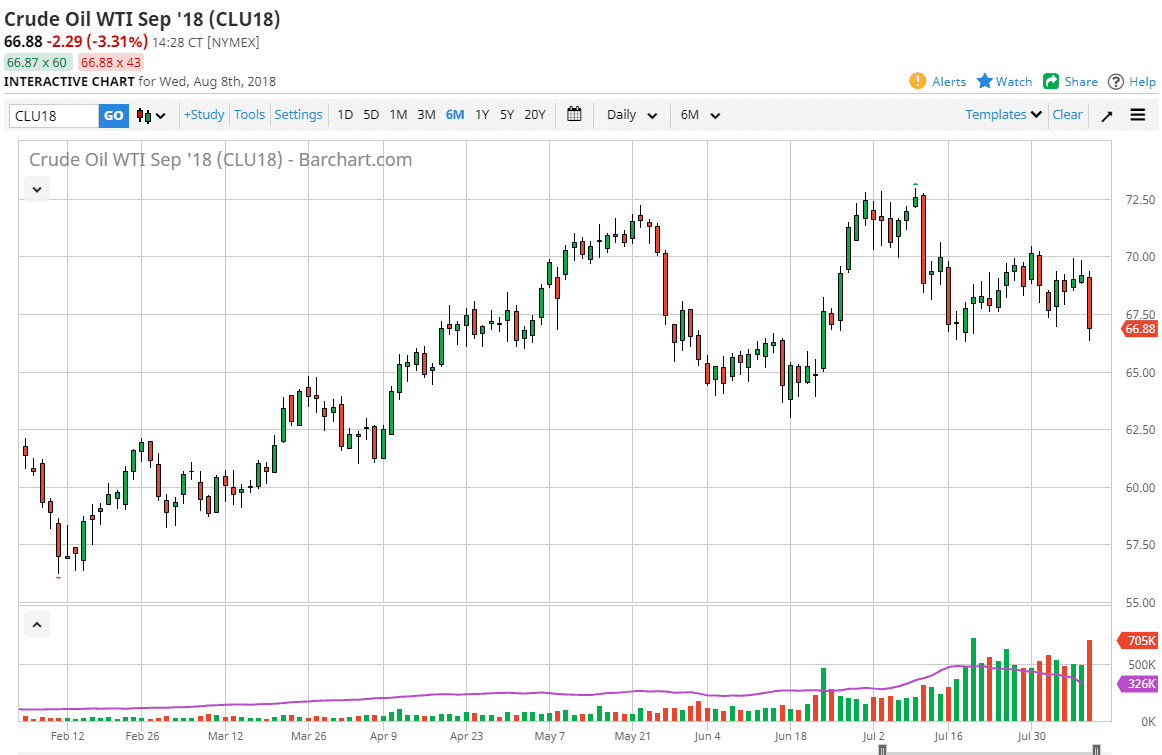

WTI Crude Oil

The WTI Crude Oil market fell rather significantly during the trading session on Wednesday, and then got an extra boost as although inventory was taken out in the United States, it was only about half of what had been anticipated. Because of this, it shows a slowing of demand, and most certainly trouble for oil markets overall. We tested the very loathsome of support, and look sent to continue to the downside. On a break below the lows of the day, I would fully anticipate a move to the $65 level. In the short term, we may get a bounce, but quite frankly oil looks very sick at this point. If the US dollar continues to strengthen the way it has, that will also put more bearish pressure on crude oil.

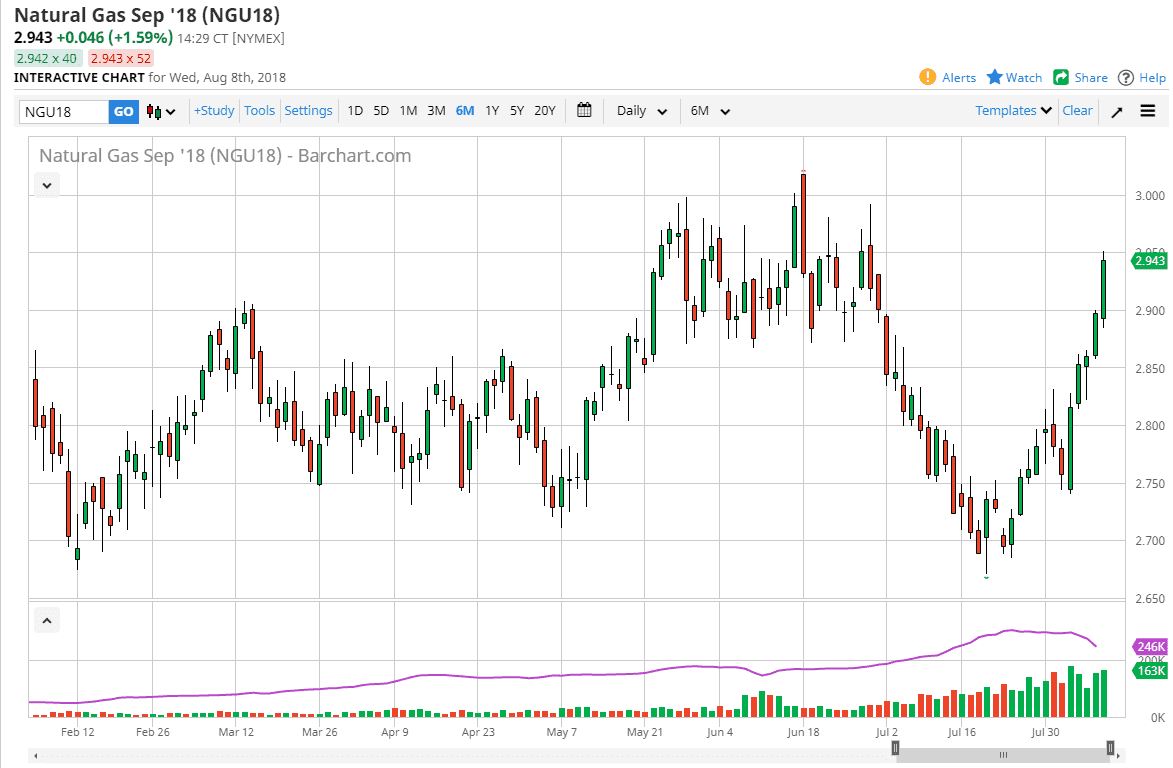

Natural Gas

Natural gas when the exact opposite direction as we reach this high as $2.95 during trading. At this point, I think we are certainly going to go looking towards the $3.00 level, but that’s the beginning of the major resistance in the markets from what I can see. In fact, I’m going to be looking for an exhaustive candle that I can sell, not only because of that resistance, but the fact that we are overstretched. Beyond that, natural gas has been a bit bearish overall, we most certainly see a lot of clustering just above that could cause issues. That being said, I recognize that the resistance extends all the way to the $3.10 level, so I wouldn’t jump in prematurely. I wait for an exhaustive daily candle to start shorting this market again. If we did break above the $3.10 level, then the market more than likely will go to the $3.40 level.