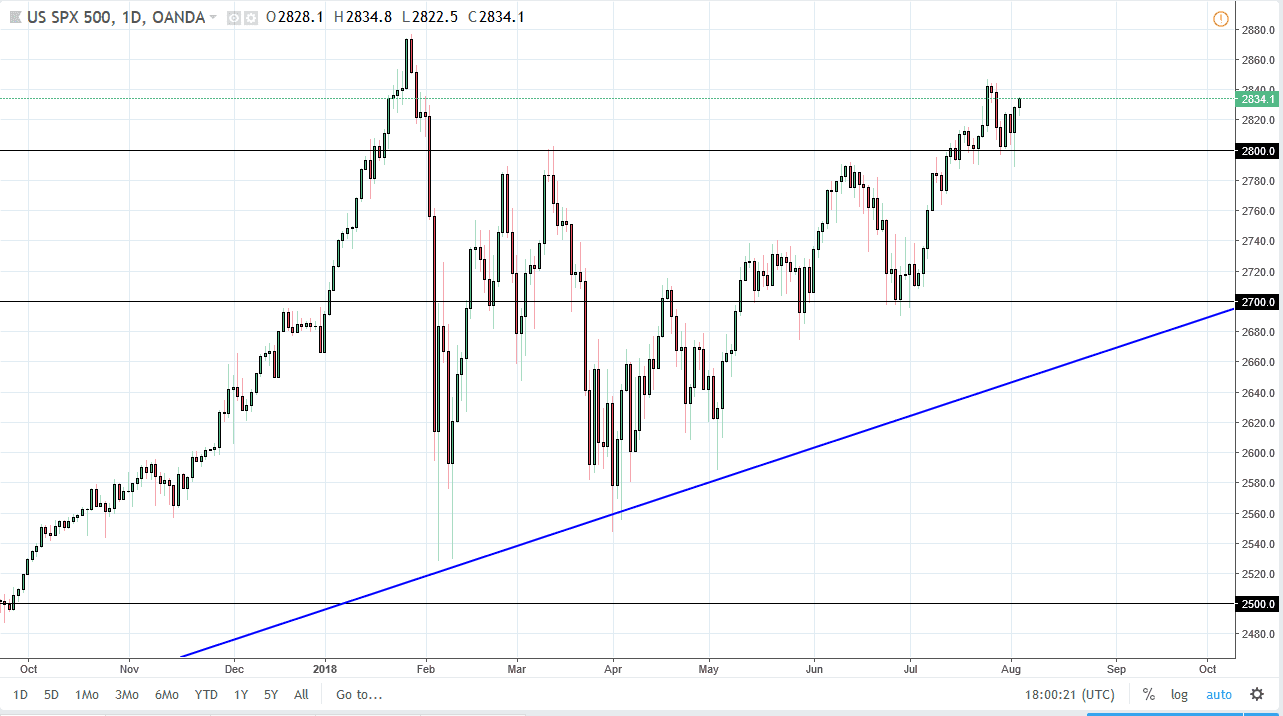

S&P 500

The S&P 500 initially fell during trading on Friday but bounced enough to rally towards the 2835 handle. I think there is a significant amount of resistance above though, especially near the 2850 level. I would anticipate short-term pullbacks as buying opportunities, but as far as momentum is concerned we need to see the 2850 level broken to be comfortable. I believe that the 2800 level underneath is going to offer support near the previous bounce, which I believe extends support down to the 2790 handle. I’m still bullish, but I recognize that the markets are a bit jittery after the slight jobs number miss, and of course the geopolitical concerns around the world right now involving trade tariffs and potential currency wars.

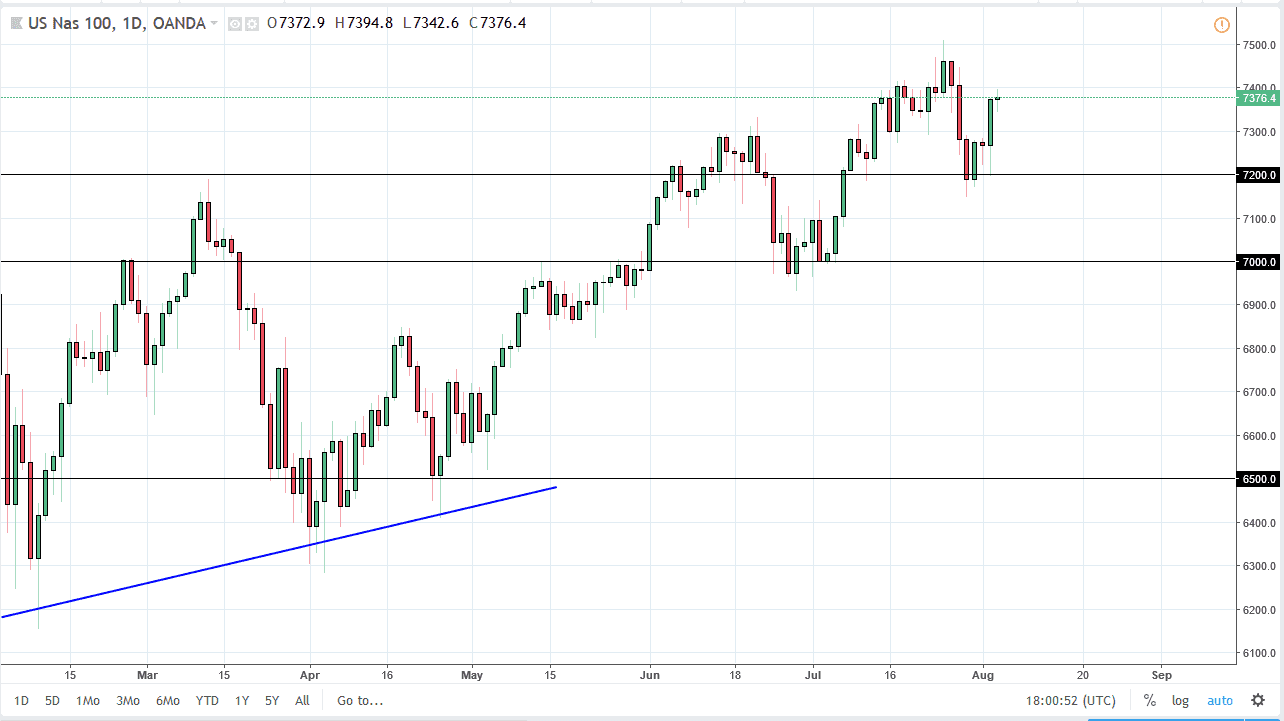

NASDAQ 100

The NASDAQ 100 had a neutral day during Friday’s trading, as 7400 continues offer far too much in the way of resistance. Because of this, I think that we may pull back a bit from here, but I would expect plenty of buyers near the 7200 level. I’m still a “by on the dips” type of trader when it comes to this market but I recognize that 7500 has a certain amount of psychological resistance built into it. If we were to turn around and go above there, the market would probably enter more of a “buy-and-hold” phase, which I don’t think it’s ready to do quite yet based upon other stock indices that I follow. I do expect 7200 to be very supportive though, so break down below there would be a bit surprising. If that happened, we would be looking at a move to the 7000 handle.