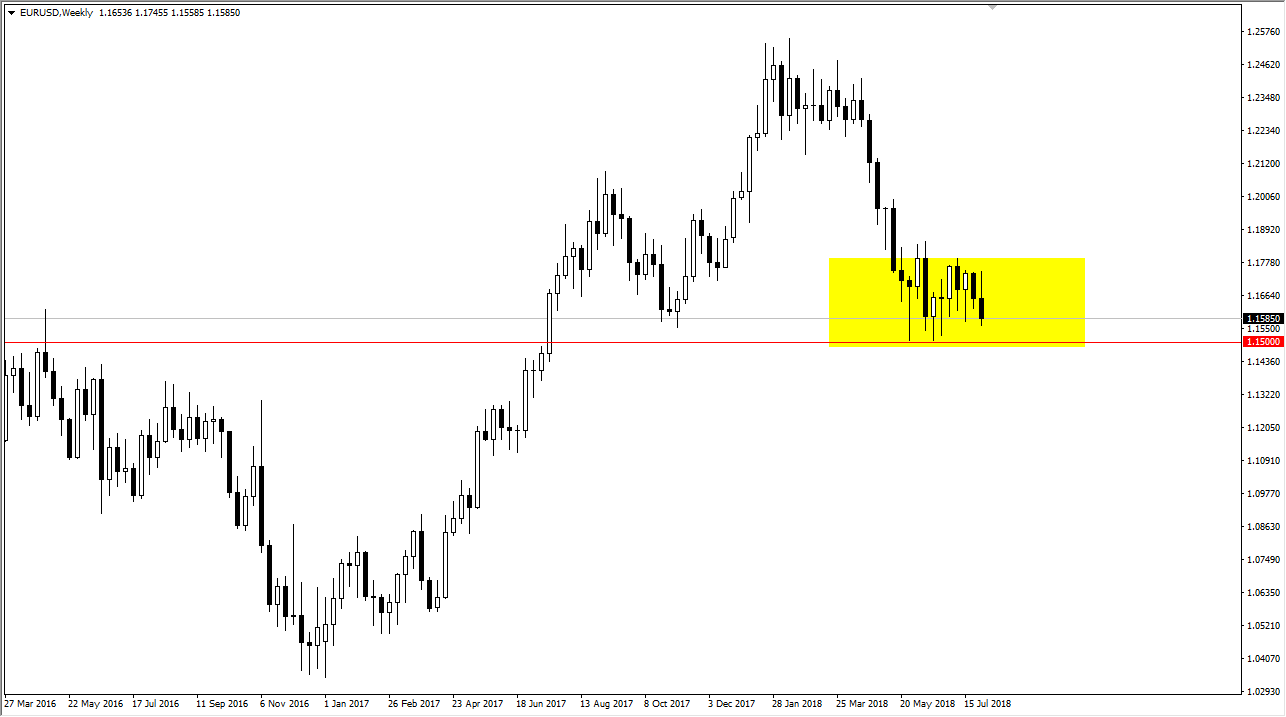

EUR/USD

The Euro continues to trade in a fairly tight range, as the market seems to have a lot of supply at the 1.1850 level, while there is a lot of support at the 1.15 level underneath. The market will probably struggle to break out of the range as we are heading into the quiet vacation month of August. The volumes will be a bit low, but then again – there are always potential headlines out there to push things around. I think that we will see back and forth action in the short-term.

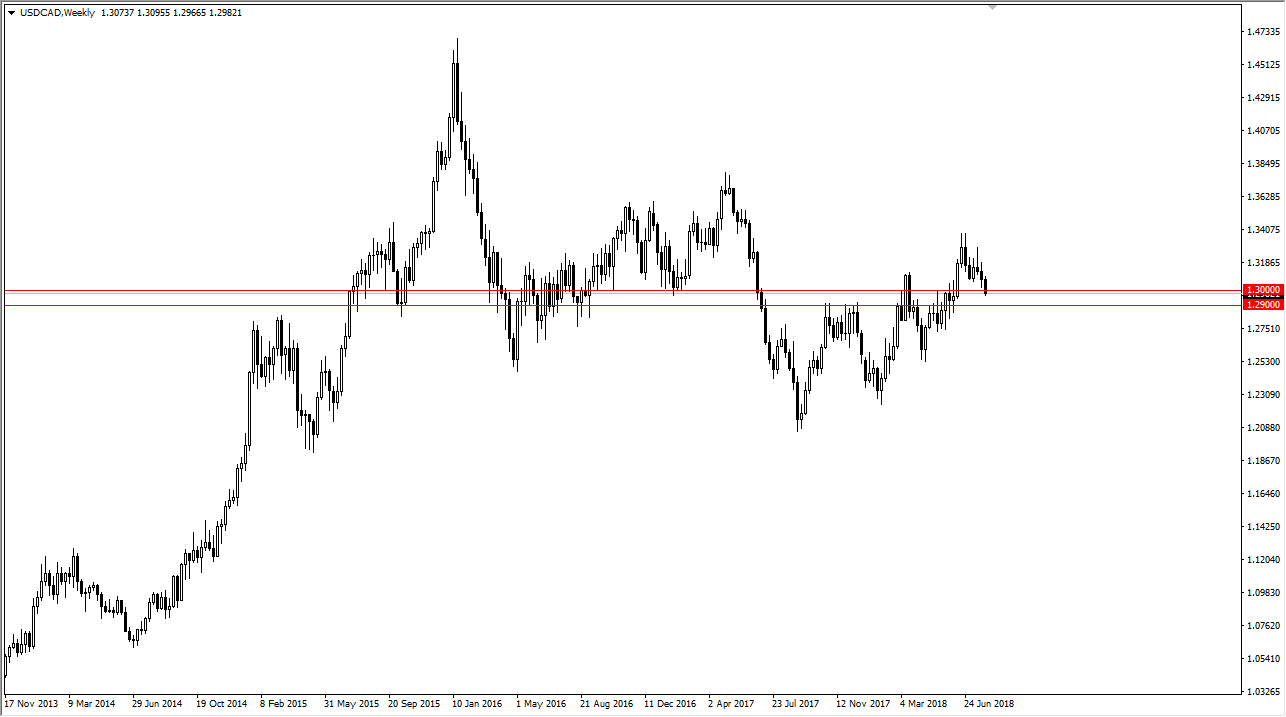

USD/CAD

The US dollar has fallen against the Loonie during the week, as we test the support area between 1.29 and 1.30 or so. I think that the market will more than likely try to test the 1.29 level, but there will be a push back at that area. I think that the oil markets are somewhat rangebound as well, so it would make sense for this market to be also.

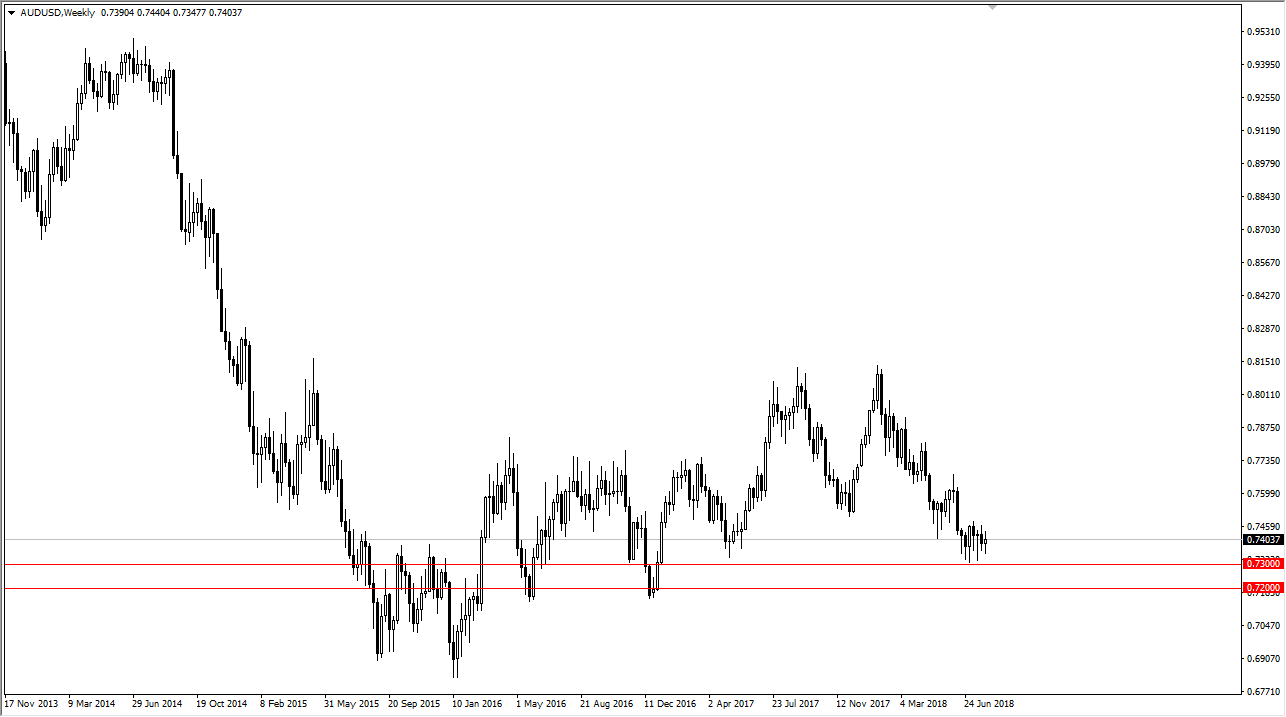

AUD/USD

The Aussie continues to go sideways, and I think this isn’t going to change in the meantime. I would anticipate that the 0.73 level will continue to offer support, while the 0.75 level above will end up being resistance. For the next week, I anticipate that we will find buyers on dips, with the eye on an eventual breakout to the upside. I think it will take a lot of momentum to finally do so, and once we do – this market will take off like a rocket. However, I think we are still a few weeks from seeing something like that.

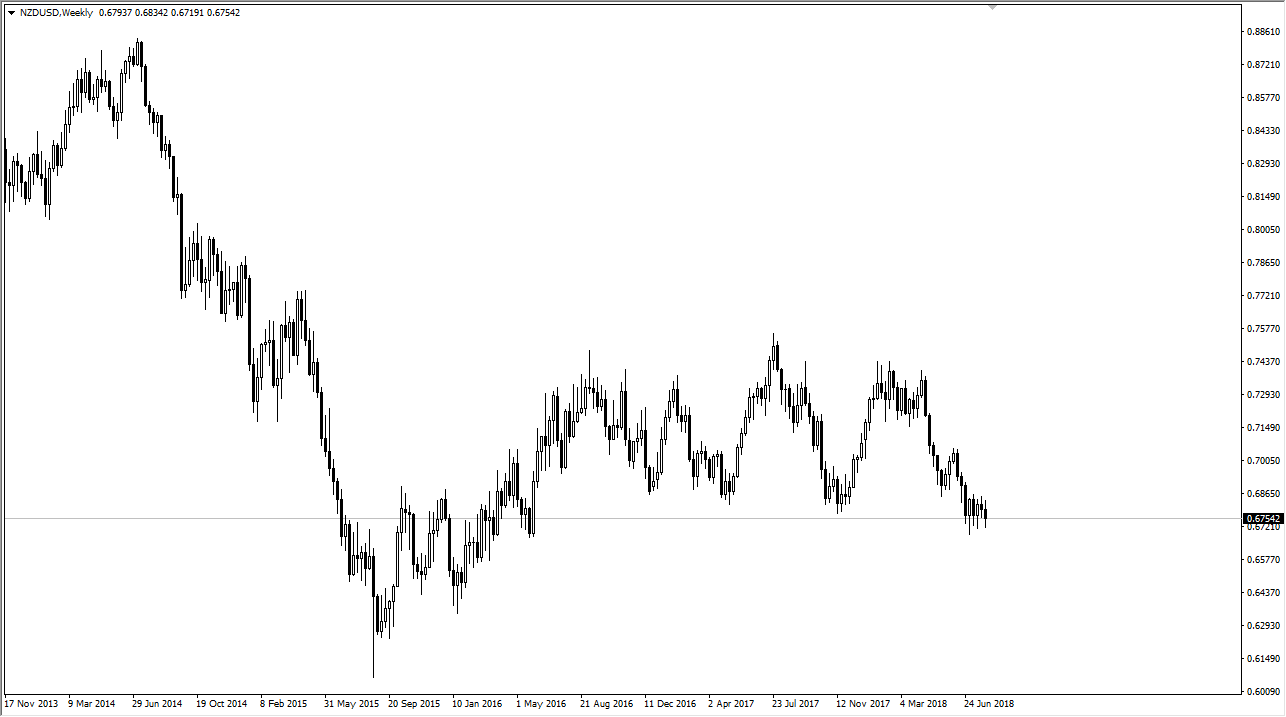

NZD/USD

The New Zealand dollar has been very noisy and soft as of late, but we are pressing the support level that I think could turn things around. This is a market that should continue to be monitored, as I think that the 0.67 handle will be important. If the USD struggles against a lot of other currencies – don’t forget to buy this pair.