EUR/USD

The Euro rallied significantly during the week, reaching towards the 1.16 level rather stringently. We are now starting to deal with a bit of short-term resistance, but I think at this point short-term pullbacks will be buying opportunities as a market has reentered the previous consolidation area. If that’s the case, I anticipate that this market will make a move towards the 1.18 level, over the next several weeks. I remain cautiously optimistic due to the bounce from the 50% Fibonacci retracement level.

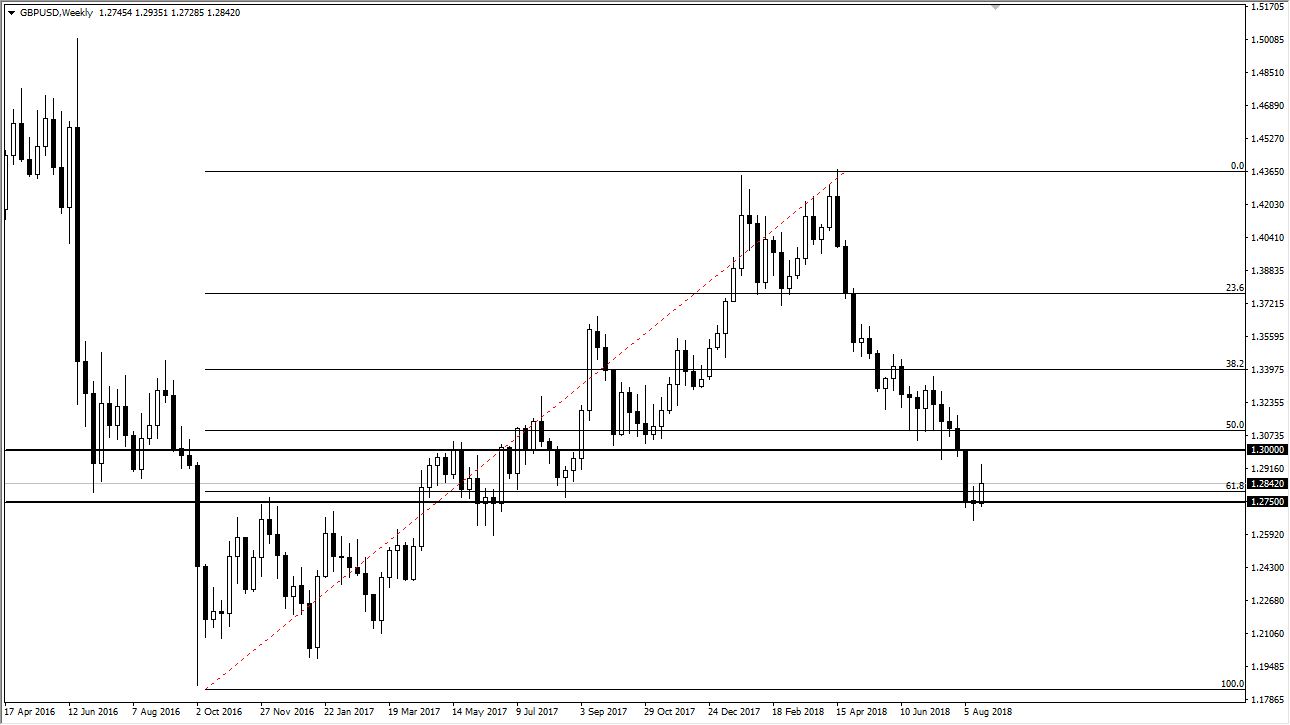

GBP/USD

The British pound rallied as well but gave back about half of the gains. This is a surprise though, because there are also concerns about the Brexit out there, so of course people are going to be a bit more cautious about Sterling. However, I think that this pair will also continue to see buyers on dips, as we make our way towards the 1.30 level. If we broke down below the 1.26 level, that could change things though.

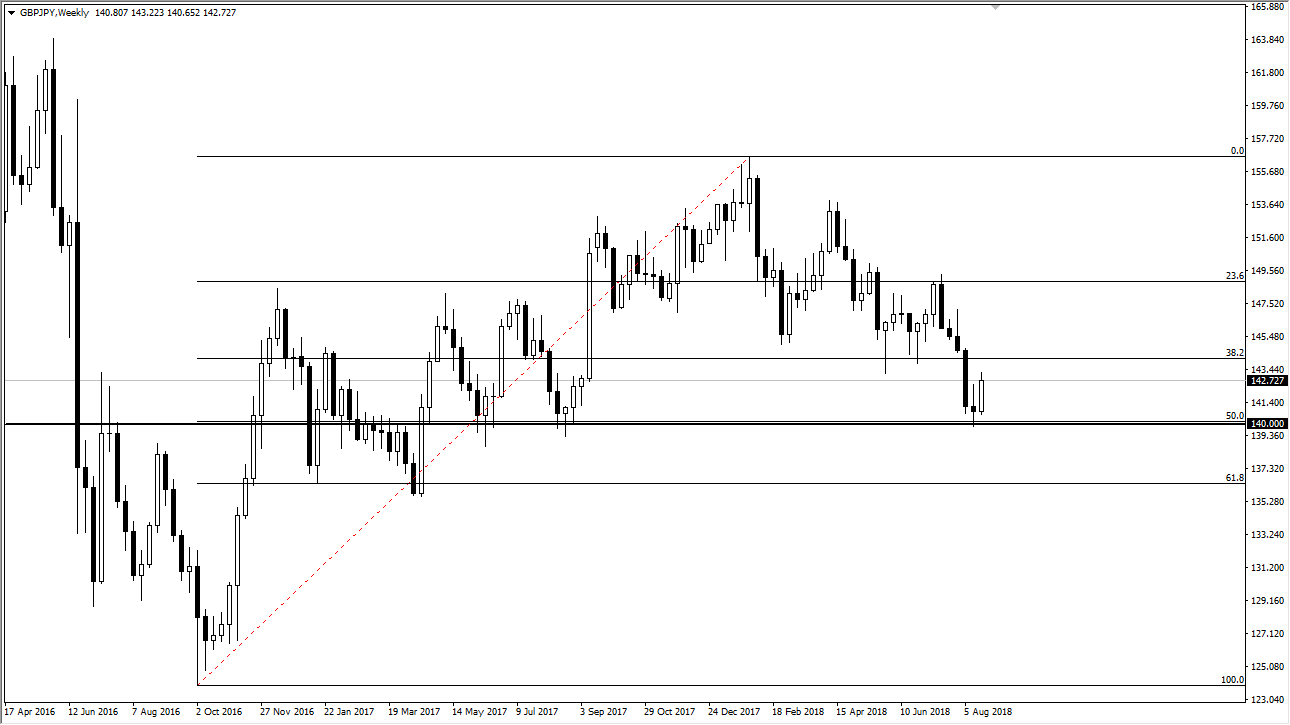

GBP/JPY

The British pound rallied significantly against the Japanese yen, breaking above the top of the shooting star like candle from the previous week. Because of this, I believe that the “risk on” rally is about to begin again. The 50% Fibonacci retracement level and the psychologically important ¥140 level has held, and it is because of this chart that I think that the GBP/USD will eventually grind higher as well. The main difference over there is that we have seen a lot of greenback strength recently. Ultimately, if we can break above the ¥145 level, this market should be able to go higher longer term as well.

USD/CHF

The US dollar had a rough week against the Swiss franc, as the market dropped to the 0.98 handle. This area has been support recently but closing as low as we are on the weekly range, I anticipate that we probably will break down below it. Once we do, the market will then start to work its way down to the 0.95 level longer-term.