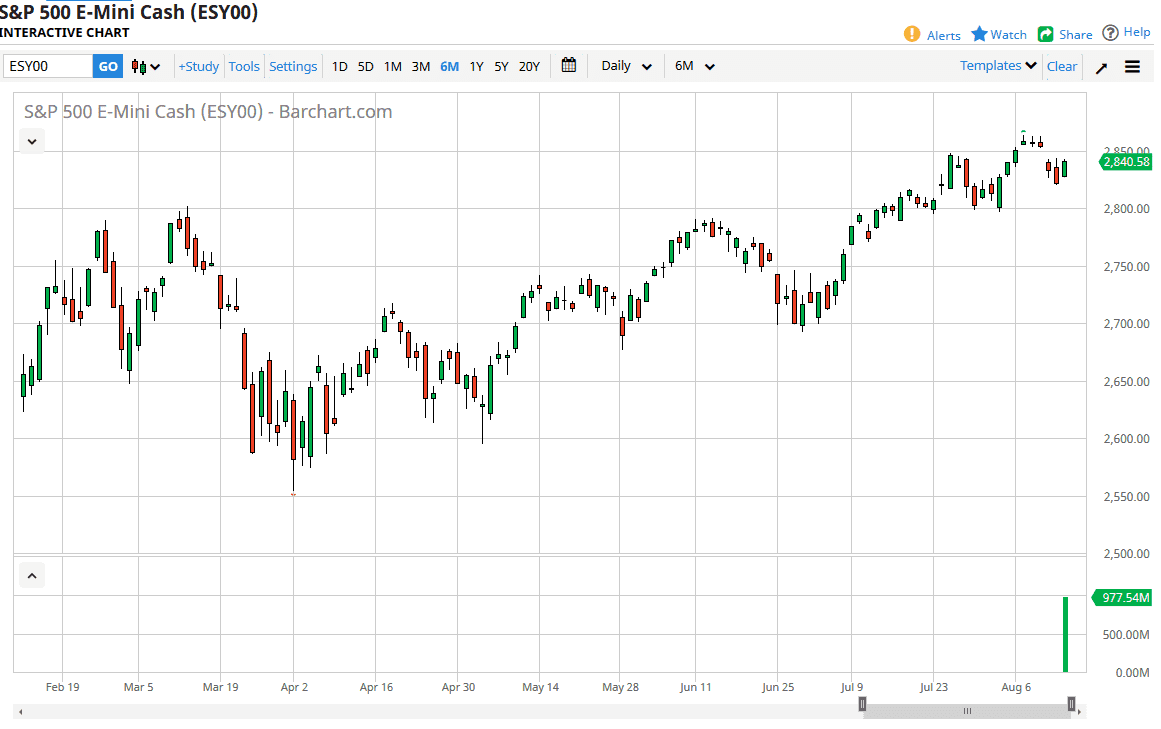

S&P 500

The S&P 500 had a positive session, gaining over 0.5% during the day, but it wasn’t the easiest day to be in the market. I recognize that there is still a significant amount of resistance above, and that the 2880 handle continues to be major supply. I believe in short-term pullbacks, as a should offer plenty of support, especially near the 2800 level. I think at this point, the market will continue to be very noisy, because quite frankly there is a lot of ugliness out there in the Third World. Contagion is suddenly a word that people are starting to utter again, and it’s not just in Turkey, in fact it could be in China if the Chinese yuan continues to fall apart. At this point, we are still very much in and uptrend, but people are awfully quick to take profits.

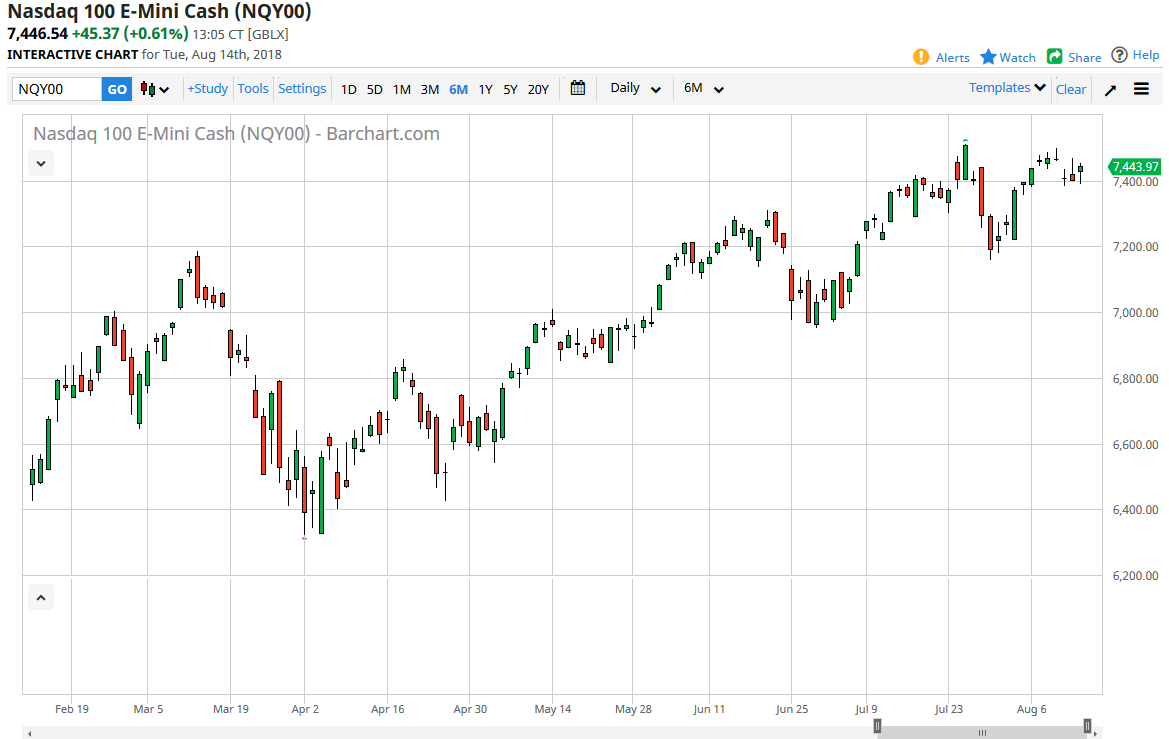

NASDAQ 100

The NASDAQ 100 continues to be very noisy, as we felt towards the 7400 level before turning around to form a bit of a hammer. That’s a good sign, but it still looks as if the 7500 level above causes a lot of psychological discomfort. I think if we can break above there, the market should then continue to go much higher. The 7500 level being broken to the upside allows the market to extend the gains, and if you look at the chart it doesn’t take much in the way of imagination to see an up trending channel. However, as I mentioned with the S&P 500, starting to see a lot of red flags around the world, and that I think is starting to weigh upon stock traders, even in the United States which is by far the strongest economy right now.