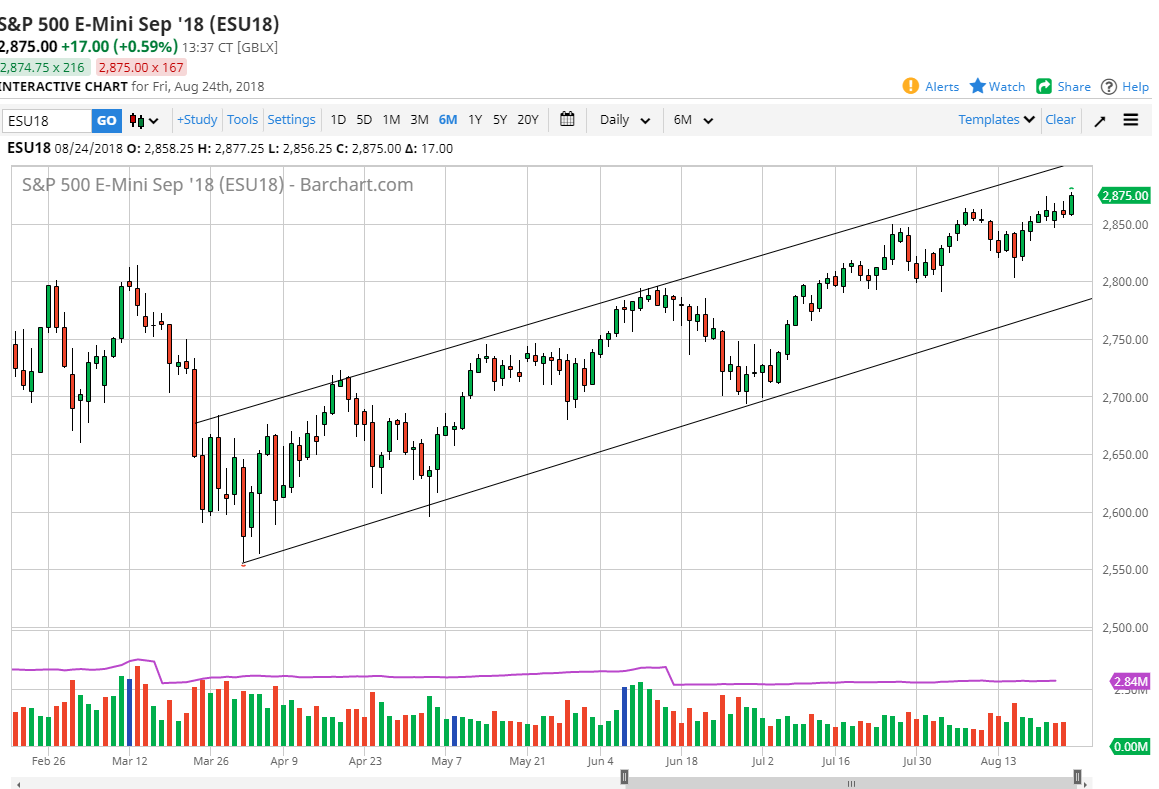

S&P 500

The S&P 500 rallied significantly during the trading session on Friday, pressing the all-time highs. The market looks look ready to go higher, but at this point I think it would be prudent to wait for a short-term pullback to take advantage of value, unless of course we can clear the 2880 handle, which should open the door to 2900. However, it’s a lot to ask on Friday for the market to continue to grind higher, as a lot of people won’t want to carry risk over the weekend. Because of this, I think we may have to wait until today or perhaps even later in the week to make that fresh, new high but to me it’s obvious it’s going to happen. Look for short-term charts to offer value that you can take advantage of with 2860 offering support, followed by 2850 and 2800.

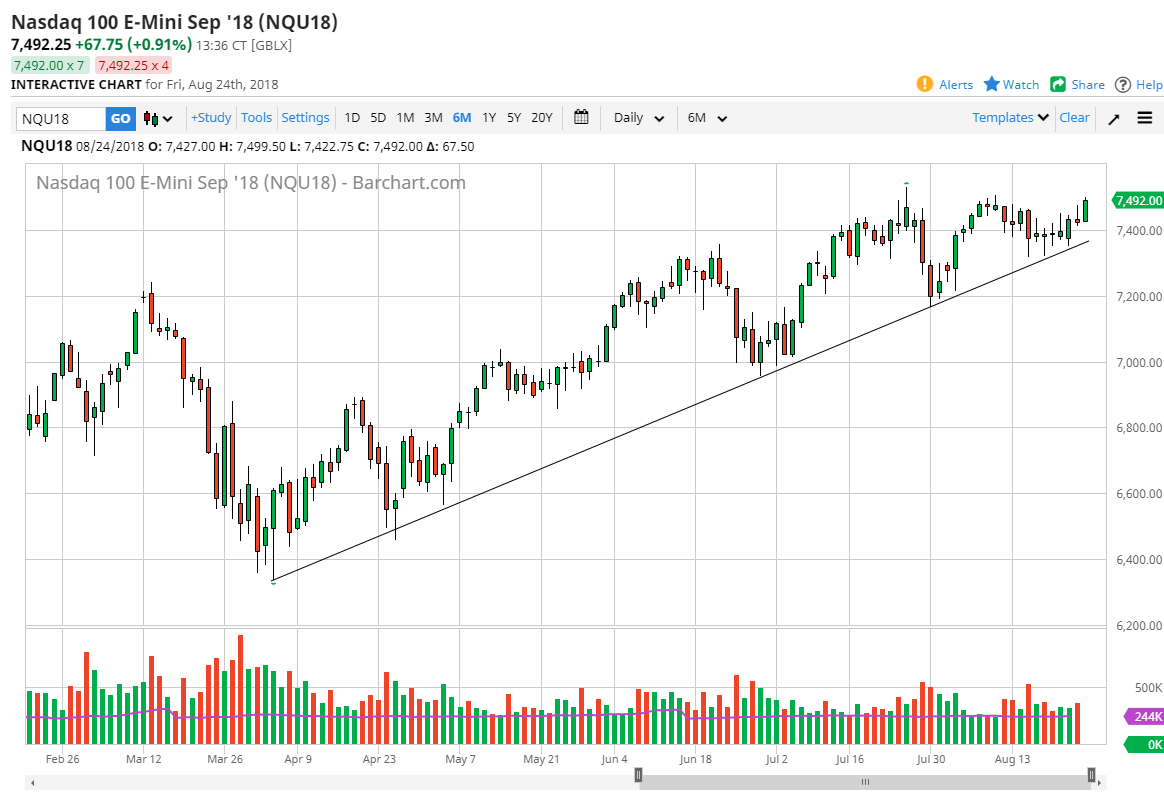

NASDAQ 100

The NASDAQ 100 is pressing the issue as well, coming tediously close to the 7500 level as I record this. The market has followed a nice uptrend line for some time, and now you can start to see how important the 7500 level will be. If we can break above that level, and I think we will, the market is free to go much higher. I believe that the NASDAQ might be the leader going forward, which is kind of ironic because just a few days ago everybody on Wall Street was talking about how we were seeing a major sector rotation, meaning out of technology and into consumer Staples, which is the last part of the business cycle. Obviously, that has not happened, and now it looks like we are full “risk on” yet again. I believe that the 7400 level underneath is going to be extraordinarily difficult to break below.