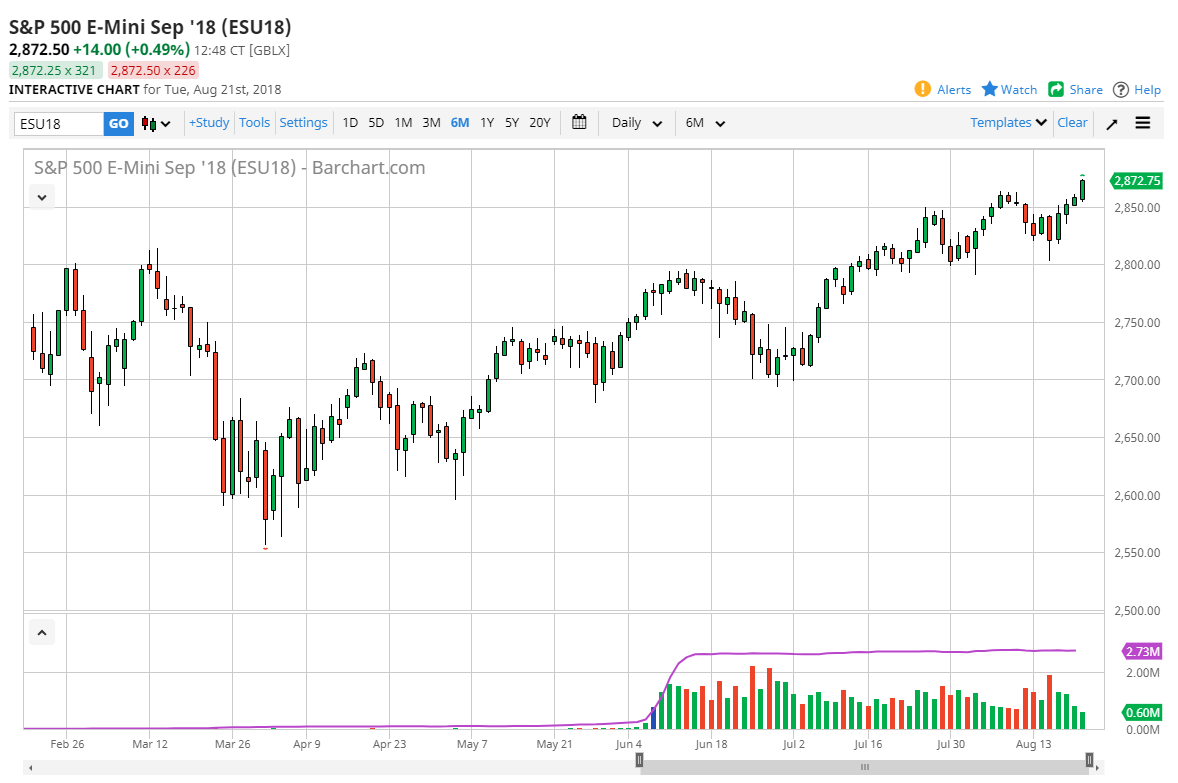

S&P 500

The S&P 500 rallied during the day, making a fresh, new high as the uptrend continues. The US dollar lost a lot of strength, and that of course help stock markets in the United States. I think that we obviously have a significant amount of support at the 2850 handle, and most certainly at the 2800 level. I think that short-term pullbacks will offer value the people take advantage of, so therefore I don’t have any interest in shorting this market. I think that the market is probably going to go to the 2900 level, and then possibly to the 3000 level after that which has been my longer-term target for some time. The market I think has a ton of support at the 2800 level. If we were to break down below that level, it would probably change the overall trend eventually. There are a lot of concerns out there, but I don’t think at this point they are going to sink the market longer term.

NASDAQ 100

The NASDAQ 100 also rallied during the day, even more so on a percentage basis than the S&P 500 did. However, we have not broken to the upside, and I believe that the $7500 level will continue to be very difficult to deal with. Technology stocks have suffered a bit, and quite frankly that is probably due to sector rotation by stock market traders. I believe pullbacks are buying opportunities, and I believe that the 7200 level is a major support level, just as the 7000 level is. If we break down below the 7000 handle, the market then will unwind and perhaps change the trend overall. This is a market that I think eventually will break out, but it’s very likely that we will lag behind the S&P 500.