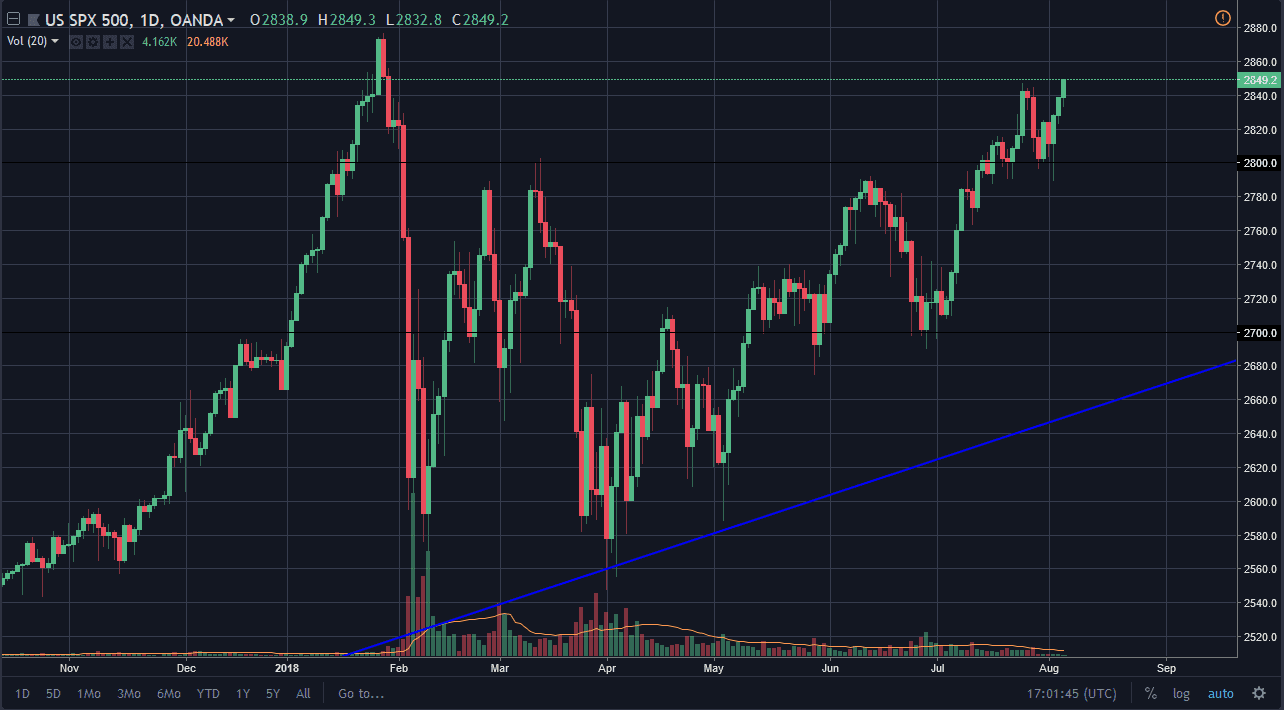

S&P 500

The S&P 500 initially pulled back during the day on Monday, but then rally again to reach towards the 2850 level. The market looks likely to try to reach the highs at the 2880 handle, but at this point you probably need to find short-term pullbacks to pick up a little bit of value and start putting money to work. I certainly would short this market, and I believe that the 2800 level below should offer support, and therefore I think that the market will find value in that area. I believe that area extends down to the 2790 handle, as it is more of a “zone” than anything else. Again though, I like the idea of buying short-term pullbacks as a sign of value, and what has been a very strong uptrend as of late.

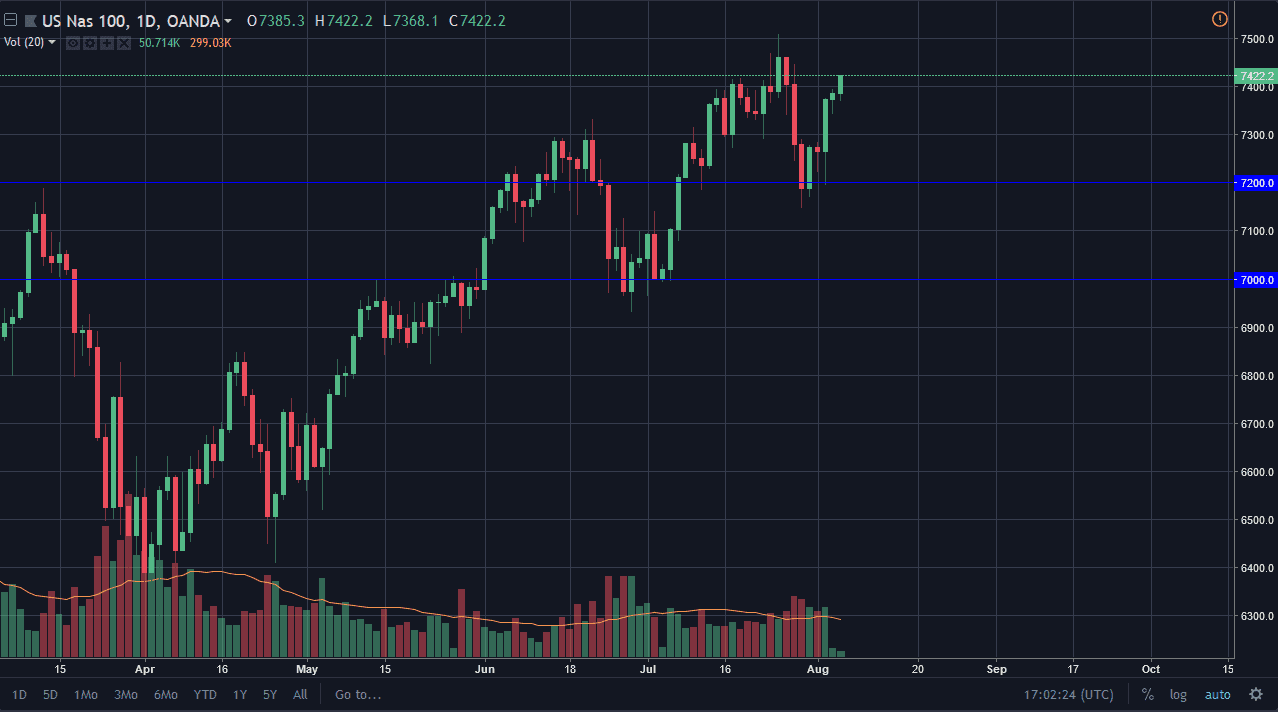

NASDAQ 100

The NASDAQ 100 initially pulled back during the trading session on Monday, but then turned around to rally towards the highs again. This is an area where we have seen a lot of selling pressure recently, so I would be a bit cautious. If we can finally break above the 7500 level, that would be assigned that we are going to go much higher. The 7200 level underneath should continue to be the “floor” in this market, so I think that pullbacks to that area will represent value. If we break down below there, we could then go to the 7000 handle under their, which a breaking of that level would change the entire trend. Once we do break above the 7500 level, it becomes more of a buy-and-hold situation, perhaps sending the market as high as 8000 over the longer-term.