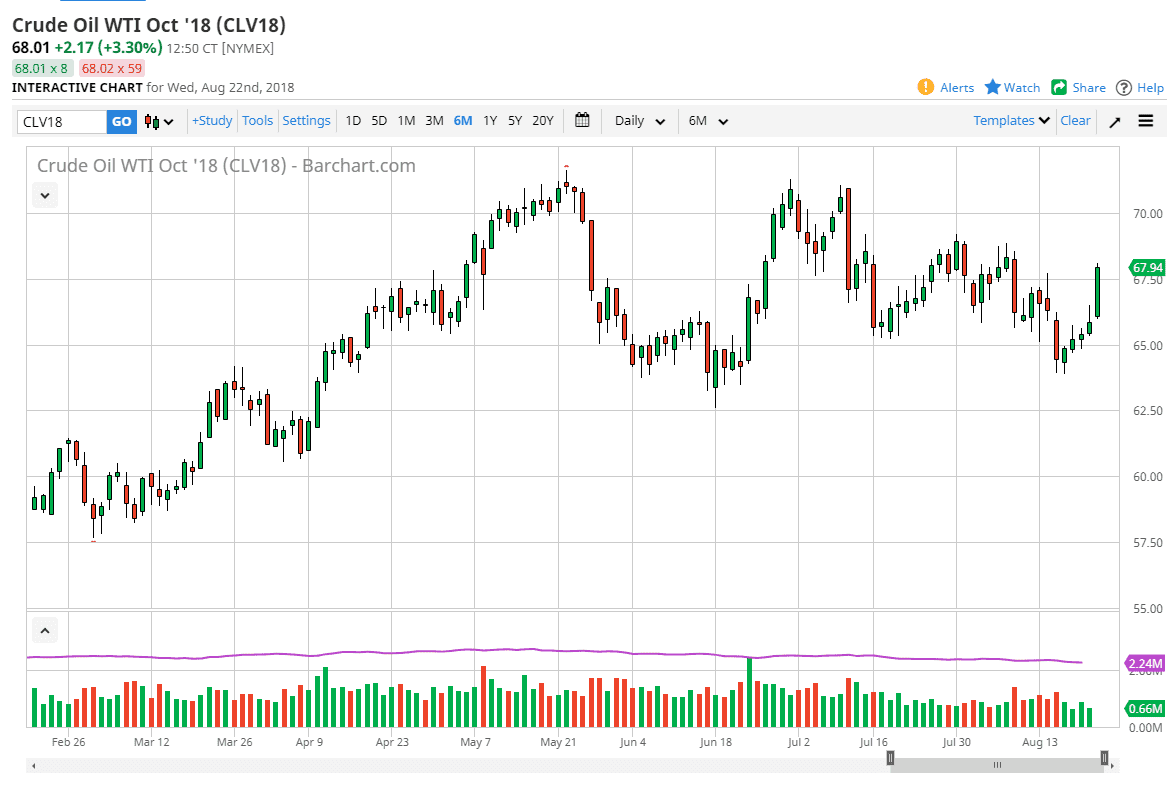

WTI Crude Oil

The WTI Crude Oil market broke to the upside during the trading session on Wednesday, as the inventory number came out much more bullish than anticipated. This negated the negative inventory number from the previous week, and at this point the market is stopping at roughly $68. I think a pullback could very well happen, but the one thing that I would point out is that volume is picking up, and that those candles are green. At this point, I anticipate that the market is probably going to pullback and offer a bit of value the people are willing to take advantage of. Eventually, I anticipate that the market may go hunting for the $70 level above. I believe that the $64 level underneath should offer a bit of a “floor” in this market.

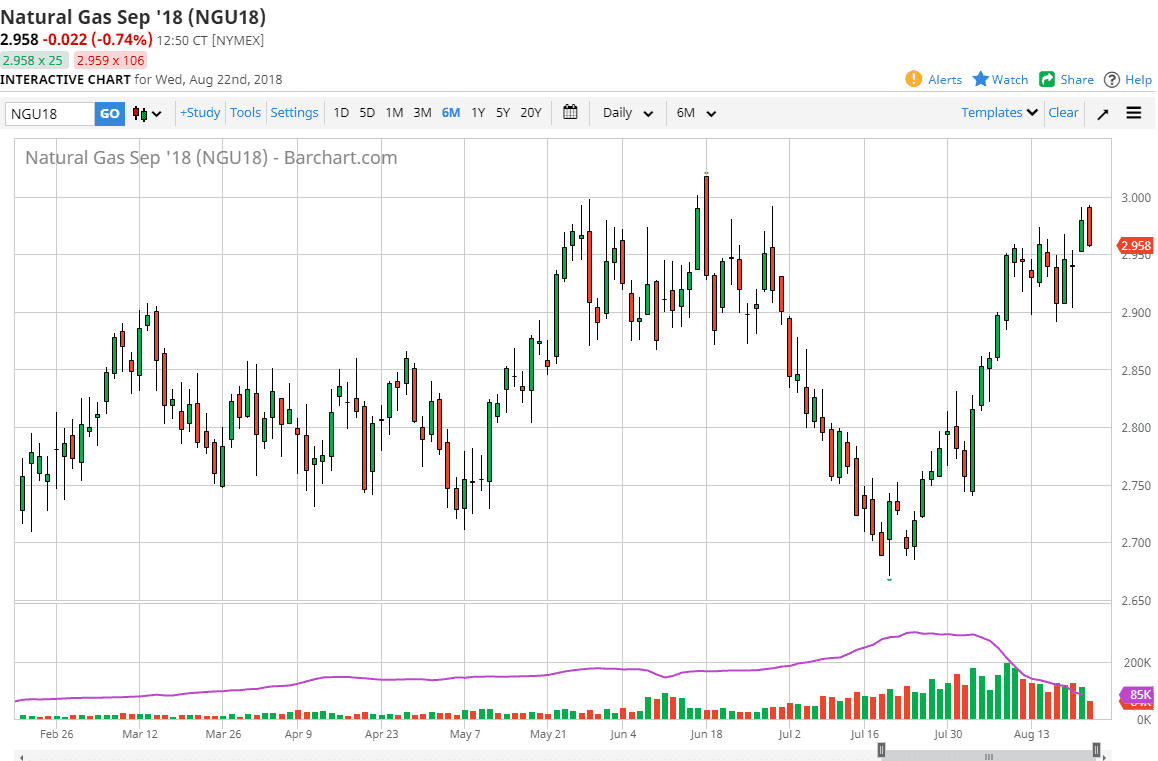

Natural Gas

Natural gas markets had a negative session after initially trying to reach the $3.00 level, an area that continues to offer significant resistance. I think that the market will eventually turn around and start falling, but in the short term it looks as if the $2.95 level is going to offer significant support, but on the short-term charts only. Once we break down below that level, we probably go looking towards the $2.90 level. It is below there that things will accelerate to the downside. The market has been in consolidation for some time with the $2.70 level being the swing low, and the $3.00 region being the swing high. Nothing on this chart has changed that, and I think it’s only a matter time before the sellers take over. Quite frankly, the market tried to reach the $3.00 level during the Asian session, and this was an excellent selling opportunity as the volume simply is not there that time of day.