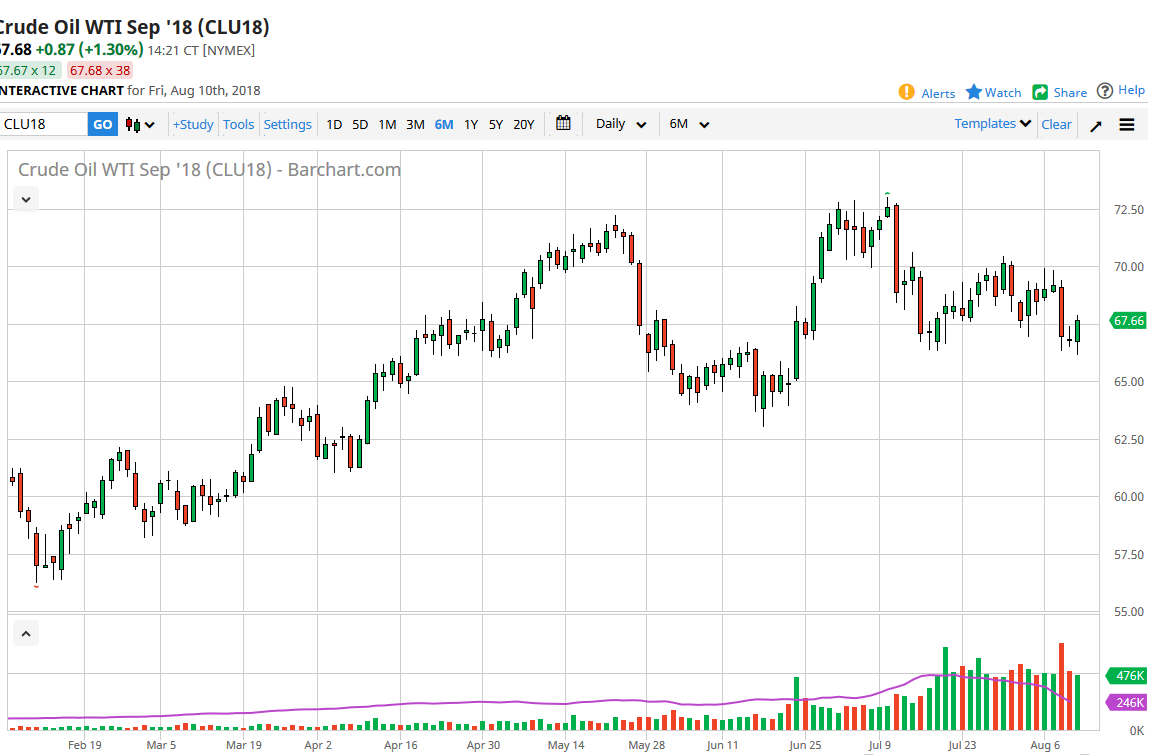

WTI Crude Oil

The WTI Crude Oil market rallied after a significant selloff over the last couple of days on Friday. In fact, we have broken above the $67 level, which is important because it shows that we are reentering the previous consolidation area. I believe that the market will find that level comfortable, and I would also point out that we have tested and confirmed a trend line. The trend line of course has been important for quite some time, and the fact that it held is crucial. I believe that many of the world’s larger institutions are looking at a potentially tight oil market in the future, so therefore they are buying on these dips. What was even more impressive was that this happened with Andy extraordinarily strong US dollar at the same time. With that, one would have to think that if the dollar wasn’t so strong oil could have really exploded to the upside.

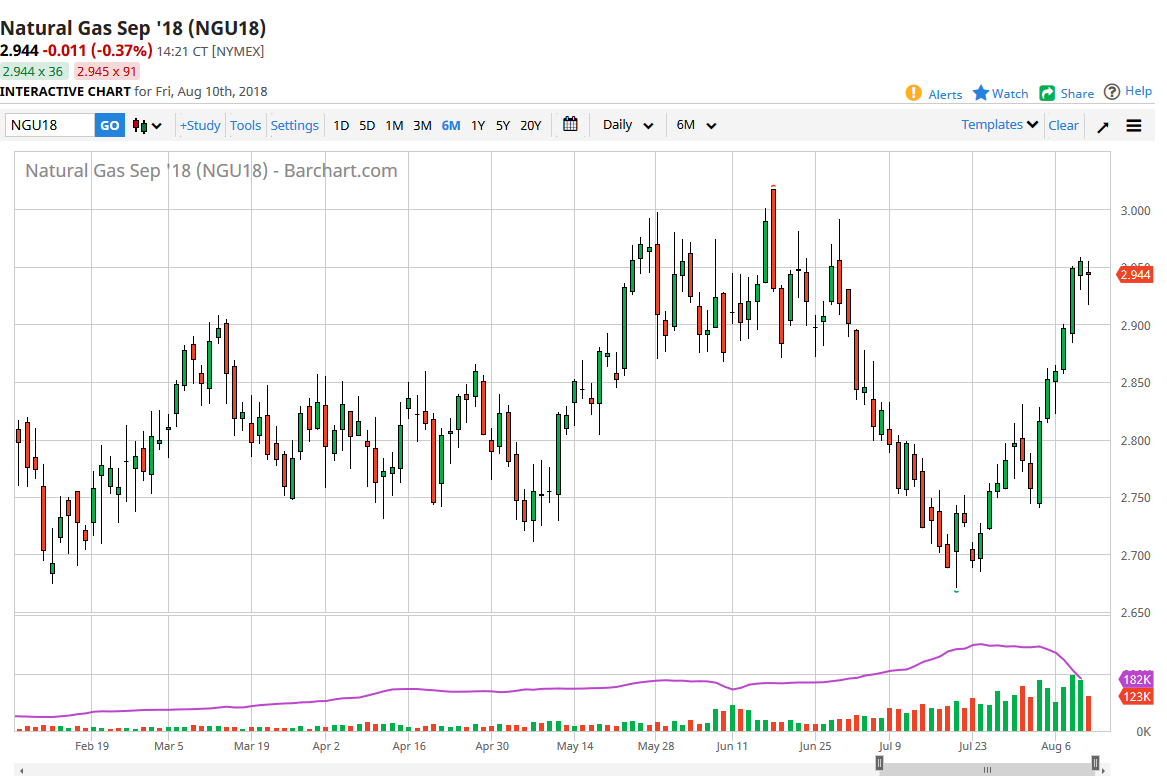

Natural Gas

Natural gas markets initially fell during the day but turned around of form a hammer. I like this actually, because it gives me the opportunity to sell this closer to the $3.00 level, an area that I think is obvious resistance. That area extends to the $3.10 level, so I’m more than willing to get short on the signs of exhaustion that I’m looking for. Some type of shooting star or even a bearish outside day would be perfect, and it could drive this market right back down to the $2.70 level longer-term. I believe that we may get a day or two of bullish pressure, followed by a return to the bottom of the longer-term consolidation bottom.