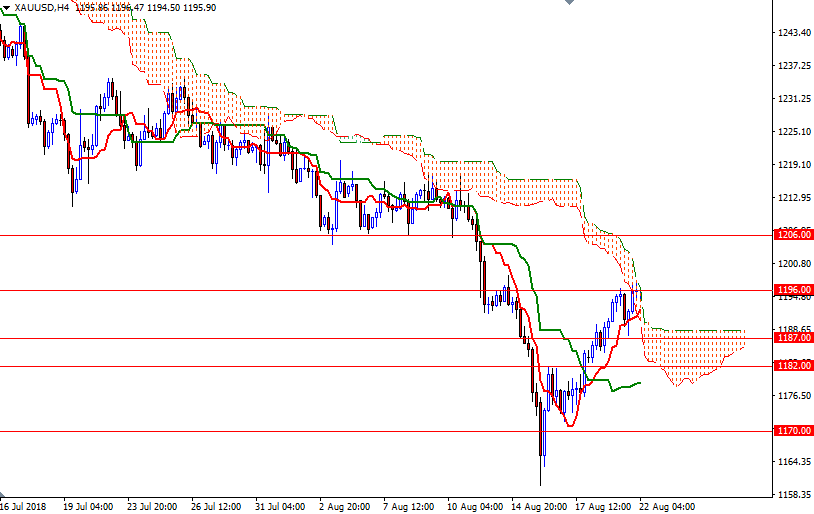

XAU/USD tested the support in the 1189/7 area before revisiting the resistance at around the 1196 level. It seems that we will have to wait until the release of the Fed minutes before prices make a strong move. The daily Kijun-Sen (twenty six-period moving average, green line) is currently standing at 1197.58. The bulls need to lift price above 1197.58 to gain momentum for 1202/0. A break through there brings in 1208/6.

To the downside, keep an eye on the 1189/7 area, where the top of the 4-hourly cloud sits. If XAU/USD dives below 1187, then we may head back to 1182-1180.50. A successful break below 1180.50 could foreshadow a drop to 1177/6. The bears have to drag prices below 1176 to challenge 1272/0.