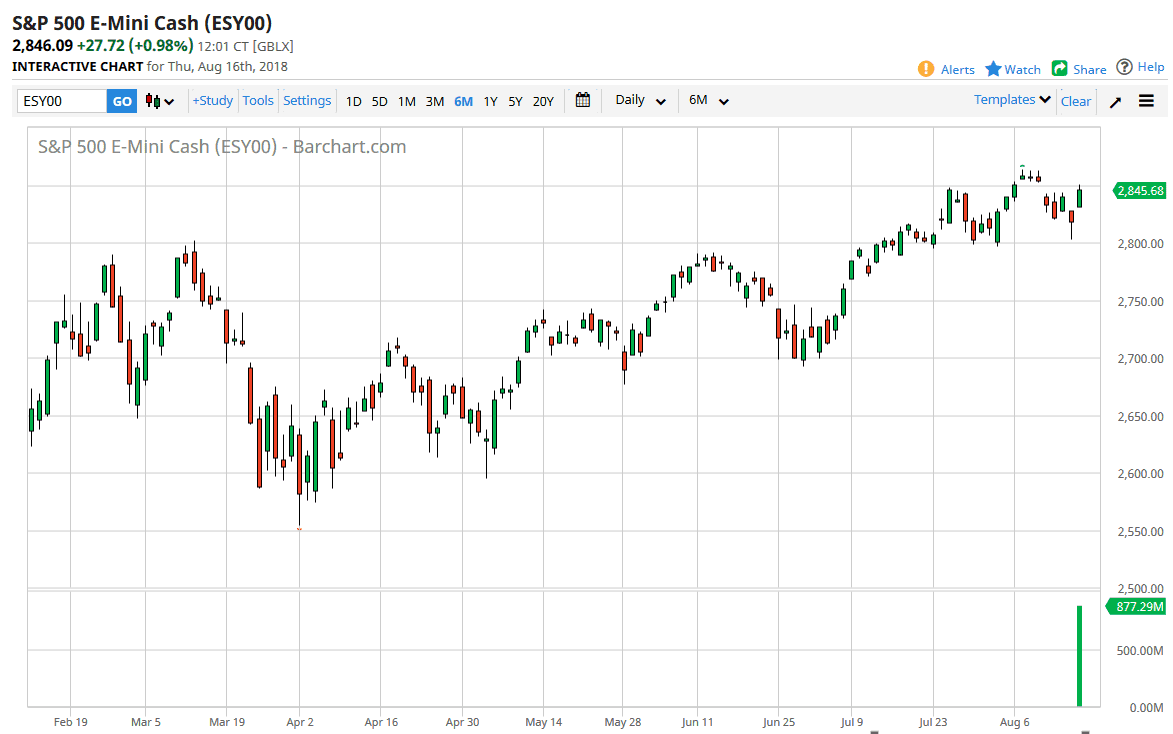

S&P 500

The S&P 500 gapped higher at the open on Thursday, as news came out overnight that the Chinese were coming to meet the Americans to discuss trade next month. It’s a low-level meeting, but it’s a step in the right direction and it was reason enough for the market to explode to the upside. From a technical analysis point of view, this is truly interesting, considering that we have just filled a major gap. Beyond that, we pulled back a little bit so it’ll be interesting to see how this plays out. If we can break to a fresh, new high, then obviously that’s a buy signal. Otherwise, we could pull back during the session today as people look to book profits ahead of the weekend, which quite frankly anything could happen. This is a very nervous market, so it would make sense for people to want to go home flat.

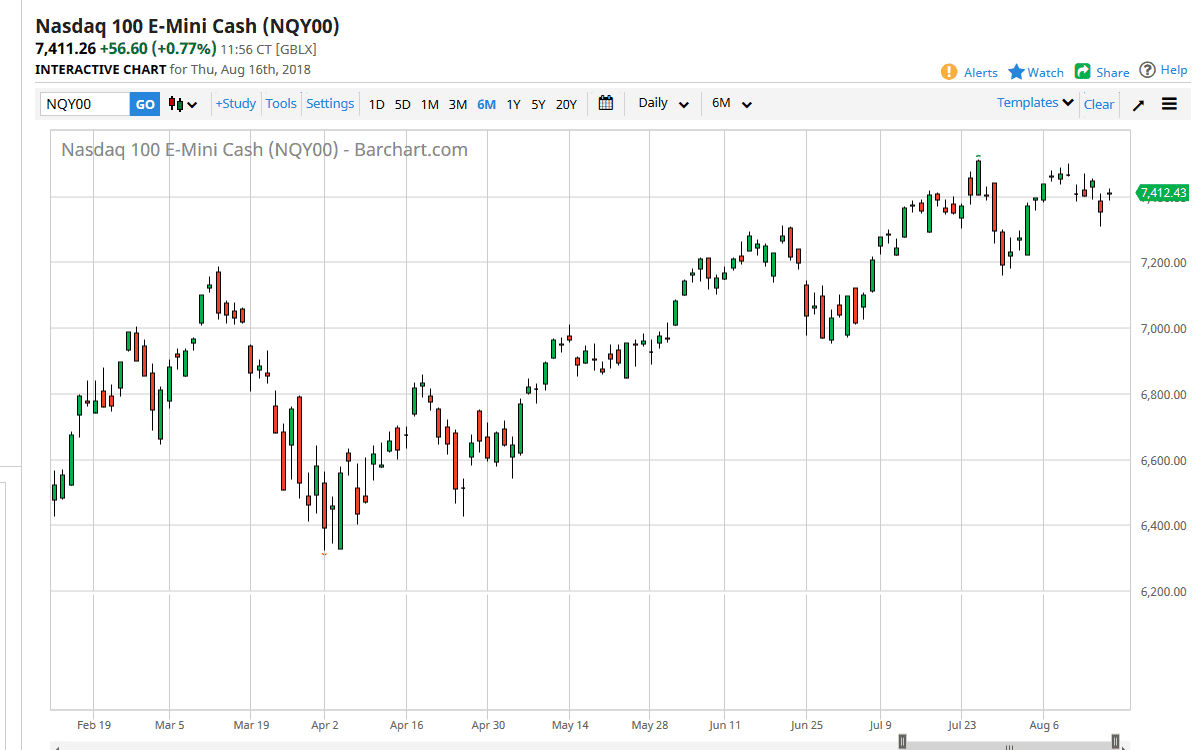

NASDAQ 100

The NASDAQ 100 also gapped higher as you would expect, reaching towards the 7425 region. The 7500 level above continues to be very resistive, so it’ll be interesting to see if we can break through that. If we do, then that would signify the next leg higher. Otherwise, I think were going to simply bounce around the 7400 region over the next 24 hours, as people look to find some type of directionality to the market. Things have been rather crazy over the last couple of days, so would not be surprising at all to see people willing to simply sit on the sidelines and relax. In this type of environment it’s very hard to have a position on over the weekend, when you simply don’t know what could happen next.