Gold prices dropped $6.49 an ounce on Monday, weighed down by climbing stocks and an appreciating U.S. dollar. U.S. stocks edged higher on Monday, lifted by the latest flurry of corporate earnings. The greenback is supported by strong momentum in the U.S. economy and outlook for higher interest rates. Rising tension between the U.S. and Iran has not yet provided significant safe-haven support for gold. There is no major U.S. economic data due for release today.

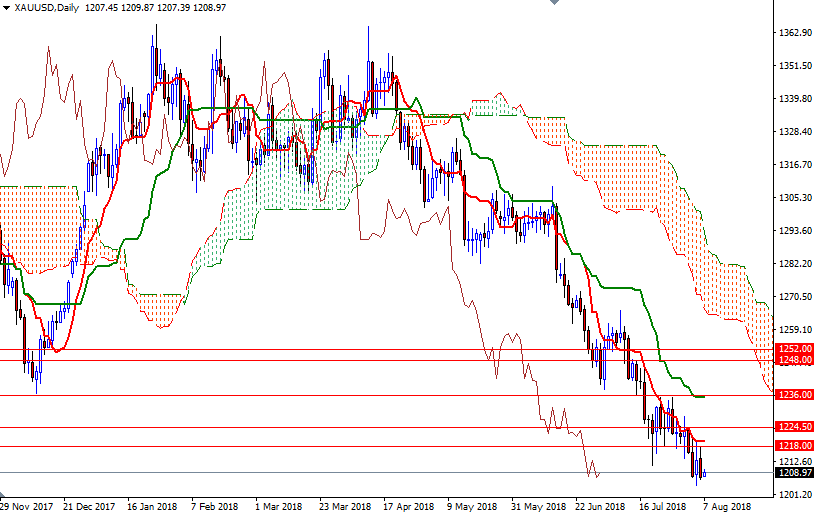

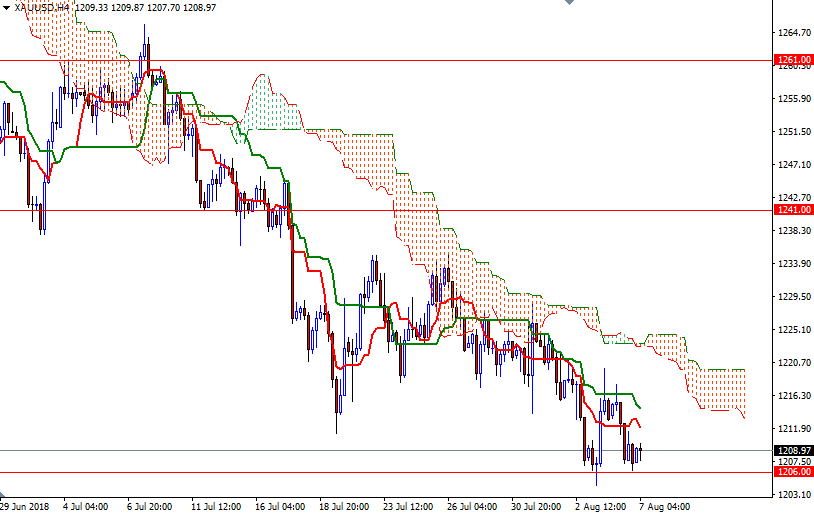

Gold bears are maintaining their firm control of the technical charts. XAU/USD is still trading below the Ichimoku clouds on the daily and the 4-hourly charts. Technically, Ichimoku clouds not only identify the trend but also represent support and resistance zones. The thickness of the cloud is also relevant as it is more difficult for prices to break through a thick cloud than a thin cloud.

Despite this bearish outlook, the upside potential will be limited unless the 1206 level that has provided support twice recently is broken. The bears have to push prices below 1206 to challenge the bulls waiting in the 1200-1198 area. A break below 1198 suggests could foreshadow a drop to 1194, which is the next strategic support on the charts. If the bulls successfully defend their camp at 1206, they may have another chance to revisit the 1220-1218 zone. The market has to get back above 1220 to test the next barrier in the 1226-1224.50. Closing 1226 on a daily basis implies that XAU/USD is on its way to 1236.