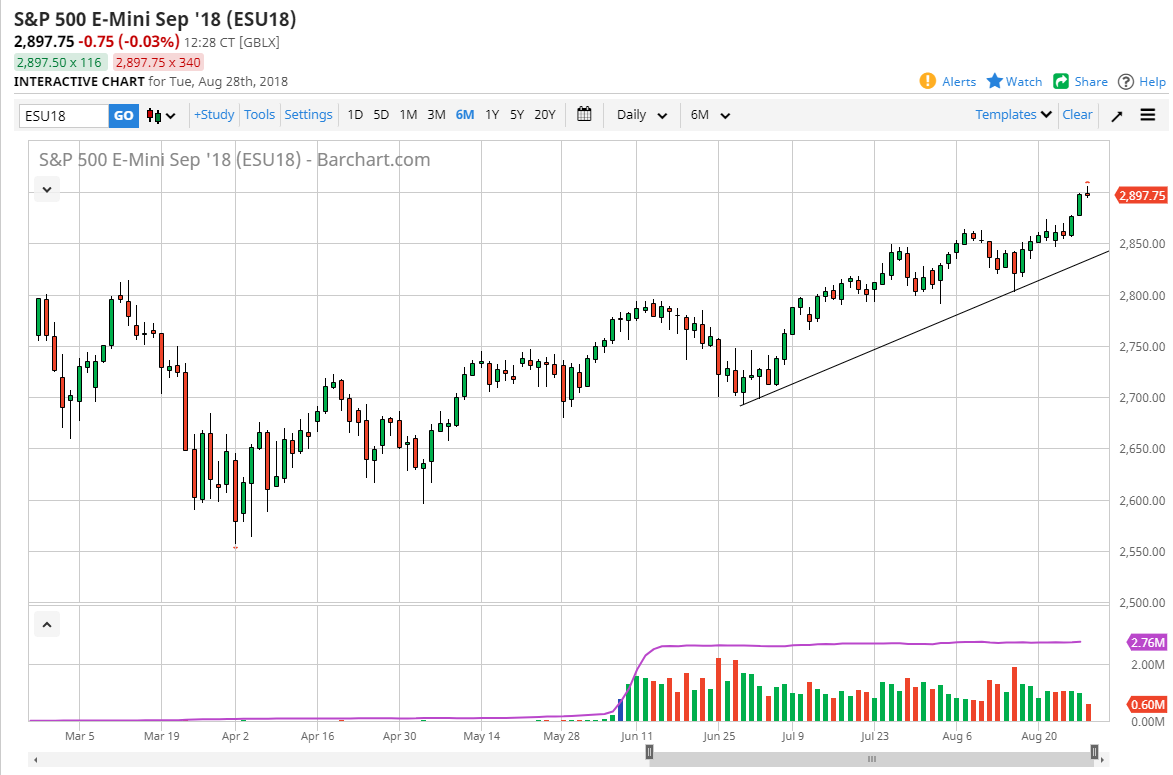

S&P 500

The S&P 500 couldn’t decide what to do on Tuesday, as it initially tried to rally but then gave back all of the gains to form a bit of a shooting star. By doing so, it looks as if we may need to pullback to build up momentum to continue the overall uptrend. I don’t have any interest in shorting this market, but it’s very likely that we will see this market pull back during the session. I look at the 2850 level and the uptrend line underneath as a likely place where the buyers will come back into play. Having said that, if we do break above the top of the range for the session on Tuesday, that would be a very bullish sign as well. At that point, I suspect that the market would continue the longer-term uptrend, reaching towards the 3000 level eventually.

NASDAQ 100

The NASDAQ 100 did the same thing, initially breaking out to the upside but giving back most of the gains. The market ended up forming a shooting star, which of course is a very negative sign. The 7600 level has offered resistance, and I think at this point we might be a little bit overbought. I think a short-term pullback will probably offer buying opportunities, especially near the 7500 level. The alternate scenario in this market is very much the same as the S&P 500, meaning that if we break above the top of the shooting star would send this market much higher. At that point, the market should continue to reach towards higher levels. The NASDAQ 100 should continue to be bullish right along with the S&P 500, but the occasional pullback is definitely needed to attract fresh money into this market.