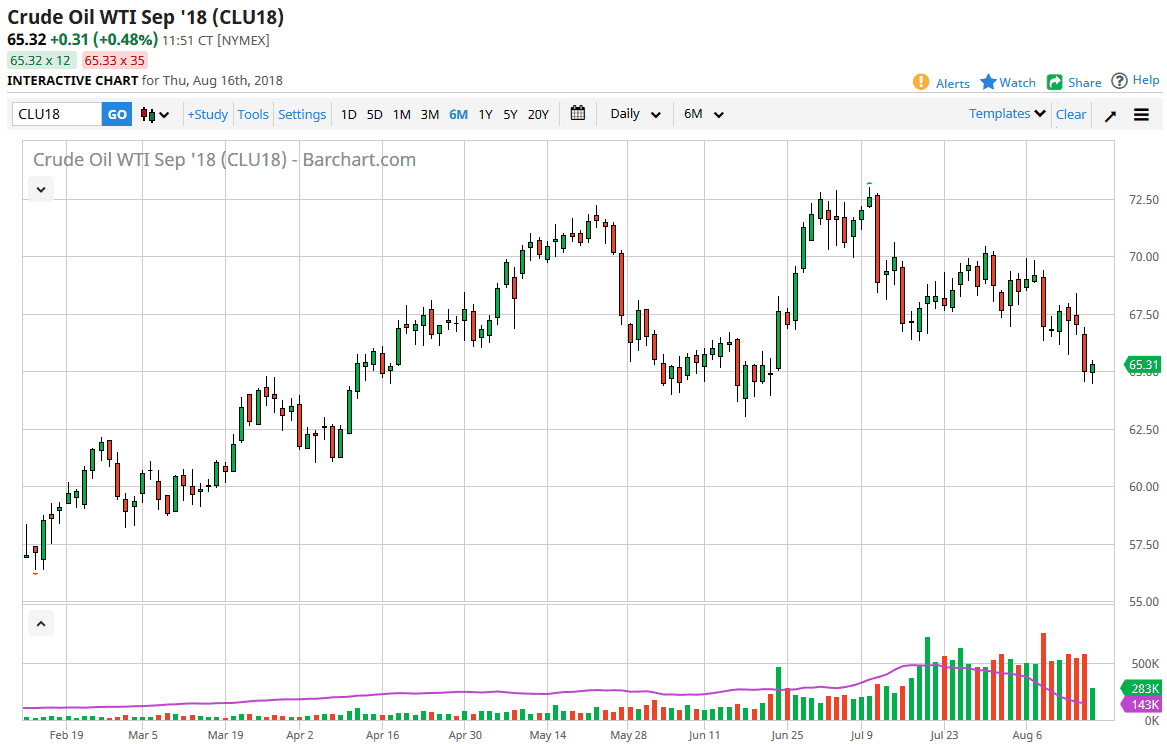

WTI Crude Oil

The WTI Crude Oil market has bounced a slightly during trading on Thursday, as it reached the psychologically important $65 level. By hanging on to this level, it shows signs of life, as this is a crucial level to say the least. I think that part of this is probably due to the Chinese coming to America, to discuss trade talks. There is perhaps hopes that demand will return to the market. However, the volume is a bit lacking so that does concern me. If we break down below the $63 level, that unwinds the next phase of support, and could be very negative indeed. I suspect that we are probably going to see a short-term bounce though. I think that $66 would be a bit too rich, and certainly $67.50 would be. This is a short-term “smash and grab” type of trade at best. Remember, the inventory number was horrible.

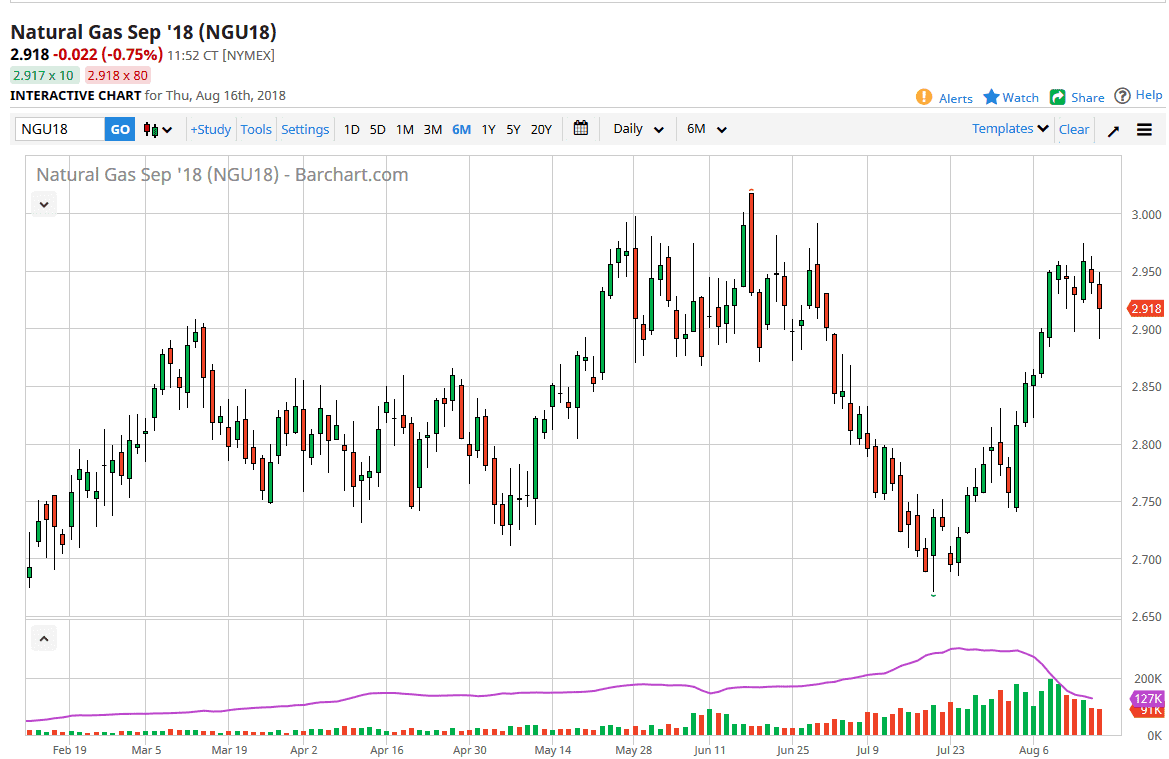

Natural Gas

Natural gas markets fell during trading on Thursday as well, reaching down to the $2.89 level. We have been consolidating for several days now, between the $2.90 level on the bottom, and the $2.95 level of the top. I think natural gas is about to make a decision, but quite frankly the last time we were up here we turned around and rolled over rather drastically. I anticipate that is probably what’s going to happen next, but that doesn’t mean that it’s guaranteed. Beyond that, I look at the $3.00 level as a significant resistance barrier that will be difficult to overcome. I think we are much more likely to hang out in the consolidation that we have been in for some time, and therefore I find myself looking for short-term rallies to sell.