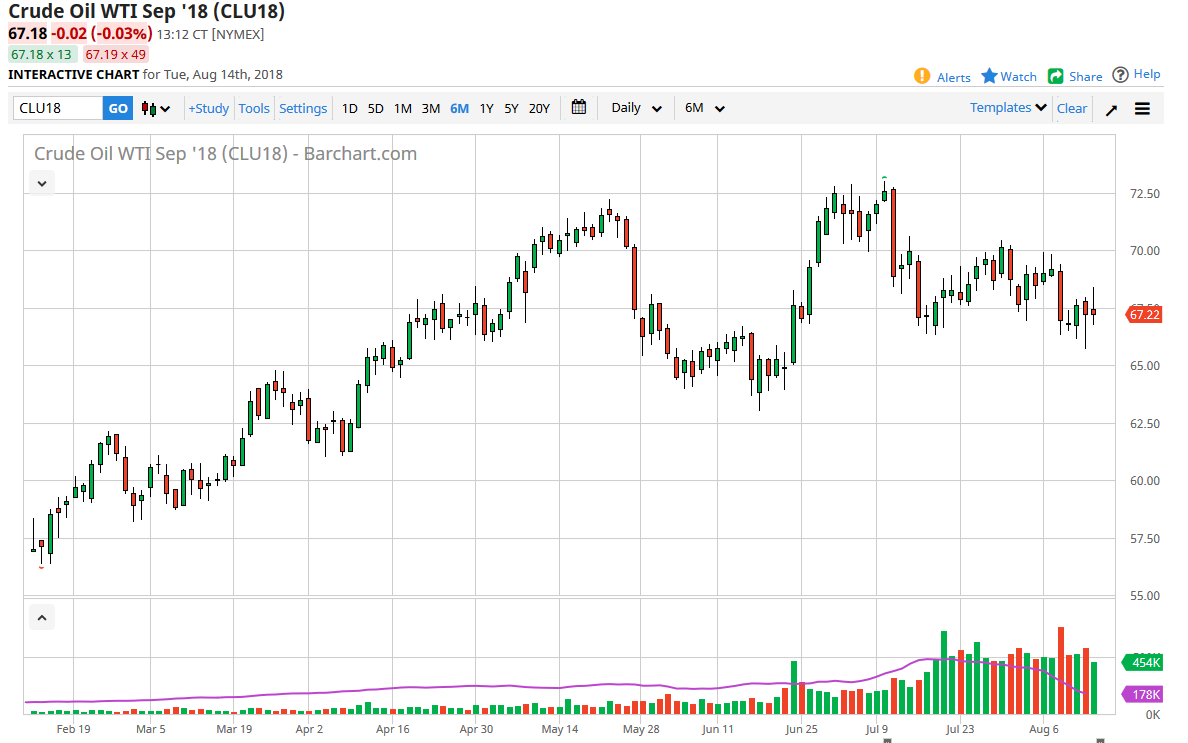

WTI Crude Oil

The WTI Crude Oil market has been very noisy during the trading session on Tuesday, initially trying to reach towards the $68 level and beyond, but we did turn around of form a bit of shooting star. The market looks as if it doesn’t know where to go next, so therefore I would urge you to stay away from it in the short term. We need some type of impulsive and volume filled candle to get involved. I believe that while there is a bullish case to be made for oil as production is falling, at the same time you have been extraordinarily strong US dollar, which pushes in the other direction. I think at this point, the crude oil markets are for daytime scalping in a small range, I know that’s what I’ve been doing on my trading desk.

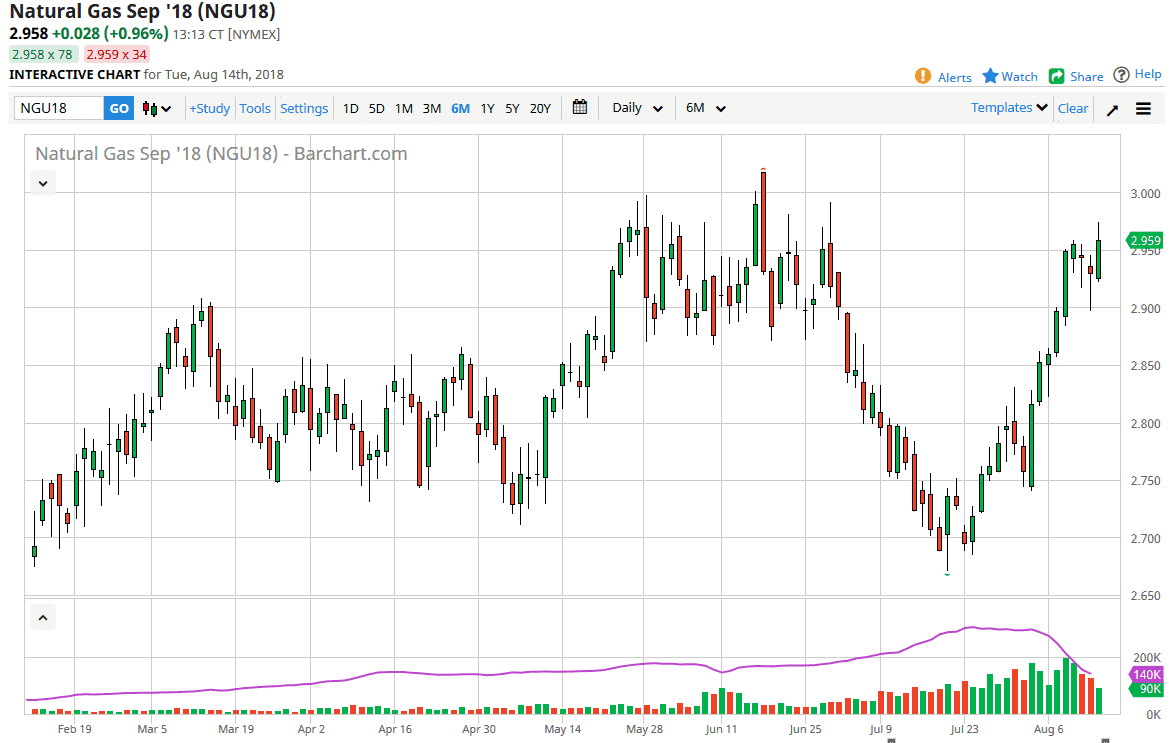

Natural Gas

Natural gas markets had a strong session during the day on Tuesday, but as we have seen in the past, once you get above the $2.96 level, things get a bit dicey. I believe that there is a massive amount of supply at the $3.00 level, and it’s likely that traders will continue to be cautious in this general vicinity. Beyond that, the market is certainly a bit parabolic at this point, so a pullback would make sense regardless. With that in mind, I like the idea of selling an exhaustive daily candle, but we don’t have it yet. This would be especially true near the $3.00 level, and I will be watching this intraday for signs of rolling over. The alternate scenario is that we turn around and break down below the couple of hammers and slice below the $2.90 level, which is also a selling opportunity.