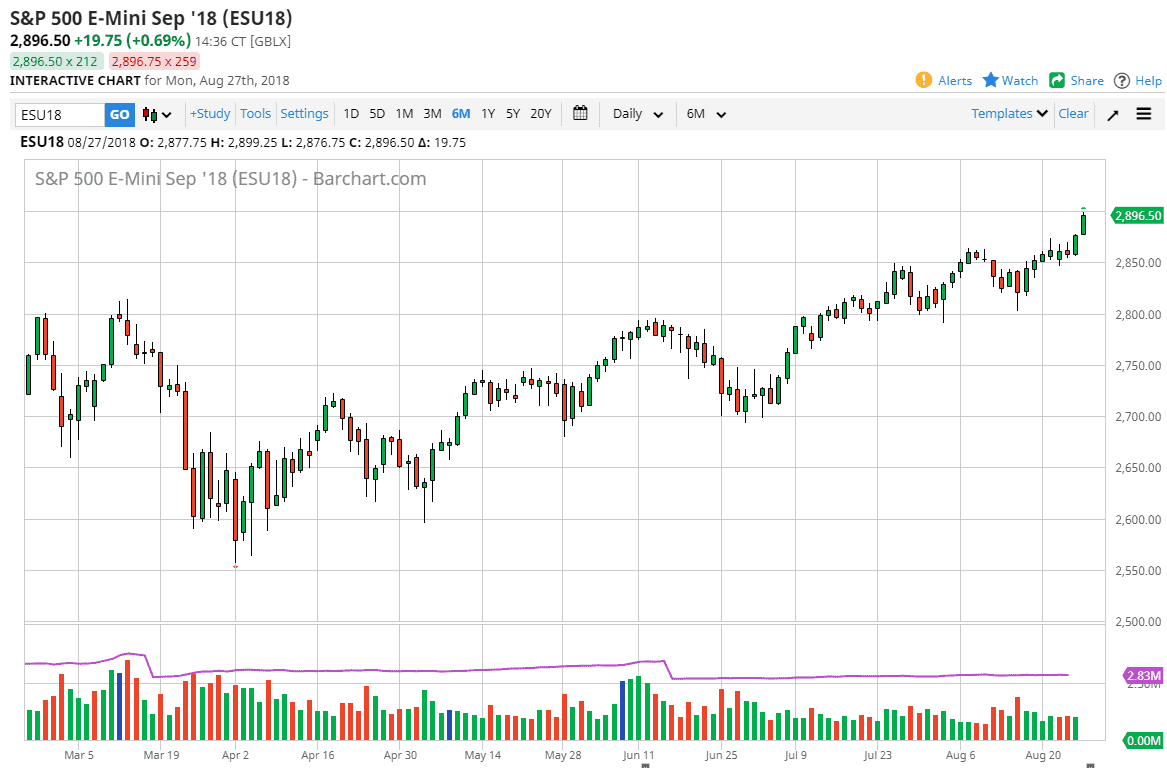

S&P 500

The S&P 500 rallied during the trading session on Monday as traders came back from the weekend. The United States and Mexico have come to an agreement, which of course helps the overall attitude of traders. The strong green candle course shows just how resilient this market is, as we approach the vital 2900 level. A pull back from here should be a buying opportunity, especially near the 2850 level, as it should be massive in its support. Beyond that, the 2900 level being broken to the upside should send this market towards the 3000 level after that. Anytime the market pulls back, you should be looking for short-term support of candles to start buying. I believe that the overall “floor” in the market is near the 2800 level, and if we can stay above there we are still very healthy for the uptrend. Corporate profits have been very good as well, so that should continue to push this market to the upside.

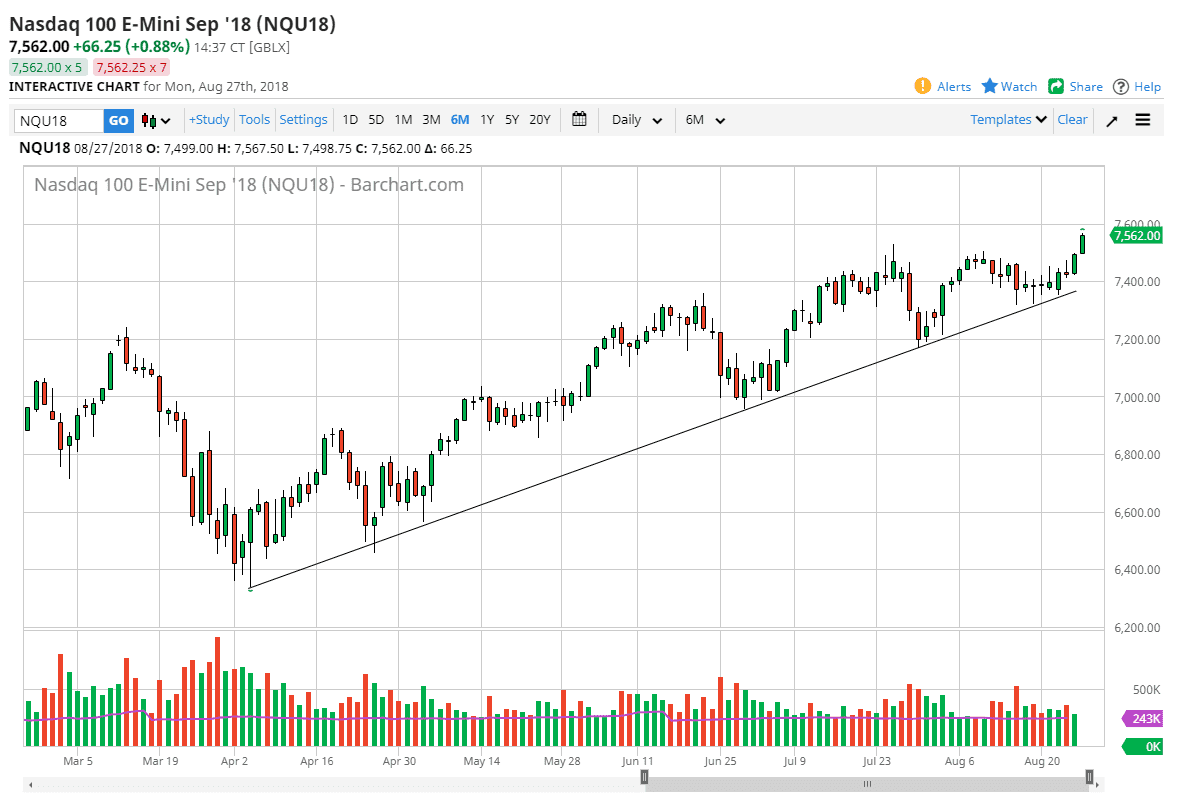

NASDAQ 100

The NASDAQ 100 rallied during the trading session on Monday, looking towards the 7600 level above. If we can break above that level, the market could go much higher, but I think at this point a pullback should only attract more buyers. The uptrend line continues to show signs of life, and I think that if we can clear the 7600 level, the market will simply go higher. Pullbacks should be supported all the way back down to the uptrend line, so at this point I have no interest in trying to short this market, I think that the best possibility might be to look for value in this market.