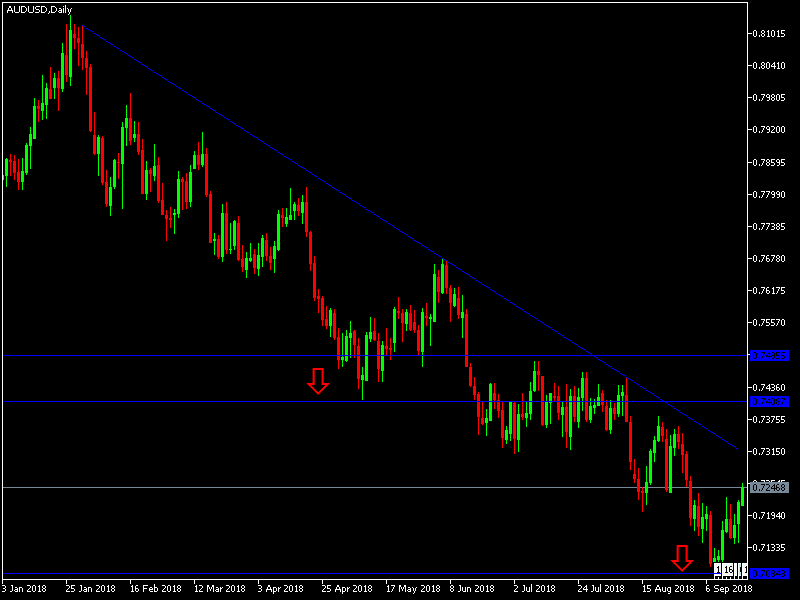

Today’s AUD/USD Signals

Risk 0.50%.

Trades may only be taken from 8am New York time until 5pm Tokyo time, during the next 24-hour period.

Long Trades

- Go long following some bullish price action on the 1H1 time frame H1H1H1 time frame immediately upon the next touch of 0.7175 or 0.7060.

- Put the stop loss 1 pip below the local swing low.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trades

- Go short following some bearish price action on the 1H1 time frame H1H1H1 time frame immediately upon the next touch of 0.7335.

- Put the stop loss 1 pip above the local swing high.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

AUD/USD Analysis

For the third day in a row, this pair remains in a correction mode above from the support level 0.7141 up until the resistance at 0.7255. Recent US dollar gains have temporarily halted the pair's recent moves. The continuation of the US-China trade war threatens the Australian economy and therefore any gains in this pair will be new opportunities for a sell-off.

There is nothing important due today concerning the AUD. Regarding the USD, here will be the release of the Building Permits data.