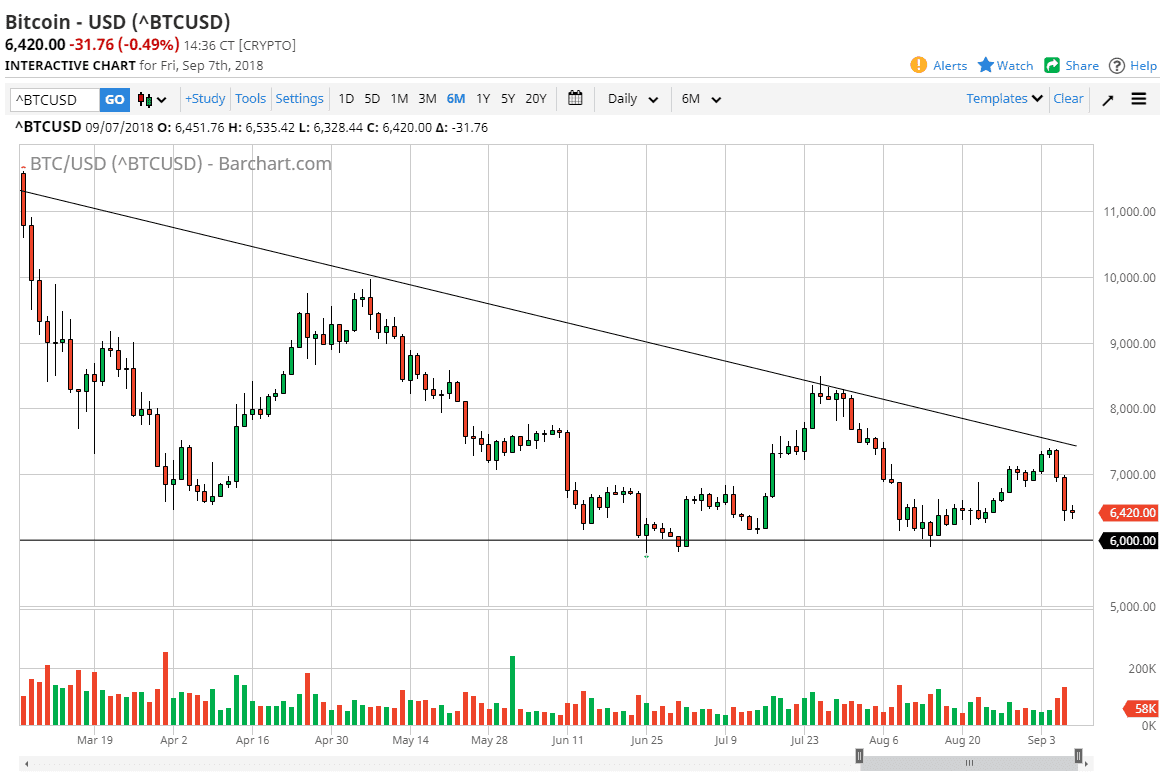

Bitcoin markets did very little during trading on Friday, as we continue to see this market drift lower overall, but obviously we need to see some type of calming effect after the last couple of very bearish days. The $6000 level continues to loom large underneath, and quite frankly I think that we are going to attempt to break down below there. Over the weekend, I would expect a little bit of a bounce, only to be sold again as we approached the downtrend line. If we can break above the top of the downtrend line, essentially the $7500 level, we could send this market much higher. A break above the $6000 level to the downside should send this market much lower, probably down to $5000. Overall, bitcoin continues to struggle to find its footing, and there’s really nothing at this point to turn things around. I think that it’s very difficult to buy this market, and I don’t see any reason to put money to work here.

If we do break out to the upside and above the downtrend line, we will then test the $8200 level, an area that should be resistive. If we can clear that level, then we would be free to go even further. Overall, I think bitcoin continues to struggle and I think it’s got further to go to the downside. If you believe in the measuring power of a descending triangle, it suggests that a break down could send bitcoin is low as $1000. At this point, the biggest problem bitcoin has is that nobody’s willing to put a lot of volume into the market. Volume has been miserable for the most part since February, and it hasn’t really picked up.