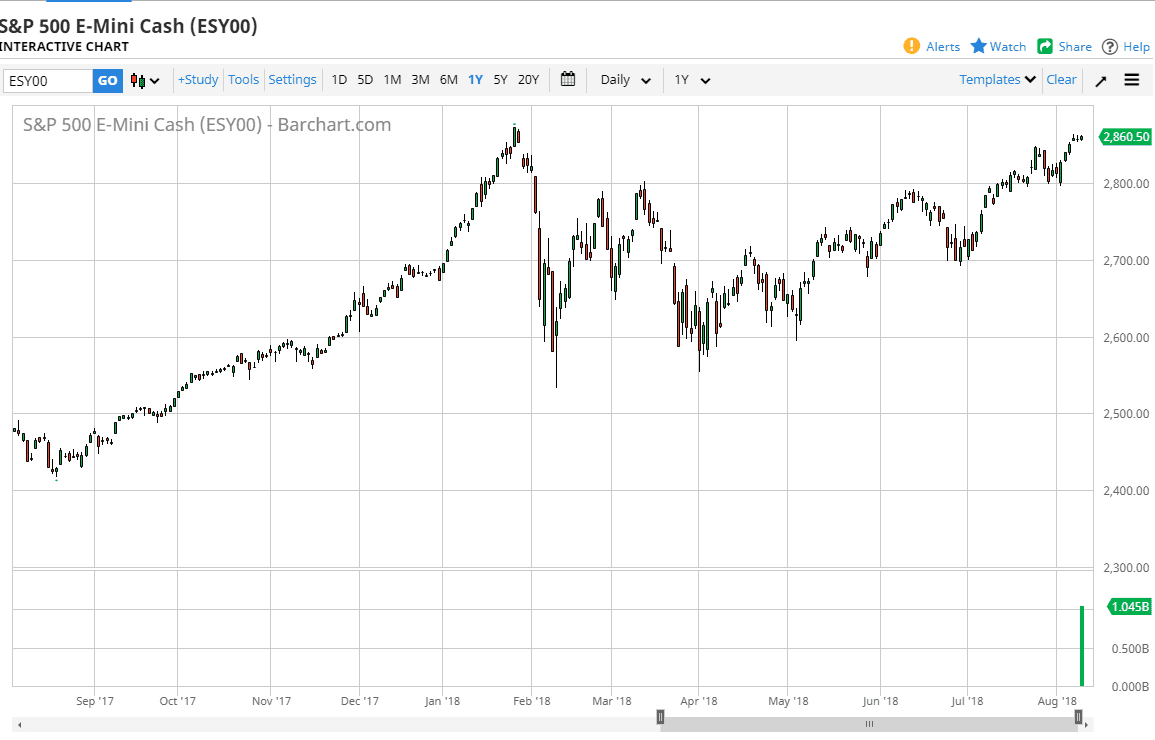

S&P 500

The S&P 500 had a very quiet session during the trading session on Thursday as we continue to hover around the highs. This was an area that we had sold off from rather drastically back in January, so I think there is a certain amount of trepidation this point, and it will be interesting to see if we can clear the 2880 handle. Right now, it doesn’t look like we are ready to when we may need to pullback to build up the necessary momentum. However, if we turn around and break below the 2800 level, something that probably won’t happen today, this market could roll over and confirm a double top. A break above to a fresh, new high opens the door to 2900, and then eventually the 3000 over the longer-term. Right now, I’m not looking to sell but I am paying attention to the bearish daily candles.

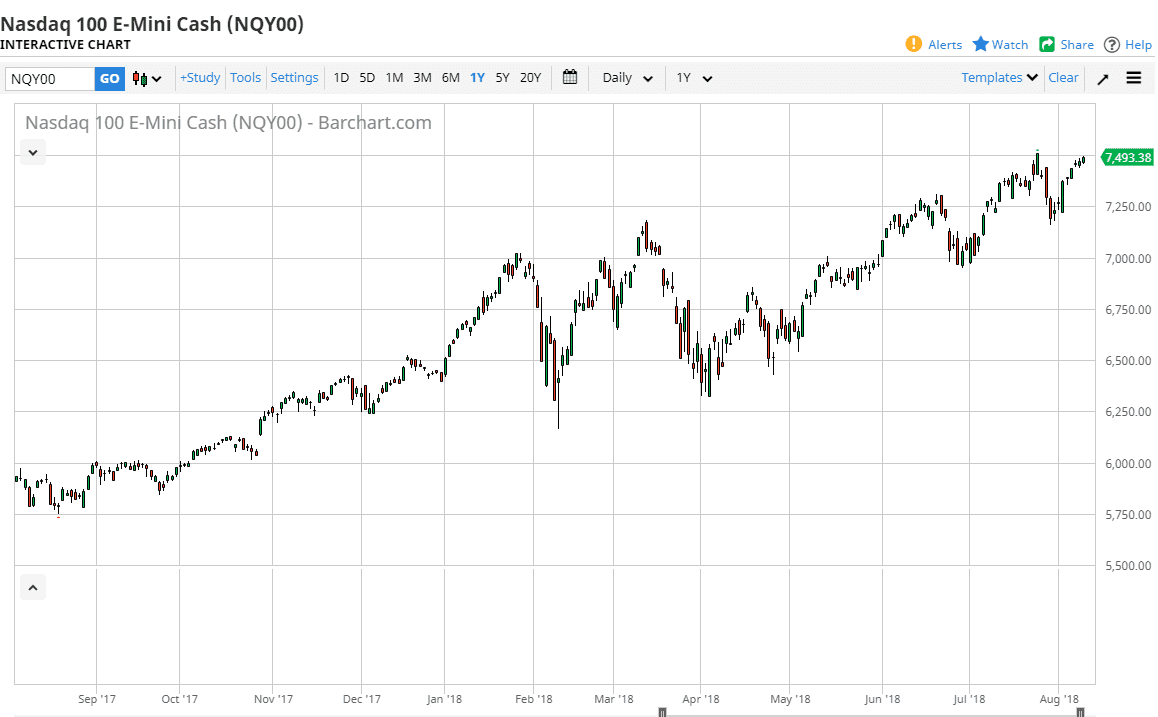

NASDAQ 100

The NASDAQ 100 rows as well but continues to struggle with the 7500 level. I think if we can break above to a fresh, new high, the market would enter the next leg higher, meaning it would become more of a “buy-and-hold” marketplace. Short-term pullbacks should have plenty of buying pressure though, and I think that there is significant support at the 7250 level. Longer-term, if we break to the upside I think that we could then go to the 7750 handle. This is an uptrend, so I don’t feel I need to fight against that, but clearly there are a lot of concerns out there that could cause major issues with stock markets around the world. Geopolitical concerns with North Korea, Iran, and of course trade wars between various nations in the United States could all cause issues.