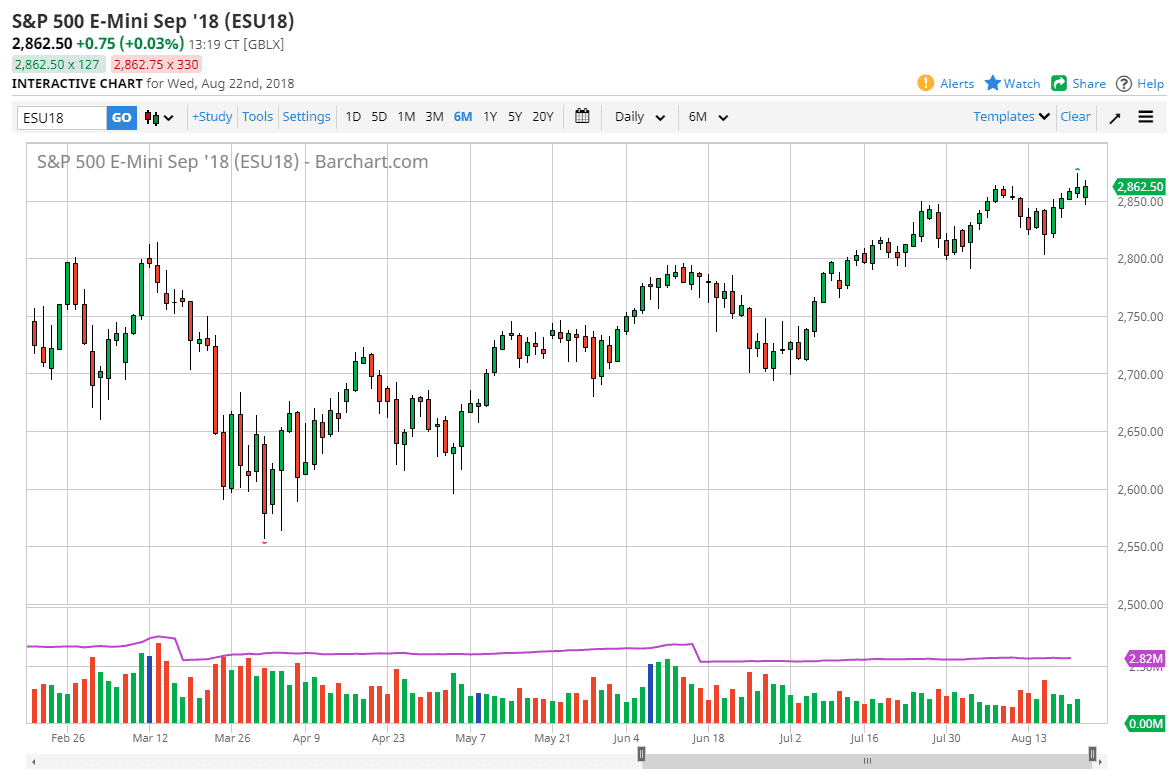

S&P 500

The S&P 500 had a decent session during the day, considering that we had initially pulled back and started to lose ground during electronic trading overnight. We ended up closing near the breakeven point, which of course is a bullish sign, as we approached the all-time highs again. The shooting star that formed during the Wednesday session is something to consider though, as it is a sign of significant resistance above. If we do break above the top of that shooting star, I think that will be the next leg higher. This is a market that continues to have a lot of noise attached to it, but let’s be honest that we continue to see buyers every time we did. That of course has not changed, so we could drop as far as the 2800 level before I would become concerned.

NASDAQ 100

The NASDAQ 100 initially dipped during the trading session on Thursday but found enough support at the trend line I have drawn on the daily chart to turn around and rally. This is a good sign, because we are hanging onto the gains that we had been giving up over the last couple of days. That doesn’t mean we can’t pull back, and quite frankly I hope we do so that I can pick up a little bit of value. In general, I think the 7500 level above is going to continue to offer resistance, but if we can clear that level then the market will be free to go much higher. If we break down below the uptrend line, extensively the 7300 level, then I think we could probably drive down to the 7200 level, possibly even the 7000 level after that.