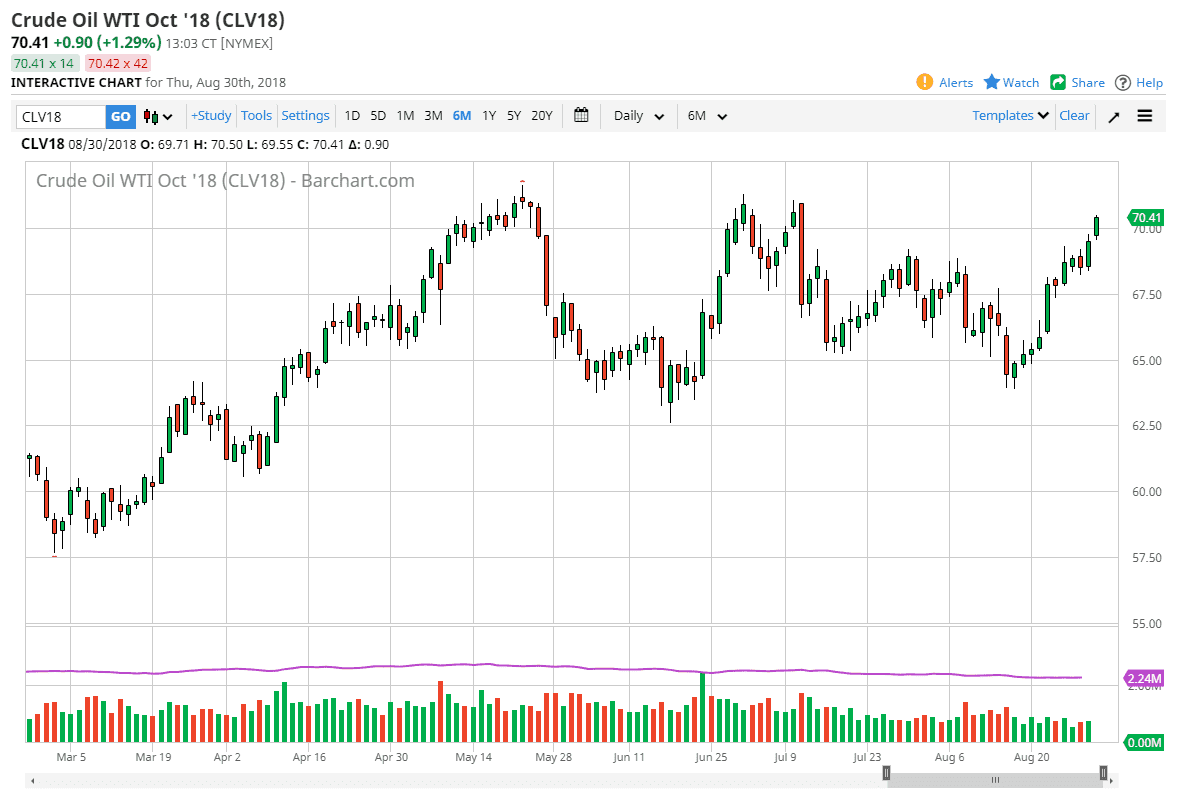

WTI Crude Oil

The WTI Crude Oil market rallied again and broke above the $70 level during trading on Thursday, but the daily candle doesn’t tell the whole story. As somebody who was trading the futures markets today, I can tell you that most of the move occurred late in the day, and quite frankly it was very choppy going. The $71 level above has been massive resistance more than once, and the fact that this is Friday tells me that it’s likely a rally will be sold. I don’t necessarily think we are going to enter a new bear market, just that I think there is a significant battlefield just waiting to happen and $71. If we clear that level, this market is going to take off to the upside rather quickly, perhaps reaching towards the $75 level next. A bit of a pullback on a Friday wouldn’t be a huge surprise to me though.

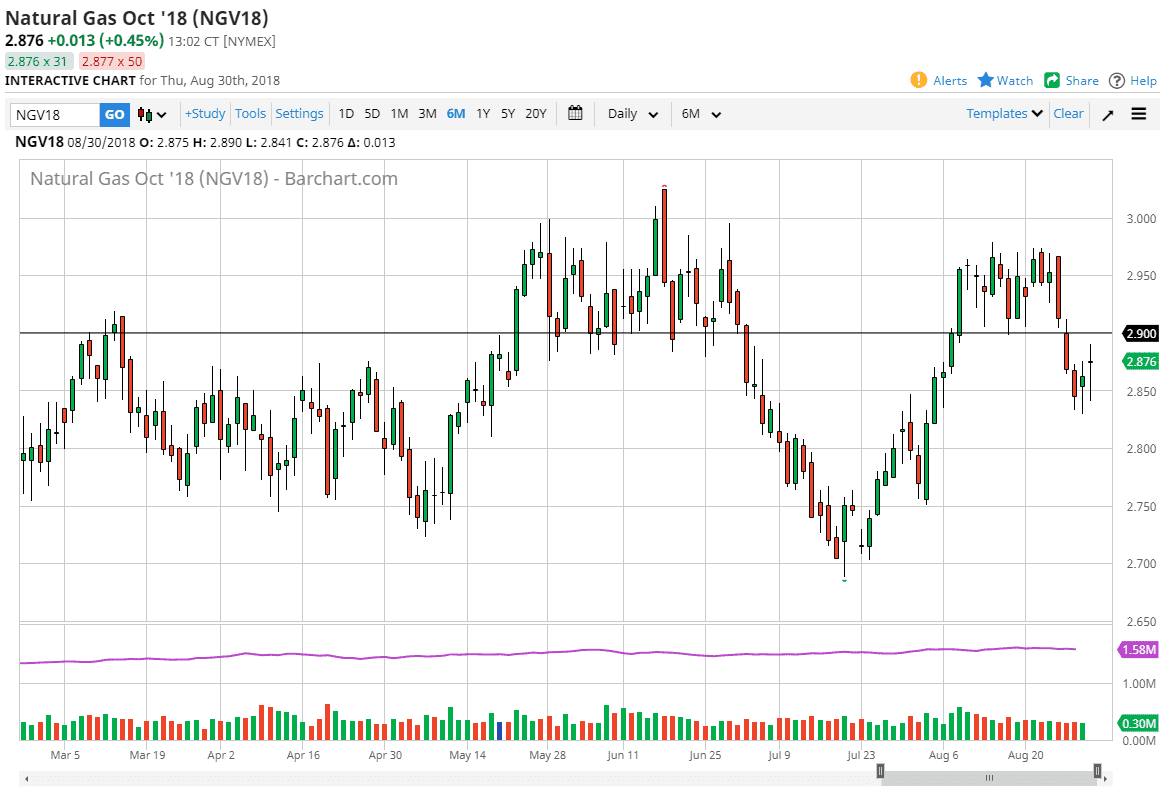

Natural Gas

So this market was a bit out of control during the day as well. We have formed a hammer just below major resistance at the $2.90 level. We could bounce up into that level, perhaps even above there to go looking for resistance. If we can do that and start selling off, I think we could find a nice area to start shorting from. Alternately, if we break down below the Wednesday session, then the market will continue to go lower as well. Even though this candle stick is so bullish, I don’t want to start buying natural gas at this level. I see far too much in the way of trouble above to feel comfortable doing so. Longer-term charts continue to suggest that the $3.00 level above is a major ceiling.