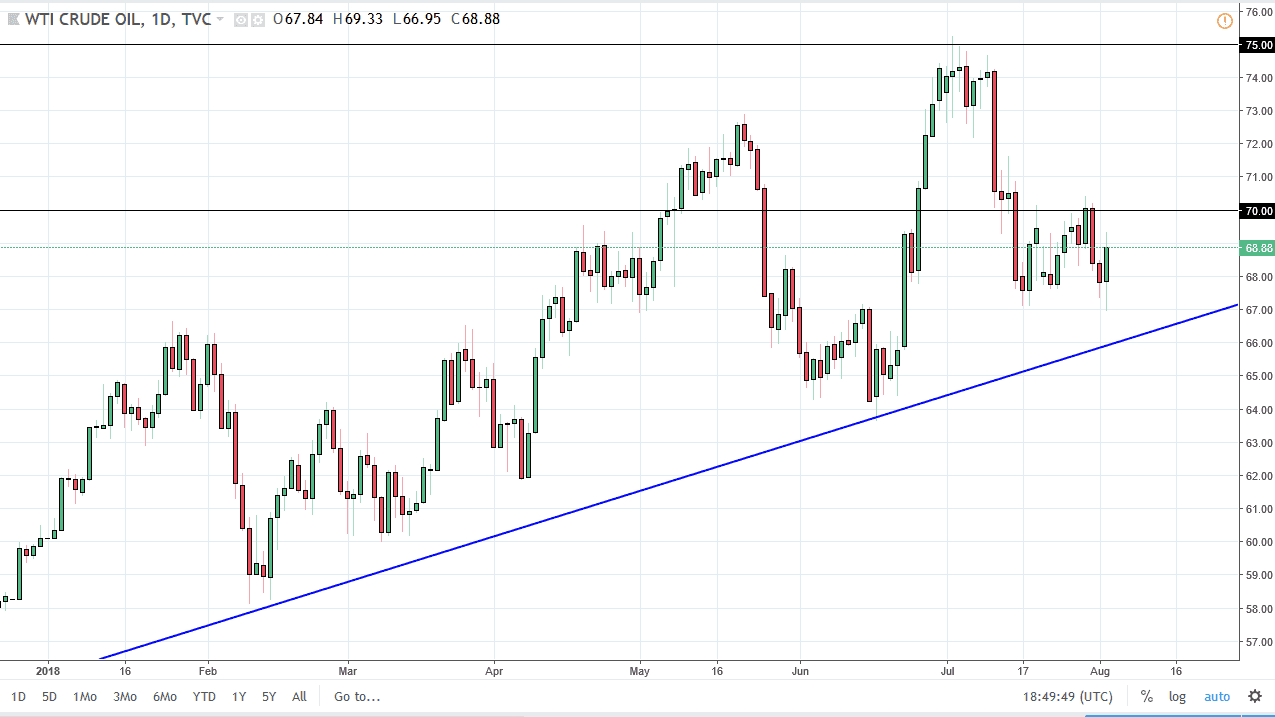

WTI Crude Oil

The WTI Crude Oil market has fallen initially during the day on Thursday, reaching towards the $67 level. We turned around to bounce significantly though, so it looks likely that we continue the overall consolidation between $67 on the bottom and $70 in the top. There is a major uptrend line underneath, and with the jobs number coming today we could perhaps get an idea as to what the demand will be in America. However, I would also point out that the $70 level has significant supply extending to the $71 level. It would not surprise me at all to see this market continue to grind sideways, but I can see that these couple of areas will be crucial as to where we go next in the market.

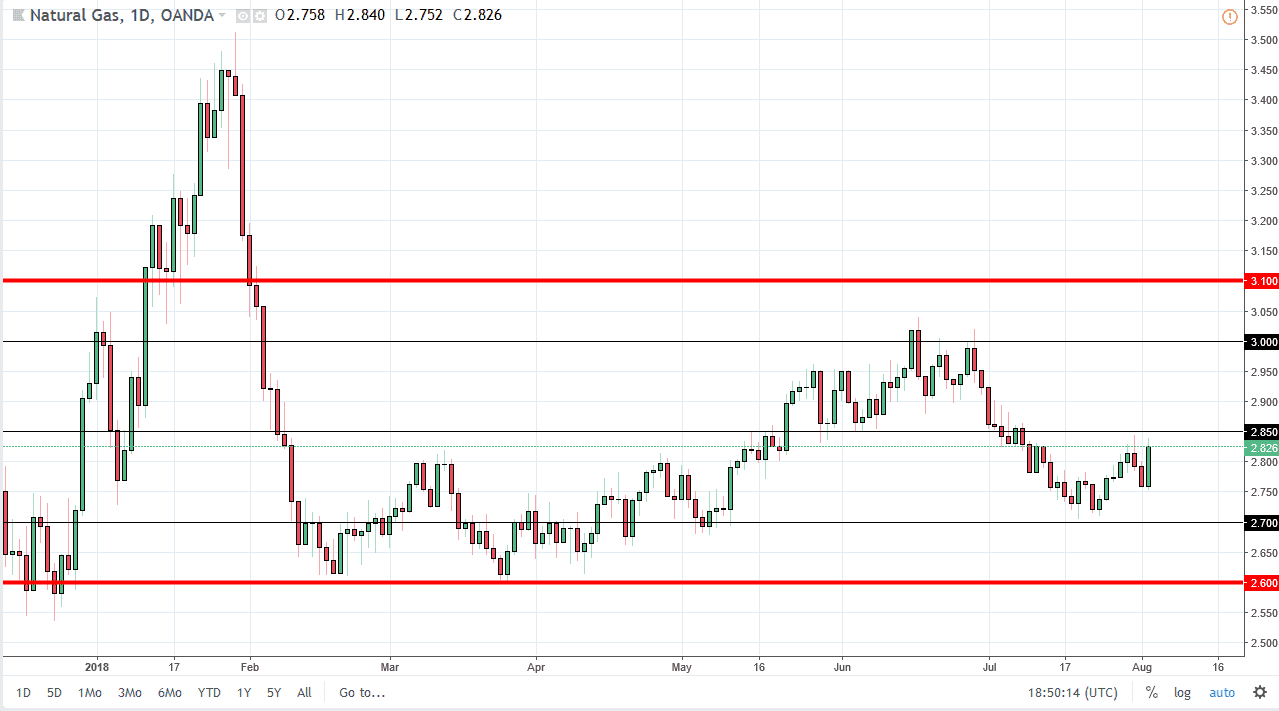

Natural Gas

Natural gas markets rallied significantly during the trading session on Thursday, reaching towards the $2.85 level. That’s an area that looks rather resistive for short-term trading, but longer-term it is simply the middle of the overall consolidation range that the market has been in. I think that we will probably rake above $2.85, eventually try to reach towards the $3.00 level. I expect a lot of sellers in that area though, so this is a short-term opportunity at best. I believe selling at that higher level makes a lot of sense, just as I believe that buying near the $2.70 level makes sense as well. I think we stay in this range, and with the jobs number today we could get a bit of volatility but at the end of the day I think we will continue to look at this as a market that is still stuck in overall consolidation.