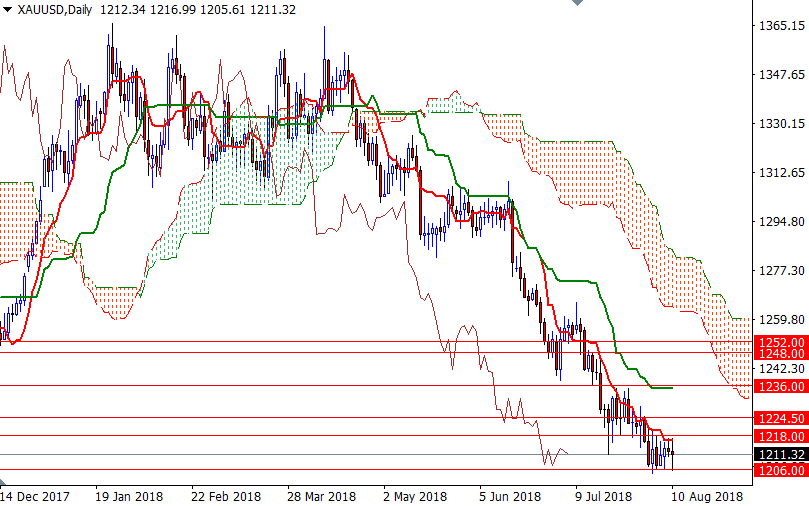

Gold prices ended the week down $2.37 at $1211.32 an ounce, marking a fifth weekly decline, as a rally in the U.S. dollar overshadowed concerns over a deepening economic crisis in Turkey. World stock markets we mostly lower. U.S. stocks finished Friday in negative territory. The yellow metal saw little benefit from the turmoil in Turkey. Expectations that the Federal Reserve will hike interest rates next month continues to put downside pressure on gold, but if volatility in the stock market heats up, gold could see some fresh safe-haven demand.

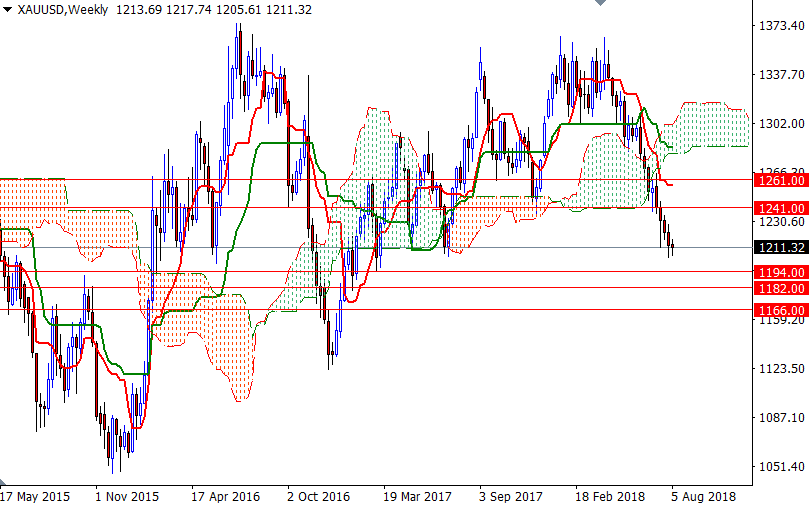

Trading below the Ichimoku clouds, along with the negatively aligned Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-period moving average, green line), suggests that the path of least resistance for XAU/USD remains sideways to lower. However, note that there are strong supports located nearby, such as 1206 and 1200-1198, so the bears will need to capture these camps to gain momentum. If the market makes a sustained break below 1194, look for further downside with 1182 and 1166 as targets.

To the upside, keep en eye on the 4-hourly Ichimoku cloud right on top of us. If prices cleanly break through the 1220-1218 area, expect a push up to 1226-1224.50. Beyond there, the 1236/5 area, where the daily Kijun-sen sits, stands out as a solid technical resistance. The bulls have to produce a daily close above 1236 to set sail for 1248.