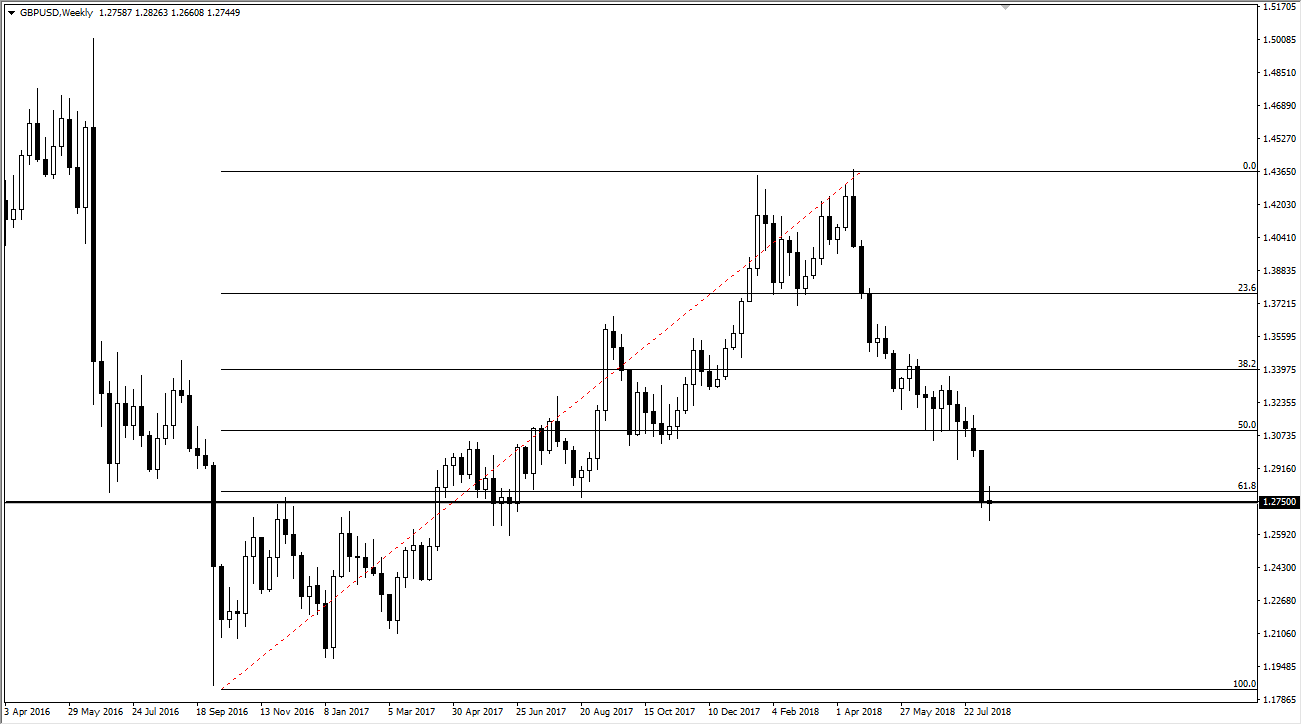

GBP/USD

The British pound had a very indecisive week, and I think this could be the first signs of life. If that’s the case, buying the dips could work out, but as soon as we break down below the lows of the week, that would be very dangerous. I would be much more comfortable buying the British pound if we can break above the 1.28 level, which would be breaking above the top of the neutral candle for the week that just printed.

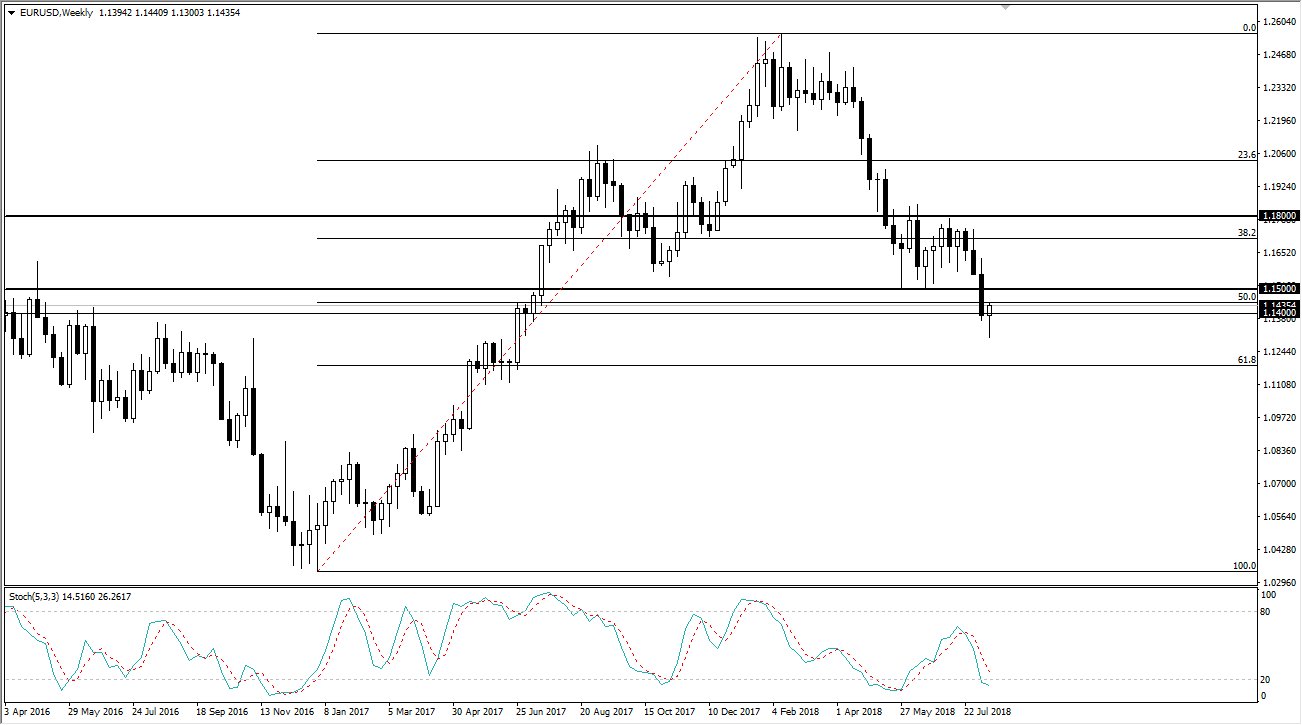

EUR/USD

The Euro has rallied rather significantly during the week, forming a massive hammer at the 50% Fibonacci retracement level. Because of this, I think the market will make a run towards the 1.15 level, and if we can break above there we could go to the 1.18 level after that. A break down below the bottom of the candle for the week would be very negative indeed, but I think at this point we are looking at a “buy the dips” attitude.

AUD/USD

The Australian dollar spent most of the week falling but had a strong turn of events as the Chinese announced that they were coming to the United States in order to discuss trade with the Americans. This could be the bottom that this pair has been looking for, as we have formed a massive hammer at major support. That doesn’t mean is good to be easy, but I think buying the dips in this pair could be the way we go forward as well. This could send the market looking towards the 0.7450 level, and possibly the 0.75 handle next. Obviously, if we get negative comments coming out of China, that could turn things around.

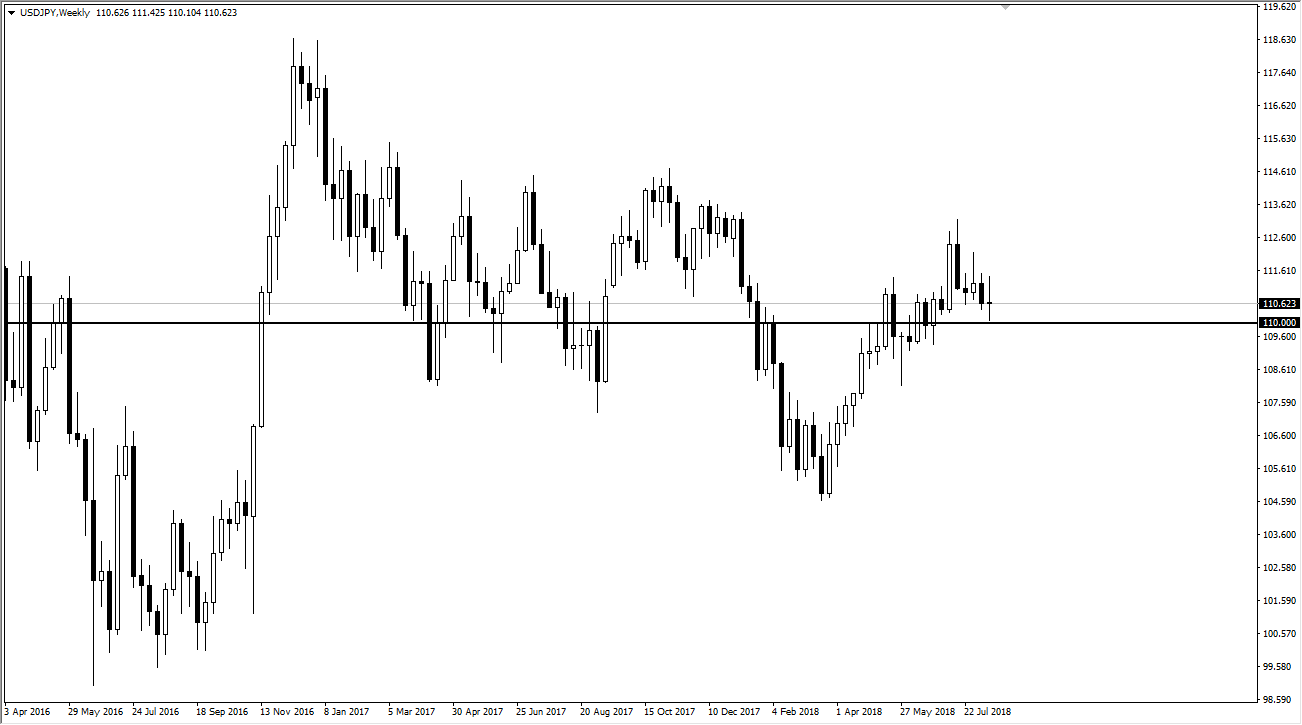

USD/JPY

The US dollar was very choppy against the Japanese yen in a tight range over the course of the past week. I’ve been getting a lot of questions about this pair, and I think that ¥110 is roughly “fair value” for the market. There is massive support at the ¥109 level, and massive resistance at the ¥111 level. Quite frankly, this pair is probably to be avoided.