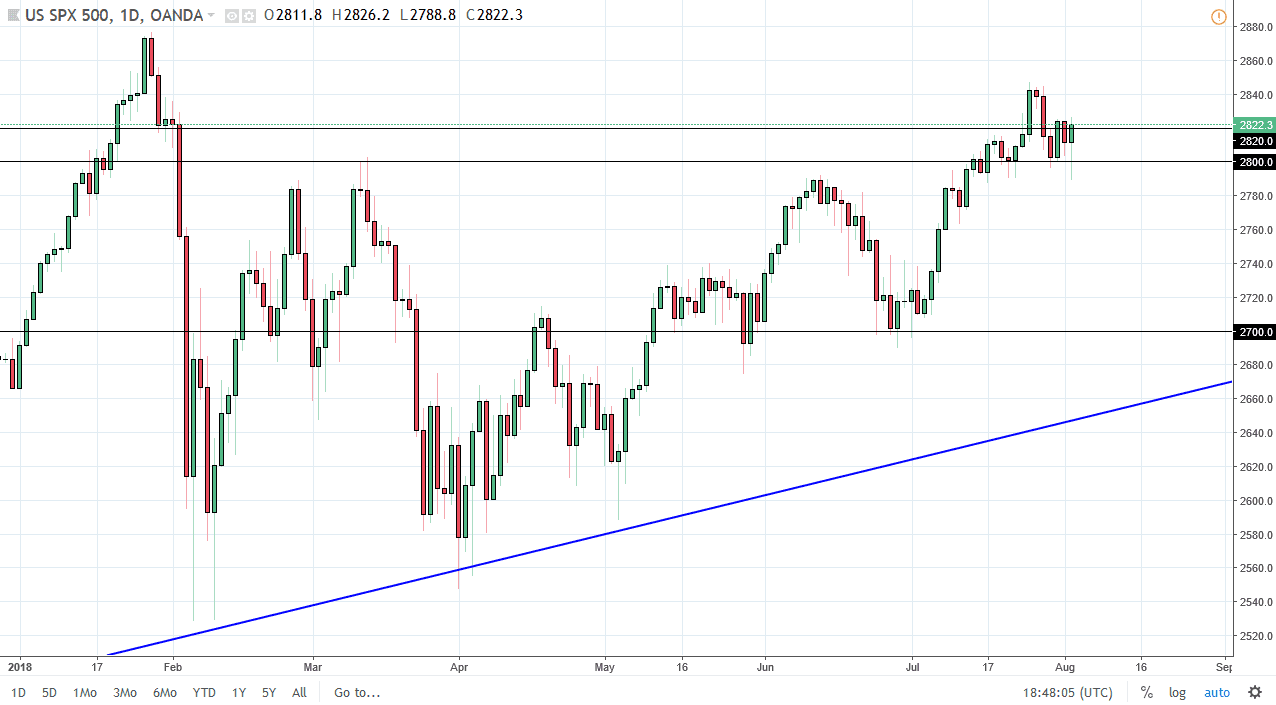

S&P 500

The S&P 500 initially fell during the trading session on Thursday, breaking down below the 2800 level before finding plenty of support near the 2790 handle. We bounced from there to turn around and form a massive hammer, which suggests to me that buying on the dips continues to be main theme of this market. With the jobs number coming out today, I think the best thing that we can help for is that we break down from here, and then start buying a bit of value when he gets offered. I believe that if we can stay above the 2790 handle, the market will continue to find plenty of reasons to go higher. If we can stay above that level, I think this shows that the underlying value hunters continue to run this market. To the upside, the 2840 level is the target, and if we can break above there then we can continue to go much higher, perhaps the 2880 handle.

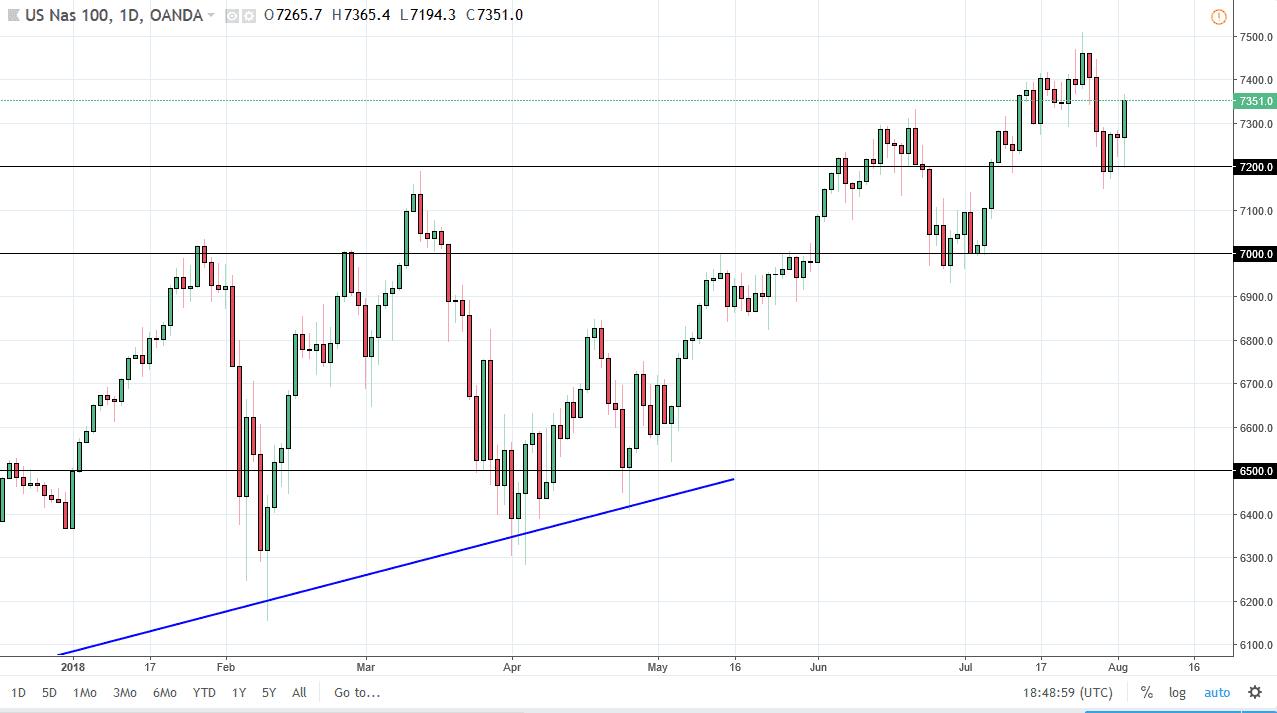

NASDAQ 100

The NASDAQ 100 initially fell as well but found a significant amount of support at the 7200 level. The 7200 level continues to be a major level of support in the market, and the fact that we bounced there tells me that market participants continue to be attracted to this market on dips as it offers plenty of value. I think that if the jobs number is decent, any type of pullback will probably be looked at as a buying opportunity. If the number is poor it’s likely that we could see the market turned around after the initial knee-jerk reaction to the downside. It’s not until we break below the 7000 level that I would be concerned.