Gold prices rose $10.84 an ounce on Friday, moving away from a 19-month low struck the previous day. Despite Friday’s gains, XAU/USD ended the week with a loss of 2.22% and recorded a sixth consecutive weekly decline. The recent batch of encouraging economic data suggested the U.S. economy’s solid growth in the second quarter continued into the third. The low risk aversion in the world marketplace and the prospect that rising interest rates will further support the greenback are likely to weigh on the yellow metal.

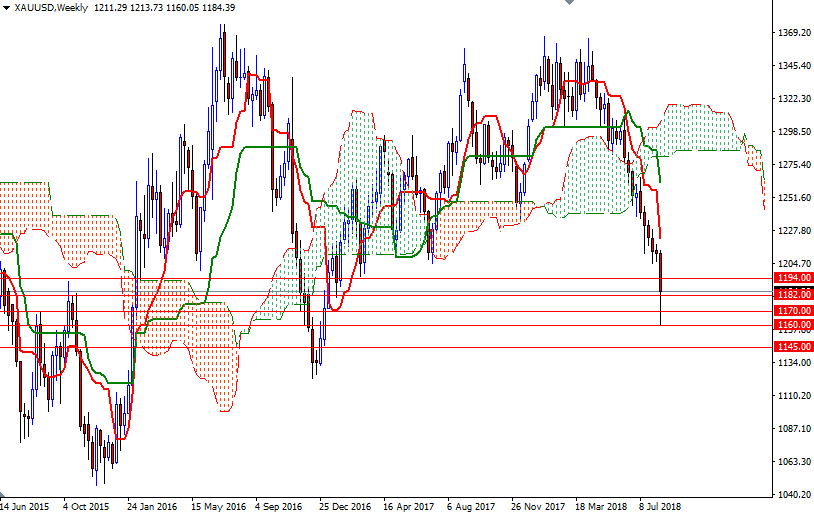

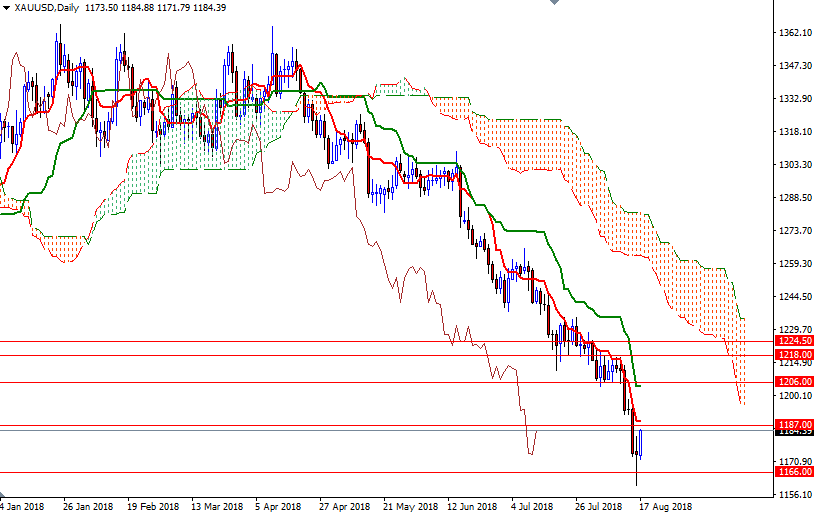

From a chart perspective, the technical outlook for gold still remains bearish, with the market trading below the weekly and the daily Ichimoku clouds. However, the currency markets have stabilized a bit in the past couple of sessions, pushing the dollar down, so selling interest in gold may be limited for a while. Prices are above the clouds on the H1 and M30 time frames, and the Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) are positively aligned, suggesting sideways-to-higher price action this week. With that in mind, I expect the market to stay within the 1206-1166 range.

To the upside, there are hurdles such as 1189/7 and 1196/4. The bulls have to push prices beyond 1196 if they intend to make an assault on 1202/0. Beyond there, the 1208/6 area stands out a strategic resistance. If this support is broken on a daily basis, XAU/USD could see a push up to 1218/6. On the other hand, if prices get back below 1272/0, the market will probably pay another visit to 1266. The bears have to produce a daily close below 1260 to take the reins and march towards 1256. A break below 1256 implies that the market is targeting 1250/45.