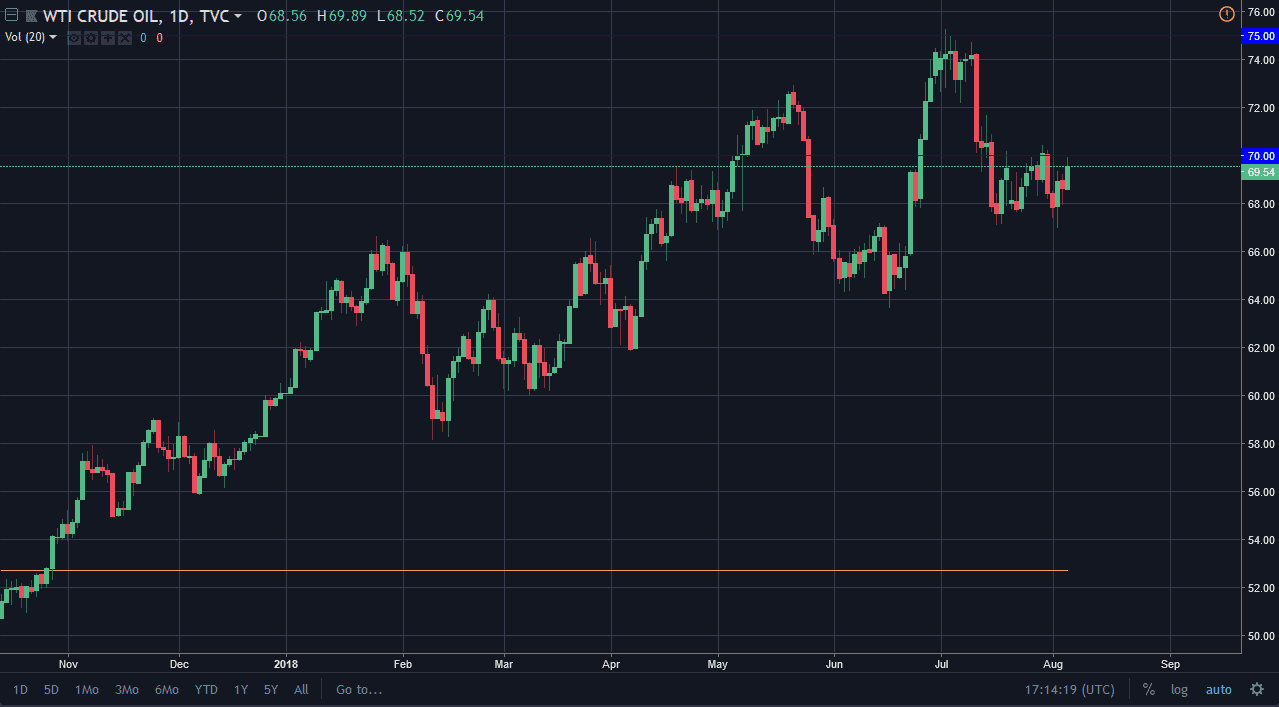

WTI Crude Oil

The WTI Crude Oil market rallied a bit during the trading session on Monday, reaching towards the $70 level that failing to break above it. Because of this, I think that the market will continue to consolidate, and I believe that there is a “zone” of resistance that extends to the $71 level. If we can break above that level, then the market probably goes looking towards the $74 level. Ultimately, I suspect that we are going to go back and forth in consolidation, looking at $67 underneath as support, while $70 continues offer resistance. All things being equal, it looks like the markets have some things to figure out, as there are concerns about a tight crude oil market, and a stronger US dollar. Because of this, we will see very difficult trading conditions, as was evident during the choppy Monday session.

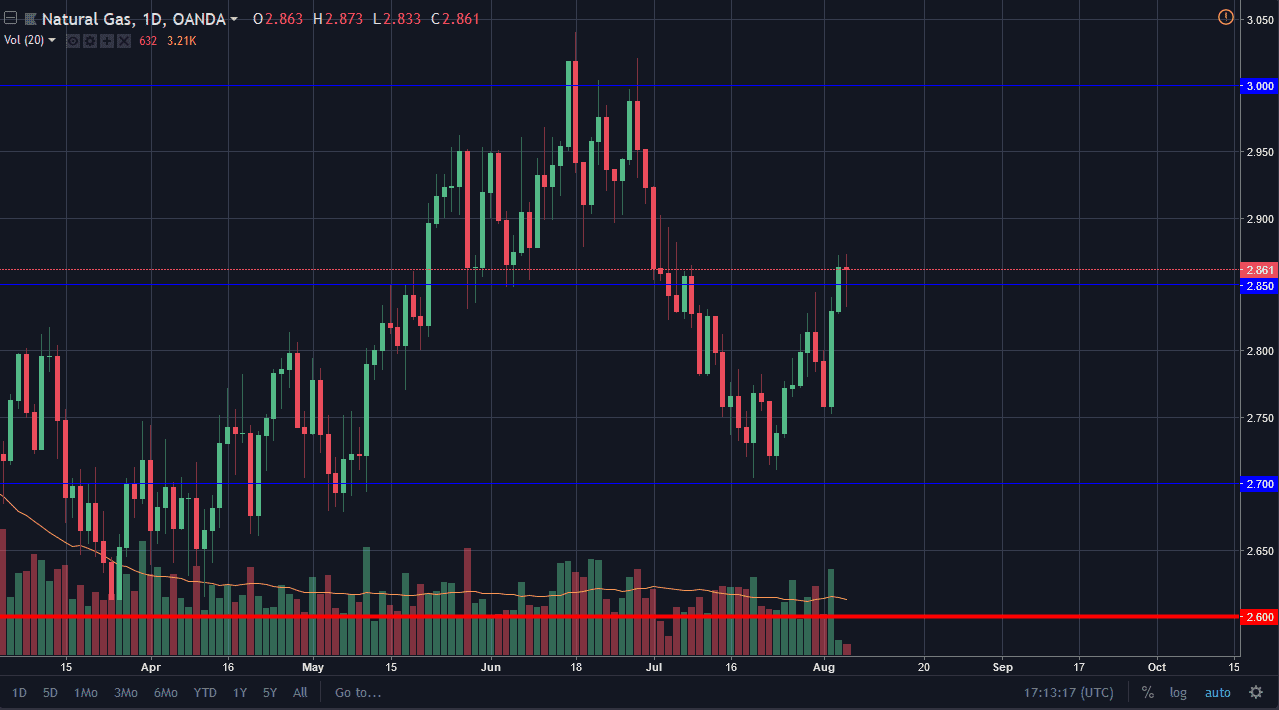

Natural Gas

Natural gas markets initially fell during the day but turned around to show signs of strength as we formed a hammer. We are above the $2.85 level again, but I do see a lot of noise just above. That is going to continue to keep things choppy, but it certainly looks as if the buyers are ready to come back into the marketplace and push towards the $3.00 level above, which is the top of the longer-term consolidation area, and the “resistance zone” that extends to the $3.10 level. I believe that we will continue the longer-term consolidation, so it’s likely that the move to the upside is short term, as it would be a simple continuation of what we have been seeing over the last several months.