BTC/USD

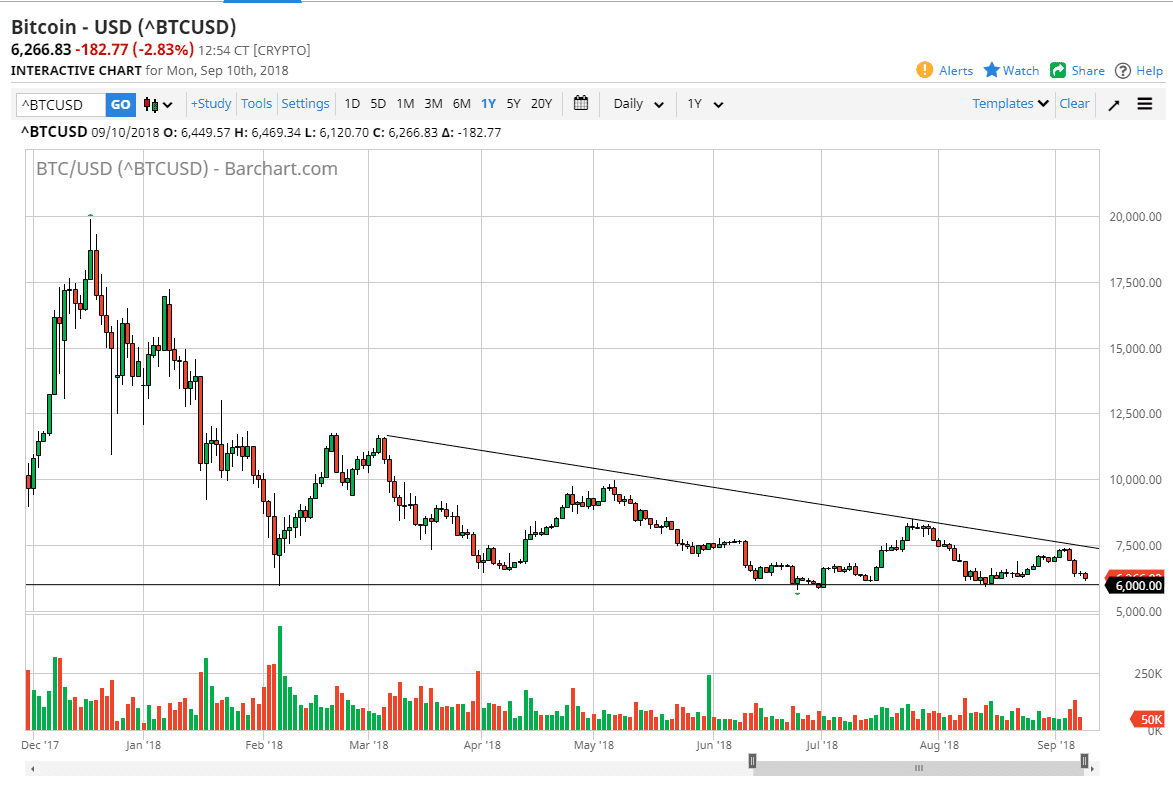

Bitcoin continues to struggle, losing 3% during the trading session on Monday to kick off the week. We are reaching down towards the $6000 level, an area that almost certainly will give way eventually. The only reason I say this is that every rally becomes even shorter, and this descending triangle is the most obvious technical signal in all of the markets that I follow. What I find interesting is that the triangle measures for a move as low as the $250 level. I think that is an extraordinary prediction, so I’m not quite ready to make that, but I do recognize that a break down below the $6000 level will almost certainly put more selling pressure in this market. If that’s the case, I think it will open the floodgates because of the $6000 level holding up so reliably over the last several months.

We do have a downtrend line that being broken to the upside would send a clear signal of buying pressure, but I think that the $8200 level would also have to be cleared in order to be comfortable holding onto a trade for a bigger move. At that point, the $10,000 level would come into view. I think the only thing you can count on is a lot of volatility but certainly this is still a very negative market overall, as there simply is no catalyst for bitcoin to rally at this point. Combine that with the reality that the US dollar is strengthening longer-term, that is going to continue to put bearish pressure on this market. Beyond that, one would have to think that most retail traders will have been flushed out of this market, at least those with large money as the losses have been far too drastic since the beginning of the year.