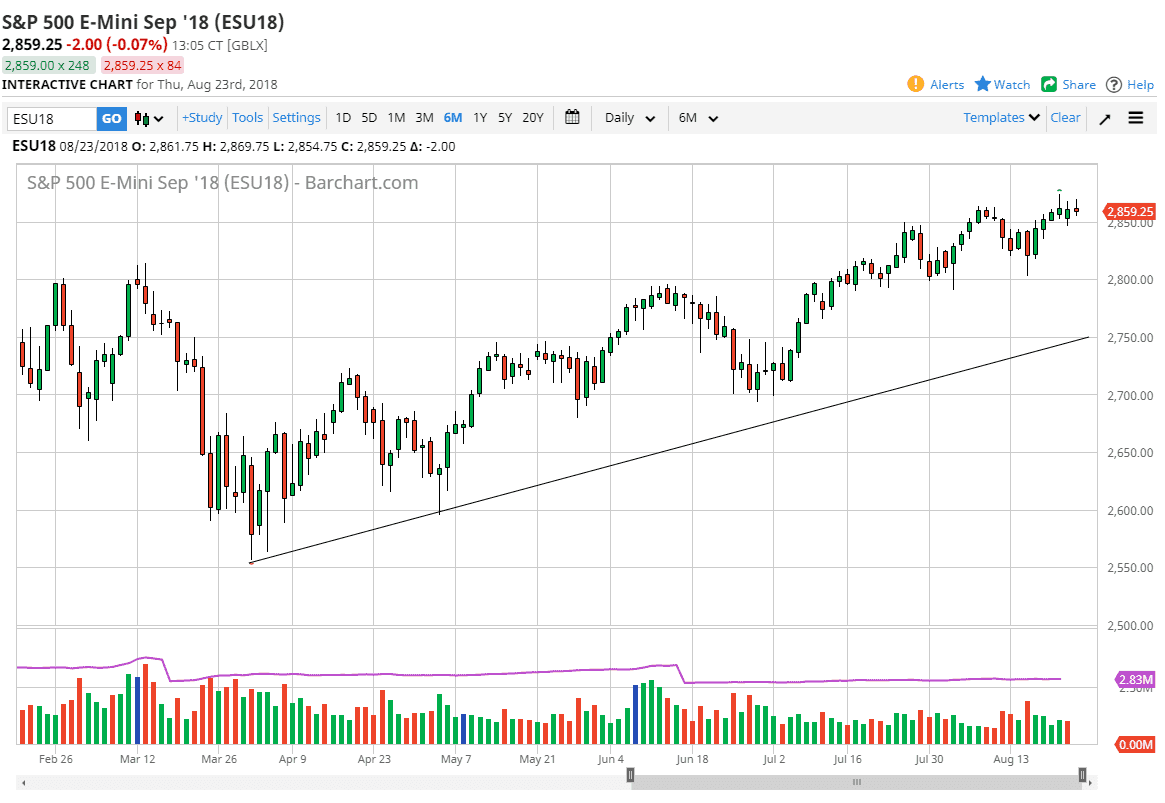

S&P 500

The S&P 500 has gone back and forth during the session on Thursday, as the market continues to struggle with the highs. That’s not a huge surprise, and we did form a massive shooting star on Wednesday that will have a lot of people concerned. I think there is support at 2850, but if we break down below there we will probably go looking towards 2800. However, if we make a fresh, new high then I think the 2900 level will be the next target. I believe that this market continues to be very volatile and going into a Friday session it’s difficult to imagine that there will be major moves, unless of course there is some type of news event. At this point, the market looks as if it is a little bit exhausted, so caution would be needed.

NASDAQ 100

The NASDAQ 100 tried to rally during most of the session as well, but also struggled at these lofty levels. The 7500 level has offered a massive amount of resistance, so breaking above there would be a crucial change in the fortunes of this market. There is an uptrend line underneath though, and I will be paying close attention to that as it should make a major difference. If we break down below that uptrend line, then the market could find itself unwinding to the 7200 level. I do believe that the upside is the correct direction overall, but right now the market does look a bit tired and it certainly cannot seem to get above the 7500 level. If we did, that would be the next leg higher in just starting to happen, and it could be a longer-term opportunity.