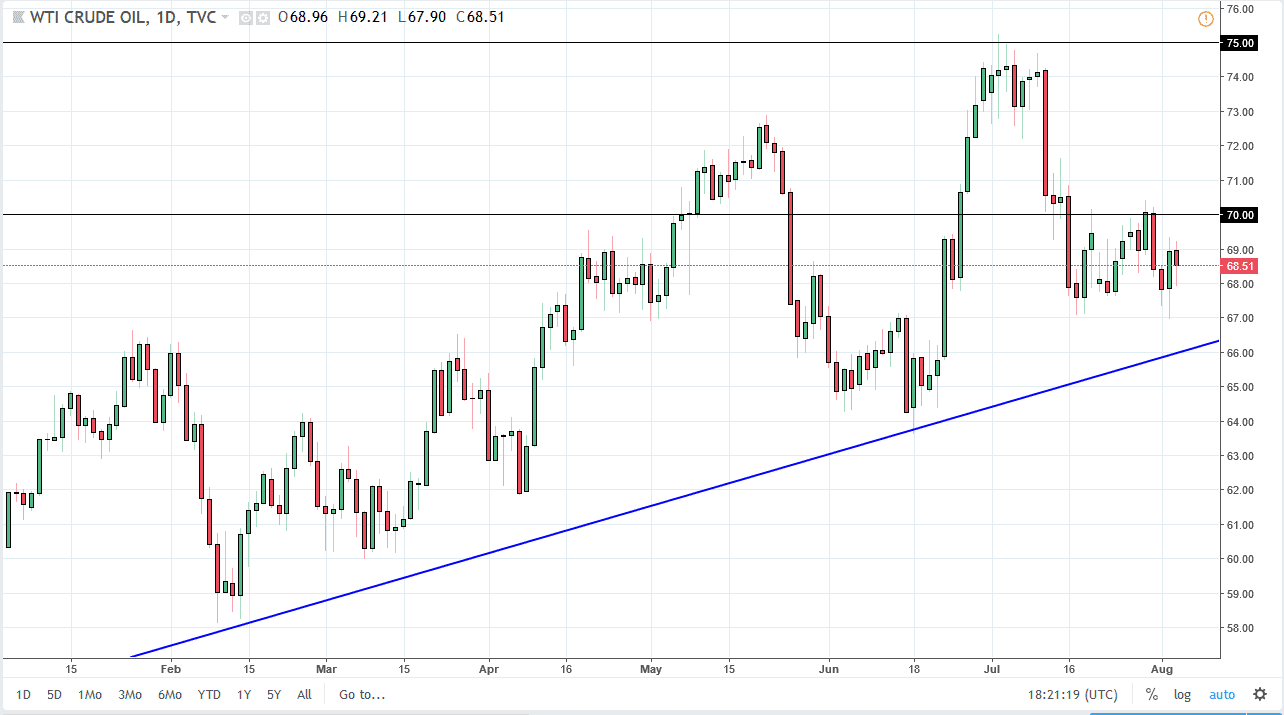

WTI Crude Oil

The WTI Crude Oil market initially fell during trading on Friday but found enough support near the $68 level to show its proclivity to stay within the consolidation area that we have seen over the last couple of weeks. At this point, I believe that the $67 level will continue to attract a lot of attention from buying participants, just as sellers will be found near the $70 level. Because of this, I don’t have any interest in being involved in this market until we reach one of those levels. It’s a lot of back and forth trading, but quite frankly that makes a great market to be involved in. If we broke above the $71 level, then the market could go much higher. However, if we break down below the $67 level, we also have an uptrend line to contend with.

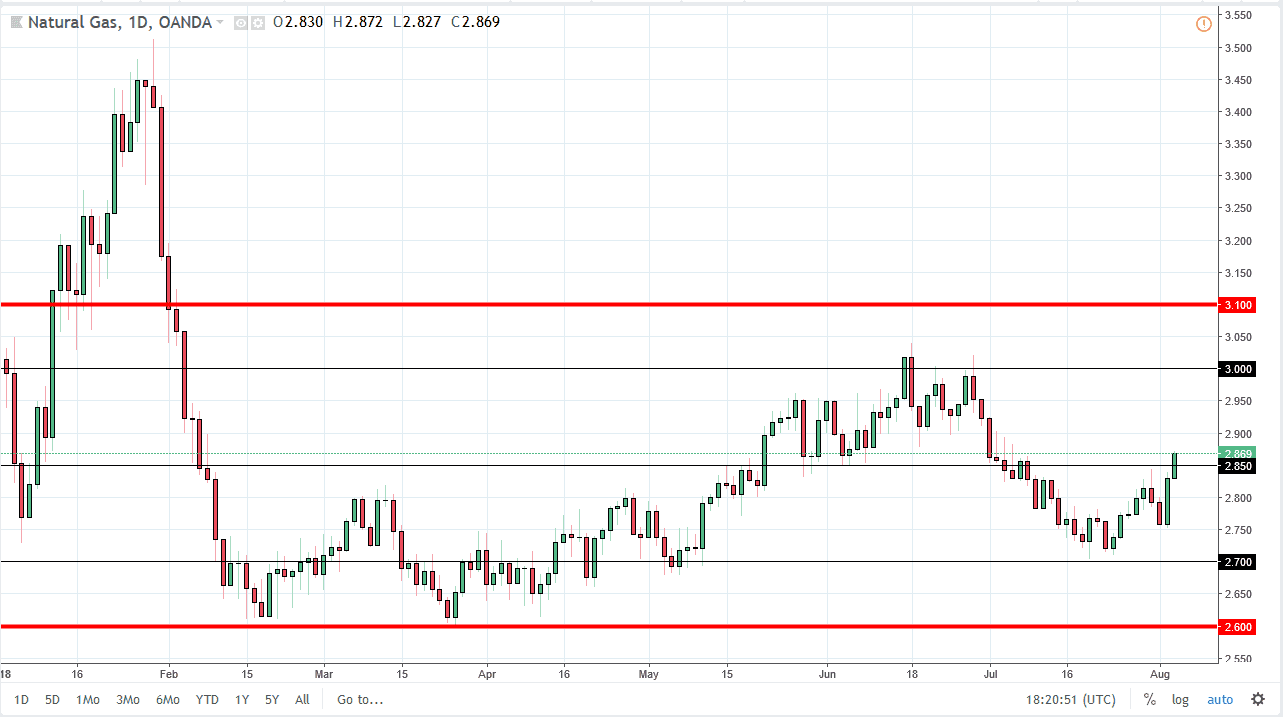

Natural Gas

Natural gas markets rallied again during the day on Friday, breaking above the vital $2.85 level. There is some resistance to be found above but I think ultimately this market will go hunting for the $3.00 level. I would not be a buyer here, I would wait for some type of pullback to take advantage of value. Currently, I believe that we are still very much stuck in a range, with the $3.00 level above being resistance, and the $2.70 level below being support. I also believe that those support and resistance levels are about $0.10 wide, so these lines on the chart are used as a guide only. We are more than likely going to see a continued push higher, at least until we get closer to the $3.00 level. At that point, I’m looking to sell.