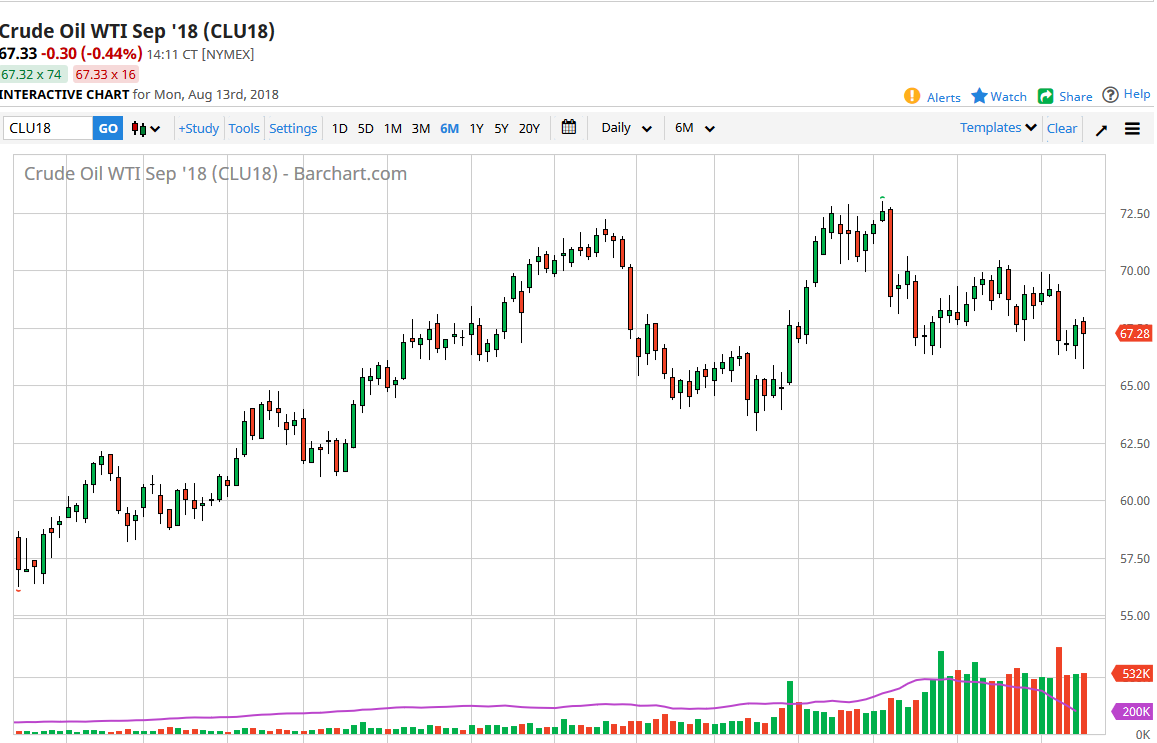

WTI Crude Oil

The WTI Crude Oil market initially fell during trading on Monday, perhaps in reaction to the general “risk off” attitude of the markets after the situation in Turkey. The US dollar strengthening put a lot of negative pressure on the oil markets, but we also have several situations going on at the same time, perhaps giving oil a bit of a lifeline as you can see we have plainly formed a massive hammer. We have reentered the previous consolidation area, between the $67 level on the bottom, and the $70 level on the top. There is a ton of resistance above at the $70 level, extending to the $71 level. At this point though, it certainly looks as if we could go back and forth quite drastically. I see a ton of support underneath at the $66 level, and perhaps the $65 level. I believe that we are stuck in a relatively tight range, perhaps with a slightly negative tilt.

Natural Gas

Natural gas markets fell rather hard initially during the day but did recover a bit to form a hammer. This is the second hammer in a row, which of course is a bullish sign, but I see a ton of resistance at the $3.00 level, and I think it’s only a matter of time before the sellers get truly aggressive. A break down below the hammer turns it into a “hanging man”, which of course is a very negative sign. That being said, if we break down below the $2.90 level I think the sellers will jump in. I also think they will jump in near the $3.00 level. If we can clear the $3.05 level, the market could go much higher.