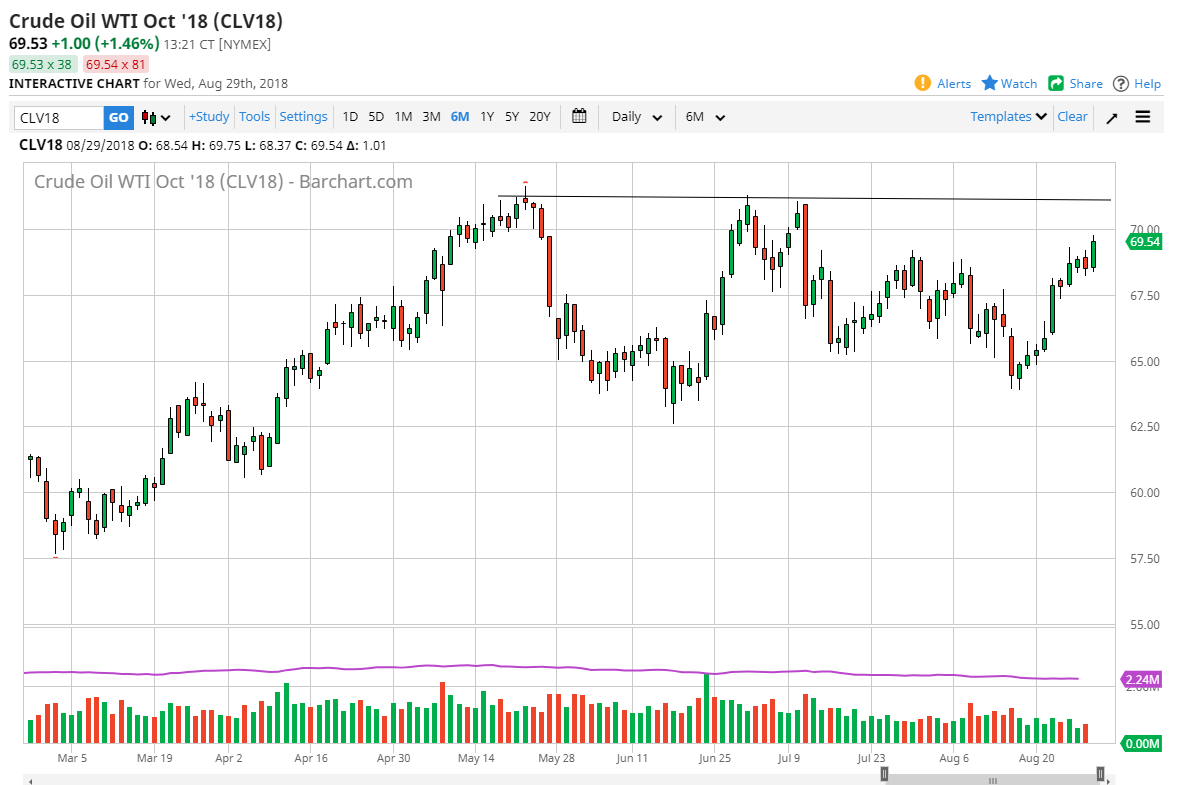

WTI Crude Oil

The WTI Crude Oil market has rallied during trading on Wednesday, as crude oil inventory numbers came out much more bullish than anticipated. By breaking above the $69 level, I think it’s only a matter of time before we rally towards the $71 level above, which is the next major resistance barrier, with perhaps the exception of the $70 level offering a bit of psychological resistance. I believe we now have a significant amount of support in the form of the $68 handle. I’m looking to short term charts to show signs of support or bouts that I can take advantage of. I also believe that eventually we will break above the $71 level, but it may take several attempts. If we do, then the next target would be $75 after that. Overall, I am very bullish.

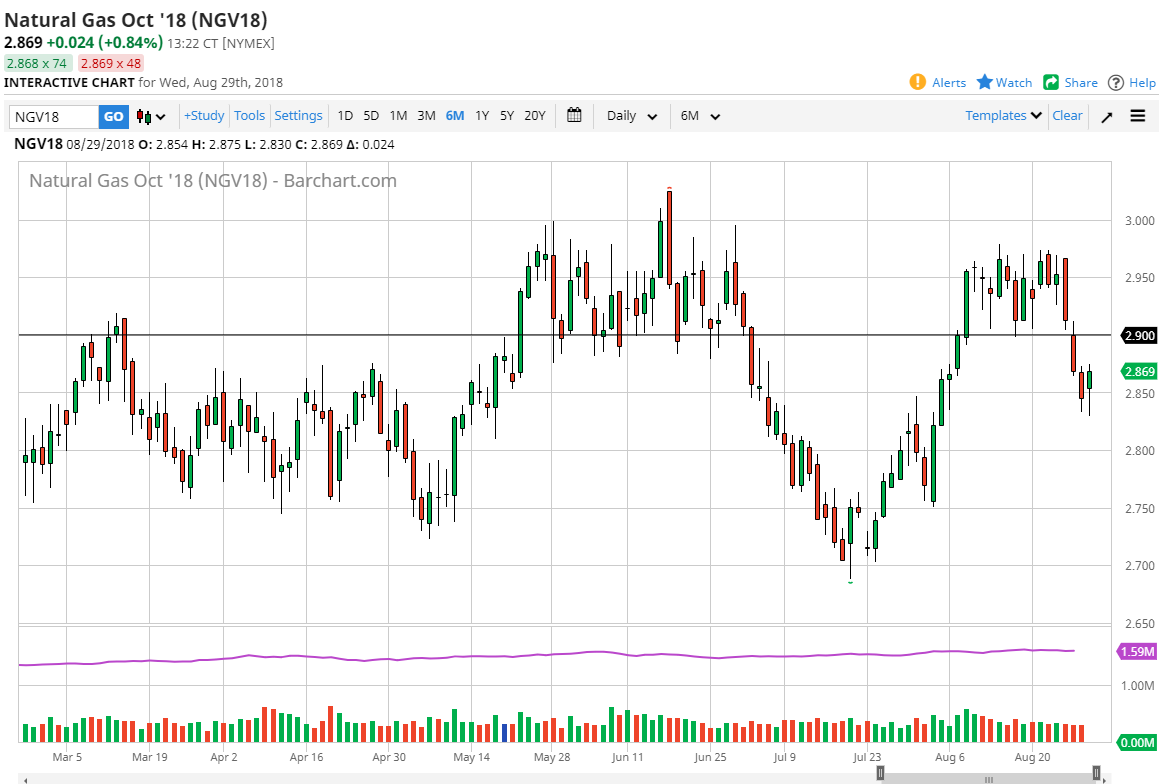

Natural Gas

Natural gas markets initially fell during the trading session on Wednesday, breaking through the $2.85 level, and then testing the $2.83 level. We have turned around of form a hammer, which of course is a very bullish sign, and quite frankly I welcome it. A bounce from here should send this market looking towards the $2.90 level, an area where I think there should be a lot of selling pressure. Some type of exhausted candle near that level is exactly what I’m looking for to start selling. The alternate scenario of course is that we break down below the bottom of the range for the day on Wednesday, which would also be a selling opportunity. I have no interest in buying natural gas at this point, and I like the idea of selling rallies going forward. I believe that retesting the $2.90 level is about as good as the buyers will get now.