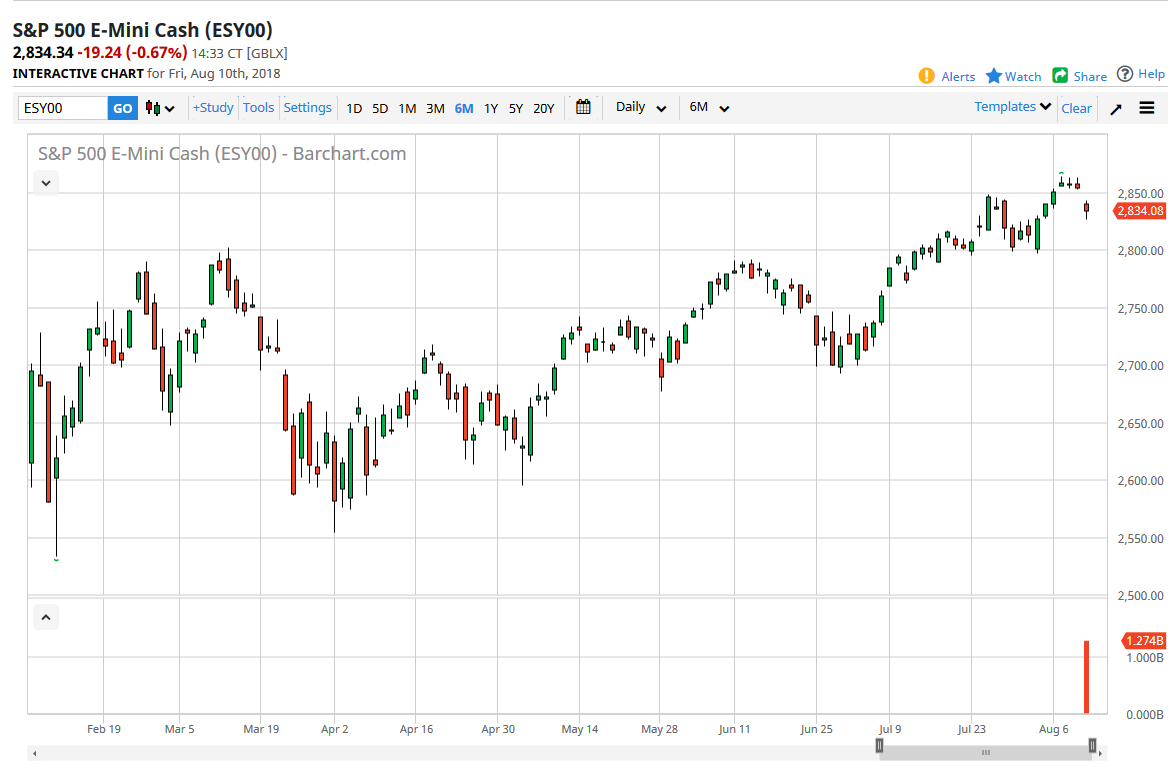

S&P 500

The S&P 500 has dropped hard during the trading session on Friday, as concern about the Turkish lira falling over 11% has rocked the markets. The US dollar got far too strong, and now there are concerns about contagion with the EU and its banks when it comes to Turkish debt. With that in mind, it was no big surprise that we felt. However, we are still very bullish in general, and it looks like we are going to continue to see buyers on dips. We don’t have anything suggesting that the market is about to collapse though, and I think at this point it makes sense that value hunters will come in sooner or later. I look at the 2800 level is very crucial, and we may drift down to that area in order to pick up a bit of value and continue the overall attitude as we break down below the 2800 level, then the market could go much lower.

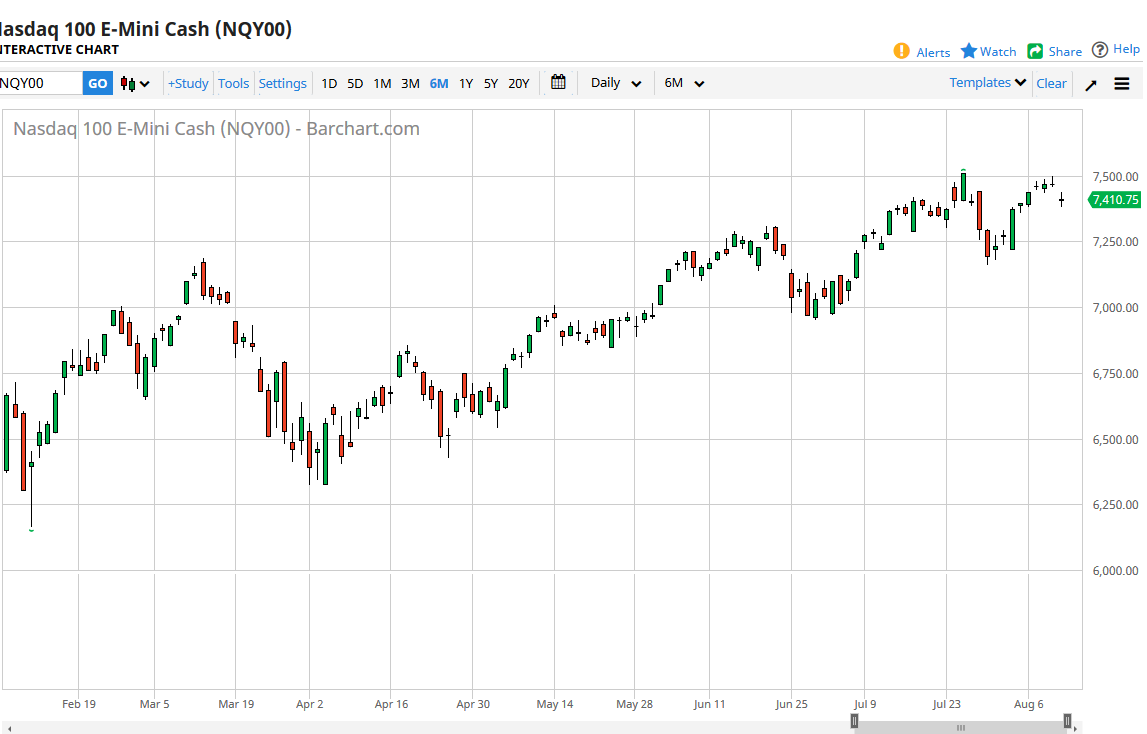

NASDAQ 100

The NASDAQ 100 broke down during the day initially, reaching down to the 7400 level. The market looks likely to find some buyers in this area, and if not we would probably find even more at 7250. It’s obvious to me that the 7500 level has been a bit difficult to overcome, and it may take several attempts to do so. This pullback at this point still remains within the overall range, so it makes sense that eventually we should find some type of catalyst to go higher. If we can break 7500, then I think the market goes even higher than that. A break down below the 7250 level could unwind this market a bit more, but we are still very much in and uptrend and I don’t want to fight that. Be patient and take advantage of value.