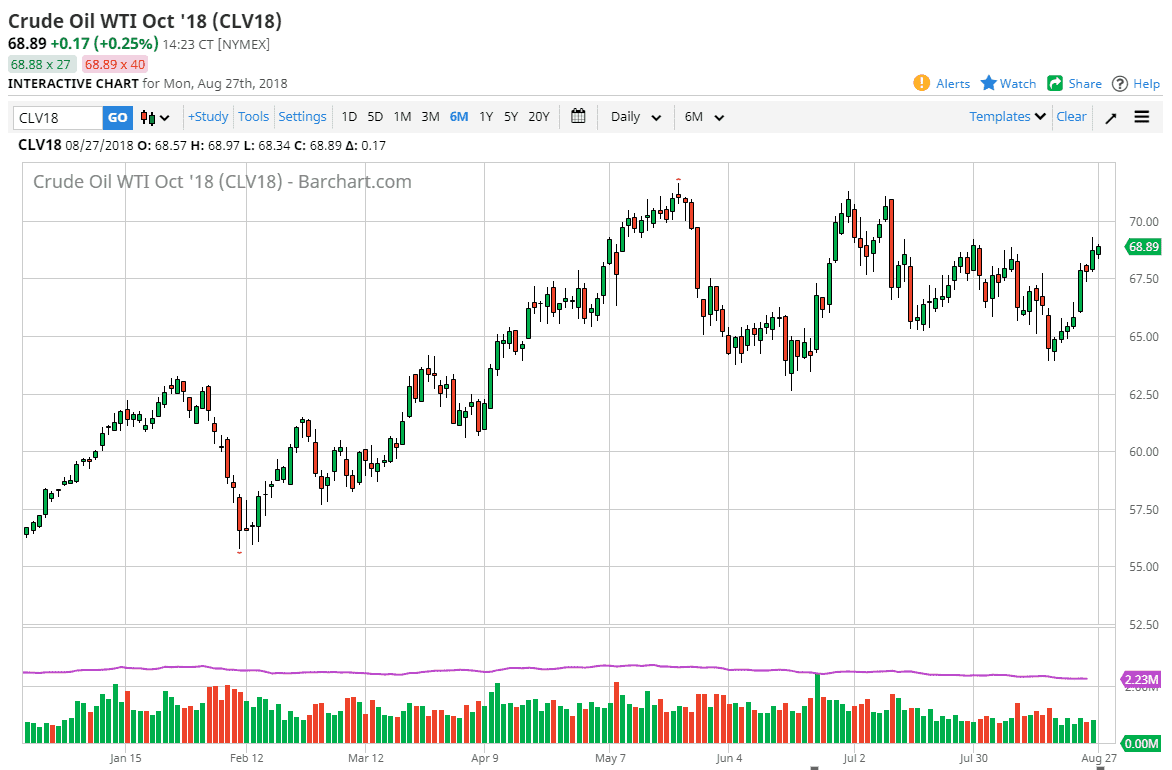

WTI Crude Oil

The WTI Crude Oil market had a slightly positive session during trading on Monday, in what would’ve been relatively quiet action. We are hovering around the $69 level, an area that we could not break on Friday, at least not hold onto gains above there. I think a short-term pullback may be coming, but quite frankly that should be a nice buying opportunity. On shorter-term charts, I see the opportunity to buy oil at $68, $67.50, and most certainly at $66. I think dips should be thought of as value, as we have made such a nice recovery in this market and have upheld a long-term uptrend line. If the US dollar continues to fall, that will only add to the upward mobility of this market, having it reached towards the $71 level again.

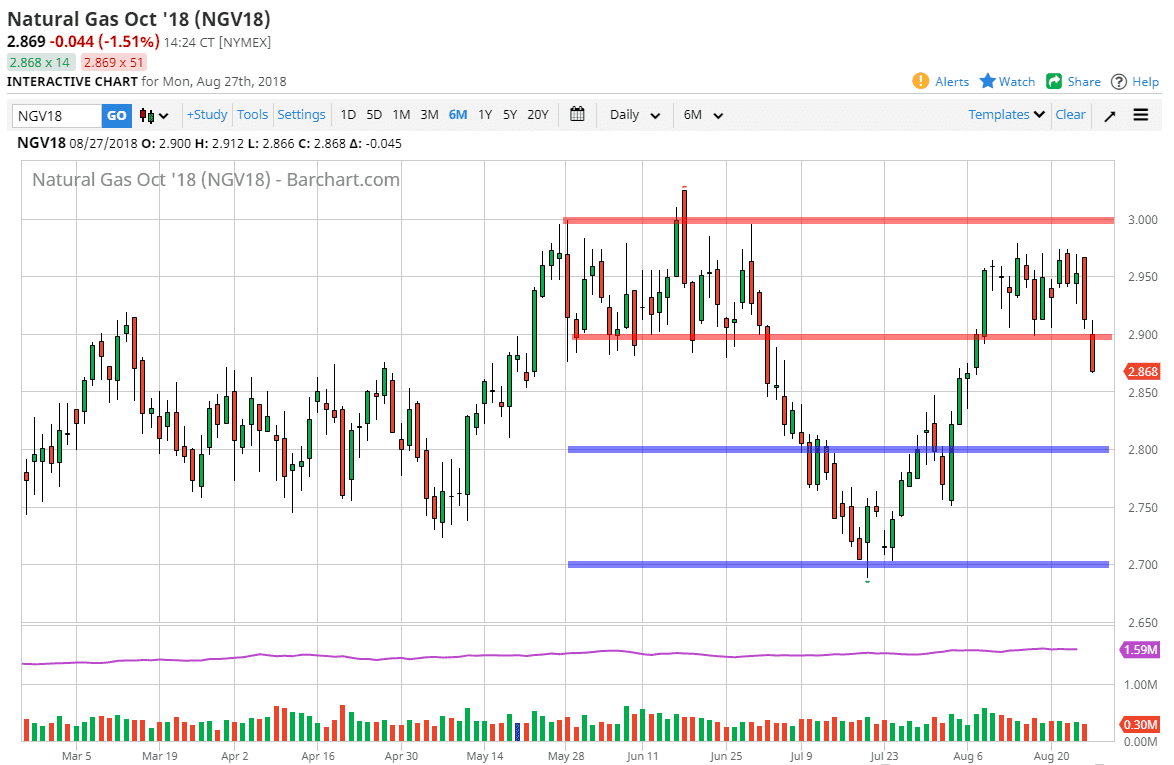

Natural Gas

Natural gas markets broke down to start out the week on Monday, slicing through the $2.90 level again. This is an area that has been important more than once, so the fact that we break down below it should be noticed. We are now more than likely going to go looking towards the $2.80 level, and then possibly the $2.70 level below there as they are a longer-term levels that have mattered. I believe at this point the market participants continue to see that natural gas is range bound longer-term, and therefore as we got far too ahead of ourselves it’s likely that selling should be imminent. I like the idea of selling rallies that show signs of exhaustion, as they have worked out so far. However, keep your stop loss is at hand, because the market is very choppy to say the least. Overall though, the oversupply is starting to become an issue.