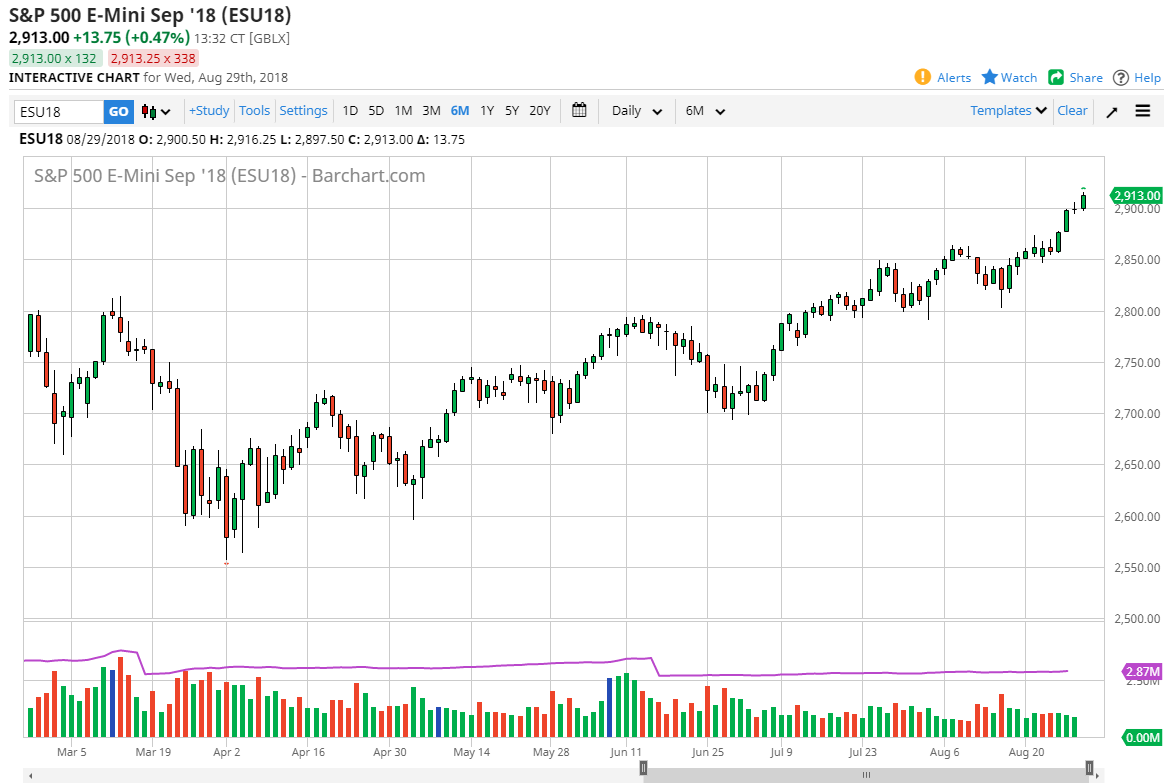

S&P 500

The S&P 500 rallied during trading on Wednesday, breaking above the 2900 level quite decidedly. At this point, I’m looking for short-term pullbacks to take advantage of, as we have cleared a major hurdle. I believe that now we will eventually go looking towards the 3000 level, but it’s going to take some time to get there. It will be choppy, but we certainly have a “risk on” attitude overall. I think that the 2900 level should be supportive, as well as the 2875 handle. We have clearly shown more proclivity to the upside than down, so I have no interest in shorting this market, I think we have further to go as earnings season has been good, and of course the US dollar is starting to soften up quite a bit. That’s certainly helps.

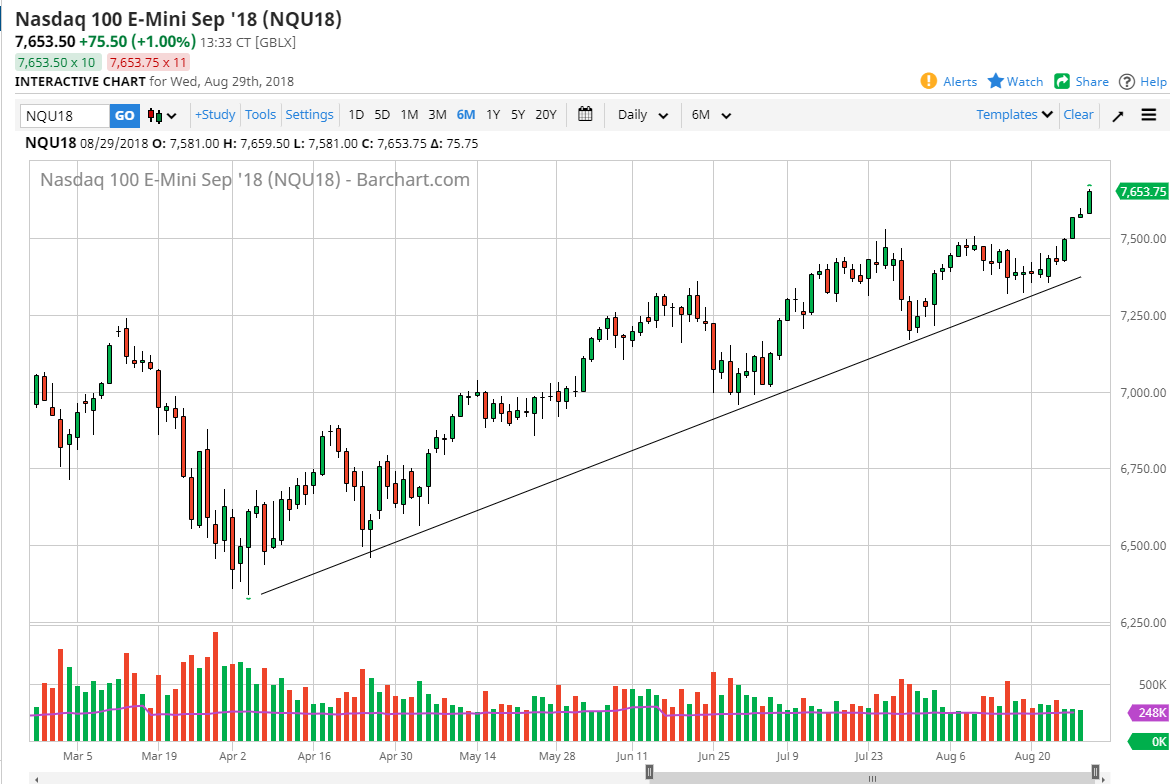

NASDAQ 100

The NASDAQ 100 rallied significantly as well, closing at the very highest. The NASDAQ 100 looks as if it is ready to go much higher. I think that short-term pullbacks will continue to be buying opportunities, as the uptrend line has certainly held. The 7500 level underneath is a massive floor in the market as far as I can see, and I think that we will continue to see buyers as soon as there is a little bit of value to be had. Technology stocks seem to be leading the way, and after of brief reprieve, the bull move has continued. In general, I believe that this market will eventually find its way towards the 8000 handle, but that’s probably a story for next year. If we break down below the uptrend line on the chart, that is an extraordinarily bearish sign.