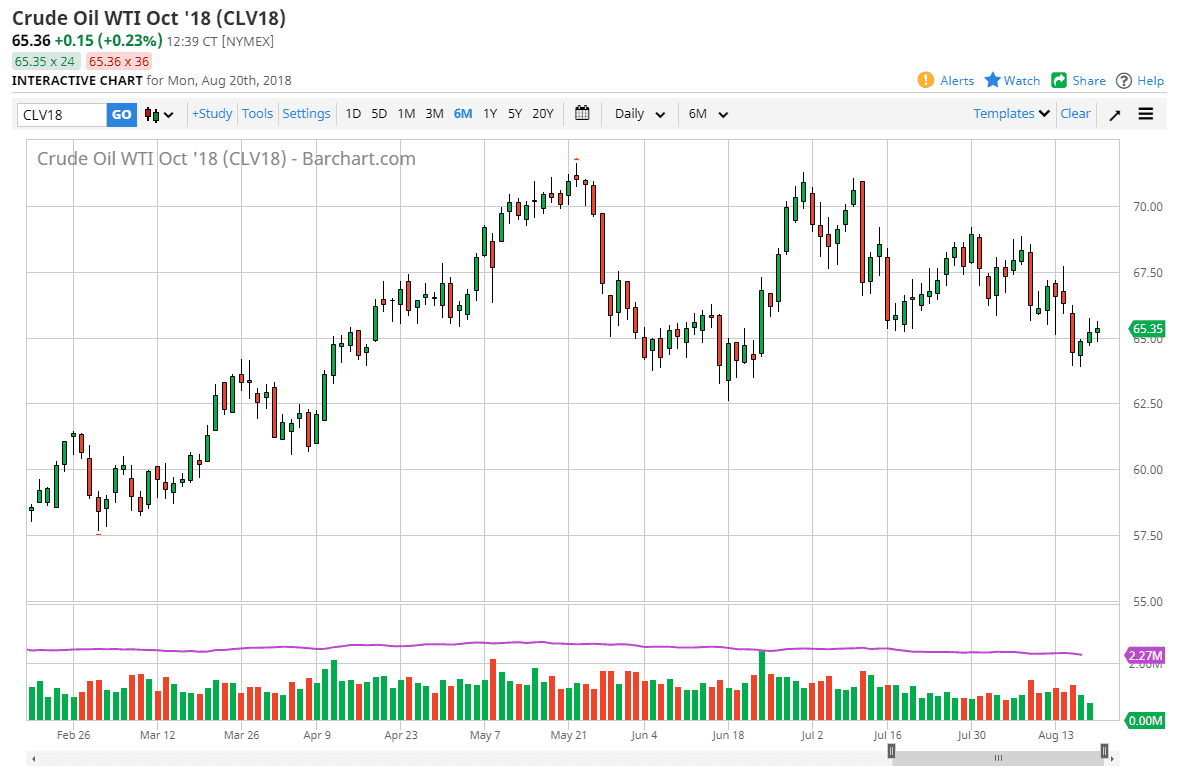

WTI Crude Oil

The WTI Crude Oil market was slightly positive during the day but more importantly it was very noisy. When you look at the daily candle, you can see that we had no follow-through when it came to the rally. We could break above the top of the shooting star from the Friday session, so I think we will probably go lower, perhaps trying to test what I see as a major trendline on the weekly chart. It doesn’t mean that I think it’s time to start selling, just that we will probably have to pull back to test support again. The US dollar will have a great influence on where crude oil goes next, and I anticipate that this week could be somewhat volatile as we have so many competing announcements. With that in mind, don’t be surprised at all if we end the week somewhere close to where we are now.

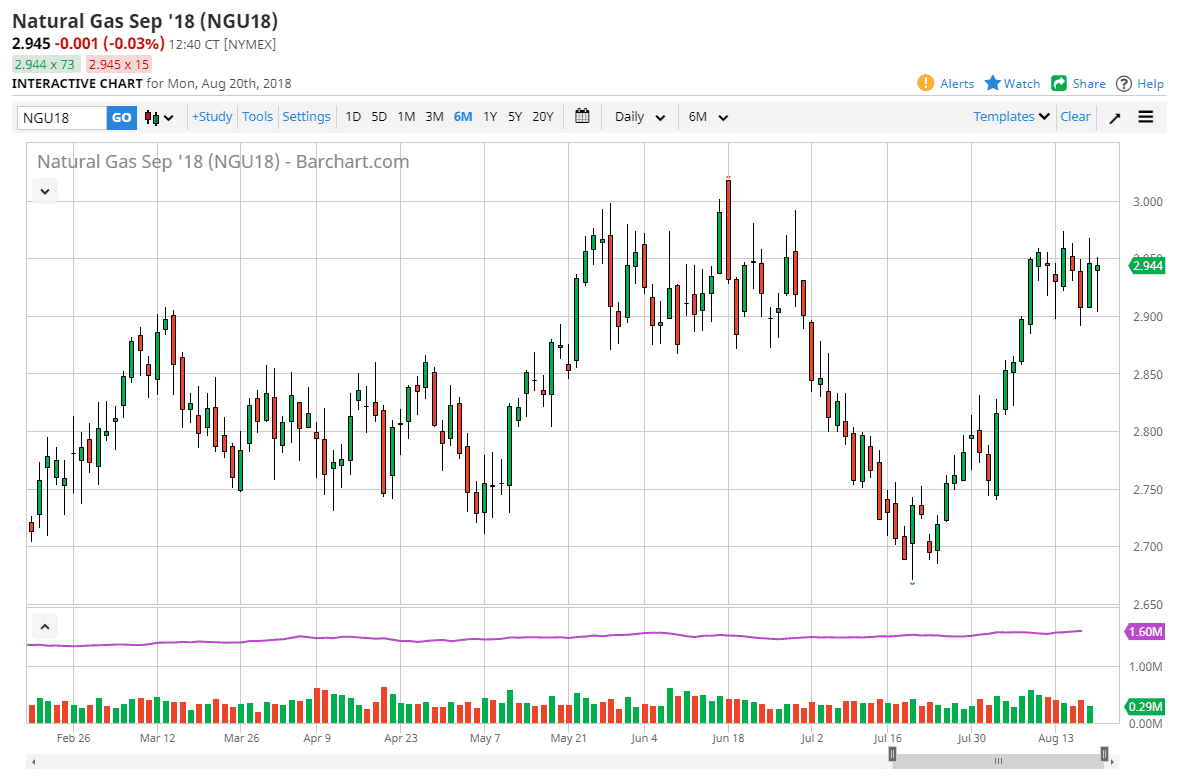

Natural Gas

Natural gas markets were both positive and negative during the trading session, settling on a hammer by the end of the day. The $2.90 level underneath is support, and I think at this point it should continue to be important. Because of this, if we break down below that level I think that the market will drop to the $2.80 level. In the meantime, I think that the $3.00 level above continues to be very resistive, so signs of failure near that area would be a nice selling opportunity. A break above that level should be a buying opportunity, perhaps to the $3.20 level next. This market has been capped at the $3.00 level for some time now, as fracking companies start dumping supply into the market at that price.